199A on the Line as House Prepares to Vote

With the House preparing to vote as early as today on the Senate-passed reconciliation bill, any lawmakers still undecided should take a close look at what’s at stake for Main Street businesses across the country. Absent congressional action, these businesses will be hit with an unprecedented tax hike, putting millions of jobs and billions in wages and economic growth at risk.

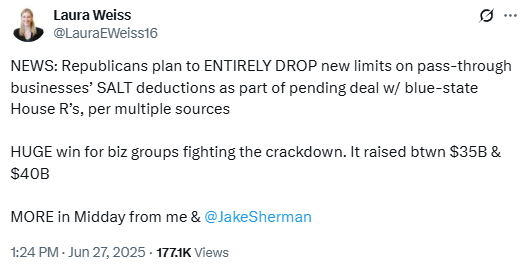

The urgency here stems from the looming expiration of the Section 199A deduction, which sunsets at the end of this year. We’ve done a number of studies in the past showing the benefits of 199A when it comes to …

(Read More)