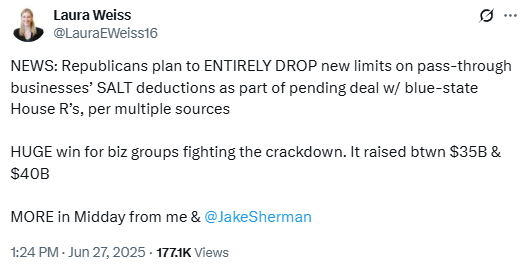

Here’s a good news story to kick off the weekend – Punchbowl News reports that lawmakers are striking the onerous SALT limitation from the reconciliation package as part of a broader compromise between the House and Senate:

The outlet also reports that the White House played a key role in helping broker the deal:

Treasury Secretary Scott Bessent is briefing Senate Republicans behind closed doors at their lunch now about a SALT deal he clinched with the White House and blue-state House Republicans…Speaker Mike Johnson and James Braid, the White House’s legislative affairs liaison, are in the Senate GOP lunch.

Under the arrangement, the SALT cap for individuals would be set at $40,000 with a five-year sunset, along with income limitations. But for Main Street businesses, the far more important piece here is the removal of language that would have prevented pass-throughs from deducting their full SALT, potentially invalidating our longstanding SALT Parity efforts at the expense of millions of companies.

So a huge win for Main Street – particularly when coupled with the permanent extension of Section 199A – but the deal isn’t final yet. It still needs approval from Senate Republicans, none of whom hail from blue states and have therefore been leery of a more generous SALT cap for individuals. That said, Punchbowl News spoke to several GOP aides that expressed confidence Bessent and others could get Senate Republicans on board, so fingers crossed for a positive outcome.

There are still a number of other policy issues to work out, but with momentum clearly on Republicans’ side and President Trump doubling down today on the July 4 timeline for passage, there’s a decent chance the One Big Beautiful Bill gets enacted into law before the end of next week. In the meantime, S-Corp and its allies will be working the phones to express our strong support for the revised tax title and help to get it across the finish line.