The Biden Administration’s sales pitch for their proposed business tax hikes goes something like this: Rates were too high prior to 2017 but Republicans overshot the mark and set them too low. Democrats want to find a happy middle ground. President Biden said as much in his remarks last week:

We’re going to raise the corporate tax rate. It was 35 percent for the longest time, which was too high. Barack and I thought it was too high during our administration. We all agreed five years ago that it should come down somewhat, but the previous administration reduced it all the way down to 21 percent. What I’m proposing is that we meet in the middle: 28 percent.

That sales pitch is being unquestioningly echoed in the press. According to a news story in Politico yesterday:

The 2017 bill lowered the corporate tax rate from 35 percent to 21 percent. Biden is proposing to bring it back up to 28 percent. So not an “undoing” so much as a rolling back.

The problem is it’s simply not true. Biden isn’t proposing a “middle ground” on business taxation. His tax plan would roll back the 2017 business tax relief and then go much, much further. This reality is due to the massive base-broadening in the 2017 tax bill that Biden would leave in place, coupled with the additional base-broadening and international tax hikes in the Biden plan.

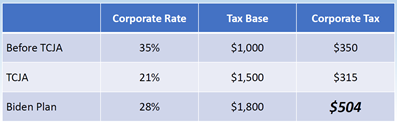

On the corporate side, this dynamic has been fully explored. As George Callas of Steptoe pointed out in our pre-election tax outlook report, the increased corporate tax base under the Biden plan completely overwhelms the modest increase in corporate rates:

The tax hike effect on the pass-through sector, however, is worse. That’s because while Biden would only raise the corporate rate halfway, he would fully repeal the rate cuts and 199A deduction applying to the owners of pass-through businesses. For those businesses, the Biden plan would:

- Raise the top rate from 37 to 39.6 percent;

- Repeal the 199A deduction for owners making more than $200,000 (single) or $400,000 (joint);

- Cap itemized deductions; and

- Limit the value of remaining itemized deductions at 28 percent.

These tax increases would come on top of the extensive base broadening provisions applying to pass-through income under the 2017 bill. That bill:

- Imposed a new cap on SALT deductions;

- Imposed new limits on NOLs and created new Loss Limitation Rules applying to pass-through losses;

- Created new limits on interest deductions under Section 163(j); and

- Repealed the old Section 199 manufacturing deduction.

To put these base-broadening provisions in perspective, the revenue increase of the SALT cap alone is twice the benefit of the 199A deduction. Under Biden, taxes on S corporations and other pass-through businesses are not reverting to pre-2017 – they are rising way past that.

Biden’s proposed capital gains rate increase would also hit pass-through businesses. A principal benefit of being an S corporation is capital gains treatment on the sale of the business. Biden would hike the capital gains rate from 23.8 to 39.6 percent on incomes over $1 million. So a business owner who makes modest wages his/her whole life and then sells the business to fund their retirement will be hit with this one-time tax.

Finally, the Biden plan would increase estate tax rates, even as it specifically targets family businesses for higher estate tax valuations. Estate tax proposals under consideration would combine 1) higher tax rates, 2) capital gains at death, 3) inflated valuations of private company assets and 4) reduced planning tools like GRATs and other trusts. By our assessment, the result would almost double tax levies on larger estates.

The net result is a full-on assault on individually and family-owned businesses. The tax hikes facing them are large, they are comprehensive, and they apply when they earn money, lose money, sell assets, sell the business, and attempt to transition the business’s ownership from one generation to the next.

The United States has never considered tax rates this high on this broad of a tax base. Even when individual rates were higher, there was always a safety valve – a place where taxpayers could earn income and not pay most of it to the federal government. With the Biden plan, however, it is hard to see how large family-owned businesses would survive over time, especially if they attempt to transition from one generation to the next.

That’s the reality facing Main Street businesses from the Biden tax plan. So forgive us if we don’t sit back and accept the “middle ground” nonsense coming from the Administration and its allies in the press.