Back in 2021, we posted all the studies and other information we’d compiled demonstrating the outsized role family businesses and other pass-through employers play in the American economy. These businesses earn the majority of business income and they employ more than six in ten private sector workers. Any conversation about the economy and American competitiveness needs to start with them.

That post was part of the fight over the Build Back Better Act, legislation that would have literally taxed many family businesses out of existence. We won that fight, but now face yet another existential threat when key provisions from the Tax Cuts and Jobs Act (TCJA) expire next year.

If allowed to proceed, these sunsets would hike taxes on more than 20 million pass-through businesses starting in 2026, even as the already low tax rates applied to Apple, Amazon, and other large public companies remain in place. The resulting rate disparity give public corporations an unprecedented advantage and encouraging further consolidation of economic and pollical power among just a handful of corporate boards.

With that in mind, below is an updated list of the resources we’ve developed to arm our Main Street allies so they can defeat these unprecedented tax hikes and protect the pass-through community.

The Importance of 199A

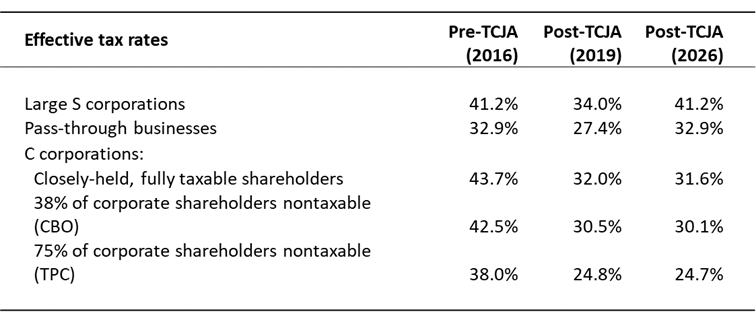

Last year’s study by EY’s Robert Carroll clearly demonstrates how vital the 199A deduction is to Main Street parity. The key takeaway is summed up in the table below – the TCJA established rough parity between public corporations and pass-through businesses, but only as long as section 199A is in place. What makes the study’s findings so striking is that absent 199A, pass-throughs lose out to large, public corporations regardless of the assumptions made:

EY’s numbers aren’t an aberration. Numerous studies conducted by the nation’s top economists from the CBO, Treasury, and the private sector all come to a similar conclusion — the effective marginal rates faced by corporations and pass-through businesses post-TCJA are roughly equivalent, but only with section 199A in place. Without section 199A, the comparative rates aren’t even close:

| With 199A Deduction | Without 199A Deduction | |||

| C Corporation | Pass-Through | C Corporation | Pass-Through | |

| DeBacker & Kasher — Market Returns (AEI) | 19.0% | 20.0% | 19.0% | 27.0% |

| DeBacker & Kasher — Above Market Returns (AEI) | 16.0% | 21.0% | 16.0% | 30.0% |

| Barro & Furman (Brookings) | 26.0% | 31.1% | 26.0% | 35.5% |

| Treasury (2021) | 18.9% | 24.2% | 23.2% | 26.4% |

| EY (2023) | 24.8% | 27.4% | 24.7% | 32.9% |

| CBO (2024) | 17.0% | 21.0% | ||

Resources:

- EY Study: Relative Tax Treatment of Pass-throughs and C Corporations

- S-Corp: The Importance of 199A

- S-Corp: Analysis Shows 199A is Essential for Parity

- S-Corp: The Main Street Defense of the 199A Deduction

- S-Corp: Nichols Explains 199A in Tax Notes

- Ken Kies (Op-Ed, Tax Notes): The Ryder Cap and Section 199A – Really!

- Joint Trades Letter on 199A Permanence

Public Corporations and the Double Tax

On paper, C corporations face steep tax rates due to the so-called double tax – an initial 21 percent on profits earned by the corporation plus 23.8 percent when the after-tax profits are distributed to shareholders. This theoretical double tax has fooled many observers into believing that public corporations face effective tax rates approaching 40 percent.

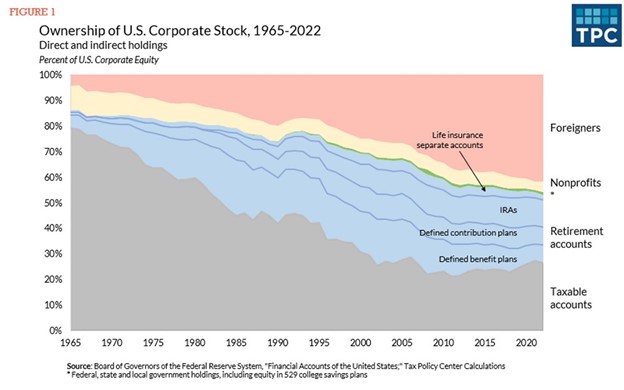

The reality, however, is that most shareholders of publicly-traded corporations pay little to no tax, thus largely eliminating the second layer. The Tax Policy Center has the latest data on this front, showing just how many of C corporation profits are earned by shareholders who pay little or no tax:

As the chart shows, the percentage of taxable shareholders has declined from around four in five back in 1965 to only one in four today. This reality means the overall effective rate paid by public corporations is significantly lower than the advertised rates (see the above section for what the adjusted rates estimates). It’s also far below what comparably-sized pass-throughs face. In an excellent defense of the 199A deduction, former JCT head Ken Kies addressed these issues back in 2021:

…In the United States it’s common to talk about the double tax on corporate earnings. As a general proposition, it’s not fake news: A corporation pays tax on its earnings and the owners of corporations — that is, the shareholders — generally also pay tax on any remaining earnings that are distributed to them.

Based on the best available data, it’s estimated that no more than 9 percent of annual corporate profits are subject to tax a second time, and no more than 14 percent will eventually be taxed upon later distribution (that is, as taxable pension or retirement account distributions). That means that only around a maximum of 23 percent of U.S. corporate earnings ever face a second layer of taxation.

The business sector has voted and it chose the single tax system. Congress need to recognize this reality and work to ensure that small and family businesses as pass-throughs aren’t penalized when they compete with larger public companies. Making section 199A permanent is step one in that process.

Resources:

- S-Corp: The “Experts” Get 199A Wrong, Part 2

- S-Corp: S-Corp: C Corps for Everybody?

- Tax Policy Center: Grappling with a Dwindling Shareholder Tax Base

- Ken Kies: The Ryder Cup and Section 199A – Really!

EY Employment Numbers Confirm Pass-Through Importance

Individually- and family-owned businesses comprise the vast majority of businesses, they employ the majority of private sector workers, and they do so literally everywhere. They are the foundation upon which thousands of communities across this country are built.

Analysis from EY shows just how many Americans are employed by individually- and family-owned businesses in each of the country’s 435 Congressional districts. The results are impressive and reveal just how important private businesses are to this nation. Below are a few highlights:

- Pass-through businesses, including S corporations, partnerships, and sole proprietorships, employ 62 percent of the American workforce;

- Private companies (pass-through businesses plus private C corporations) employ 80 percent of workers;

- For every worker employed by a public C corporation (27 million), there are more than four employed by a private business (113 million); and

- Of the 435 total Congressional districts in America, private companies are responsible for 80 percent or more of total employment in 316 of them.

Why does any of this matter? Because the expiration of the individual and pass-through tax provisions next year would disproportionately harm private businesses, putting those jobs at risk.

The Main Street Tax Certainty Act introduced by Representative Lloyd Smucker and Senator Steve Daines would make 199A a permanent fixture of the code, staving off a massive tax hike and providing these businesses with much needed certainty. It is supported by over 160 national trade associations and is cosponsored by more than 175 Congressmen and more than 30 Senators.

Resources:

- EY Study: Employment Data by Congressional District

- EY Study: Full Dataset

- Smucker 199A Permanence Bill (H.R. 4721)

- Daines 199A Permanence Bill (S. 1706)

- Joint Trades 199A Support Letter

199A Essential for Economic Growth

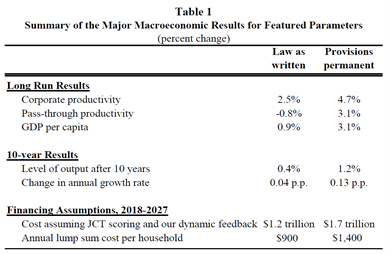

Pass-through businesses employ the majority of private sector workers (62 percent) so any increase in their taxes would have broad negative effects on the economy. A Brookings paper authored by Robert Barro and Jason Furman isolates the economic impact of the sunsetting TCJA provisions, including the 199A deduction, the lower individual rates, and expensing:

As you can see, the law as written column shows the productivity of the pass-through sector under the TCJA is negative. This result is due to the sunsets starting in 2026, plus the TCJA’s base broadening provisions that remain in place. These provisions include the cap on interest deductions, forced amortization of R&E expenses, and the other tax base broadening provisions in the TCJA. These provisions apply to pass-through businesses as well as corporations.

The result would be a significant tax hike on pass-through businesses – not relative to tax policy in 2024, but relative to tax policy pre-TCJA. After all the rhetoric about protecting Main Street, going off the fiscal cliff next year means the net effect of the Trump “tax cuts” would have been to raise taxes on millions of Main Street businesses in order to cut taxes for Apple and Amazon. (Avoiding a tax hike is how the Main Street Employers coalition got started in the first place. You can read about it here, here, here, here, and here.)

This is a ludicrous result and it is within the power of Congress to make sure it doesn’t happen. Any conversation regarding the tax code and economic growth should begin with the pass-through sector – we employ more workers and we contribute more to our national economy. Period.

Resources:

- Main Street Employers Coalition: Section 199A One-Pager

- Brookings Institute (Robert Barro, Jason Furman): The Macroeconomic Effects of the 2017 Tax Reform

- S-Corp Advisor Lynn Mucenski-Keck: SBC Testimony

- S-Corp (Presentation): Pass-Through Businesses & Tax Policy

- S-Corp: More on the Wyden 199A Bill

- S-Corp: A “Modest” Tax Hike? Not Even Close

- S-Corp: Tax Hike Premise Takes Another Hit

199A Offsets

One challenge to making section 199A permanent is the provision would lose revenue at a time when deficits are large. But the 199A deduction wasn’t adopted in a vacuum. In fact, it was paired with numerous offsetting provisions that raise lots of money – more than 199A costs – and they primarily target upper-income business owners. These provisions include:

- SALT Cap

- Section 461(l) Excess Loss Limitation Rules

- Section 174 R&E Amortization

- Section 199 Manufacturing Deduction Repeal

- Section 163(j) Interest Deduction Cap

- Section 212 Deduction Limitations

As noted above, most of these provisions are permanent and will stay in the tax code even as 199A expires, resulting in a significant tax hike on pass-through businesses. That hike is not relative to the TCJA, but rather the tax code that preceded it.

When Congress addresses the fiscal cliff next year, we fully expect these revenue offsets to be part of the discussion, so for those policymakers worried about adding to the deficit next year, make sure to look at the whole package and not just one provision.

Resources:

- S-Corp: The “Experts” Get 199A Wrong, Part 2

- S-Corp: A Rate Hike by Any Other Name…Would Still Kill Family Businesses

- S-Corp: White House Shortchanges Main Street

- S-Corp: An Anti-Main Street Budget

- S-Corp: New Budget Continues the Assault on Main Street

Where the Jobs Are

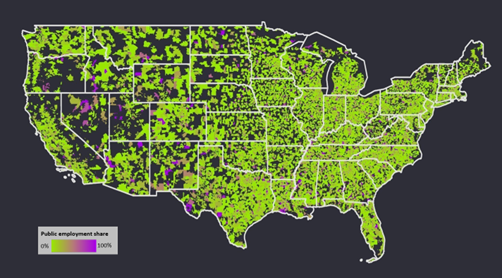

The fight over section 199A has geographical implications too. In a 2021 Wall Street Journal op-ed, S-Corp President Brian Reardon wrote:

A new study from EY demonstrates that private companies supply the vast majority of business-sector jobs nationally—77% of them. Public companies supply only 23%. As important, private-company employment is spread evenly across the country while public-company jobs tend to be concentrated in a few cities and states.

The op-ed references an EY study showing just how important private companies, including small and family-owned businesses, are to the large swaths of the United States. While public company employment is concentrated on the coasts and city centers, private business employment is spread more evenly across the country, including 22 states where private companies account for more than four out of five workers.

For Members of Congress representing those states and districts, pay attention. Getting the balance right between private and public companies is critical to the economic future of your communities.

Resources:

- Op-Ed, WSJ: The Democratic Plan to Soak Main Street

- S-Corp: Where the Jobs Are

- EY Study: Distribution of Private and Public Company Employment Across the United States

Voter Support

The Gazette recently featured an op-ed on how Americans really feel about raising taxes on individually- and family-owned businesses and farms:

Contrary to what the White House might tell you, a new poll conducted on behalf of the S Corporation Association confirms that American voters do not support aggressive tax policies or those that target individually- and family-owned businesses and farms.

The results of the survey were later presented on a webinar by David Winston of the Winston Group and speak clearly to the debate before us. American voters do not support taxing Main Street, particularly when they learn which businesses would bear the brunt of these taxes:

President Biden’s…plan would impose a new 8% surtax on a taxpayer’s income exceeding $25 million and a 5% surtax on income exceeding $10 million. Do you favor or oppose this proposal? 52-32 favor-oppose.

However, when people are told that the surtax proposal would apply to individually and family-owned businesses making $200,000 or more, voters oppose this proposal 38-45…. Among independents, support for the surtax proposal flips to opposition… 29-49.

Another reason voters oppose raising taxes on Main Street businesses is they see these tax hikes as inflationary:

Over half the country (52%) believes a tax increase would increase inflation, rather than decrease (11%) or have no impact (19%). Among independents, 55% believe it will increase inflation (7% decrease, 17% no impact).

Keep in mind these findings are from late 2021, well before inflation really spiraled out of control.

To summarize, voters are staunchly opposed to tax hikes such as the sunsetting of Section 199A, view them as harmful to the Main Street businesses that make up the foundation of countless communities nationwide, and believe they will only result in increasing prices further.

Resources:

- Op-Ed, The Gazette: Biden’s Tax Hikes are Unpopular and Congress Knows It

- S-Corp Webinar: What do Voters Really Think About the Biden Tax Plan?

- Survey Findings

Conclusion

The 2025 fiscal cliff presents an existential crisis for private companies and the workers that rely on them. Absent action, the expiration of the TCJA’s pass-through provisions would accelerate the consolidation of economic power and decision making into the C-suites of a few thousand public companies, leaving thousands of communities worse off. Such an outcome is bad for Main Street and bad for the country.

We urge you to read the materials outlined above and engage in this fight. Individual and family-owned businesses are the bedrock of local communities nationwide and they work hard to improve the lives of their employees and neighbors every day. That message won’t be heard, however, if family businesses stay on the sideline.