The Wall Street Journal’s Richard Rubin is out with a new piece that looks at our ongoing SALT Parity efforts, and the massive savings they’ve unlocked for hundreds of thousands of family businesses across the country.

Before getting to the good news, a quick primer for those new to the issue. The state and local tax (SALT) deduction cap imposed by the Tax Cuts and Jobs Act (TCJA) put S corporations and partnerships at a competitive disadvantage. C corporations could continue to fully deduct their SALT as a business expense while pass-through business owners were subject to the new $10,000 cap.

Restoring the federal SALT deduction for pass-through entities – what we call “SALT Parity” – has been a priority for S-CORP and the Main Street Employers coalition ever since. Under our approach, pass-throughs can elect to pay their SALT at the entity level, thus restoring the deduction at the federal level while maintaining revenue neutrality for the state. Here’s how Rubin summarizes the win-win proposition:

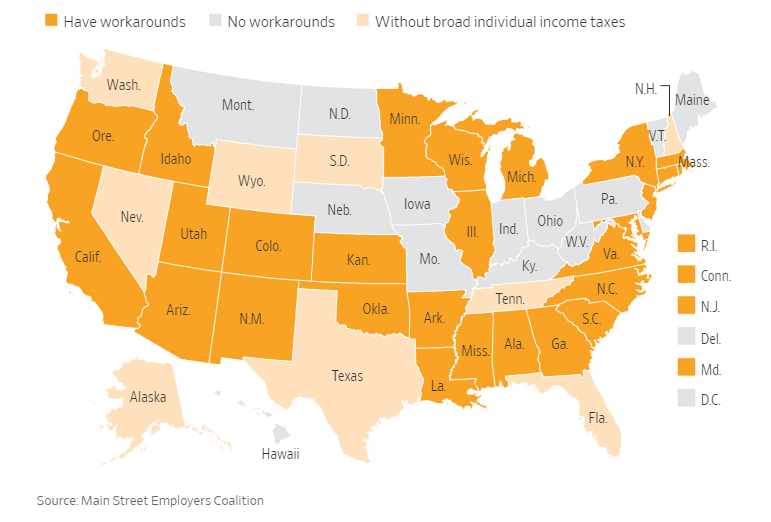

For states, approving the workarounds has been easy, because their residents benefit and state tax collections are barely altered. For business owners, the chance to lower federal tax bills is attractive, and industry groups are lobbying in the states that haven’t yet enacted workarounds.

Each state is different, but the new tax and the credit roughly offset each other, and state finances are generally unaffected. Michigan State Rep. Mark Tisdel, a Republican, said there were some implementation expenses, but a projected 40-to-1 ratio of benefits to costs made the move a no-brainer.

Largely due to the efforts of our members, some version of our SALT Parity approach has been enacted in 27 states, with a handful of additional states actively considering bills right now.

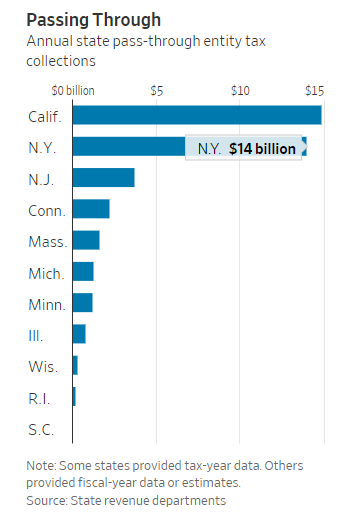

How much is at stake? We previously estimated that if all 41 eligible states were to take up our reforms, the result would be approximately $6 billion in annual savings for Main Street businesses. As the WSJ piece makes clear, we underestimated these benefits by a long shot:

Business owners are likely saving more than $10 billion annually in federal taxes through state laws that circumvent the $10,000 cap on state and local tax deductions, according to a Wall Street Journal analysis of state data.

…The Journal’s estimate relies on data from 11 states that enacted workarounds and provided annual collections data or estimates for their pass-through entity taxes, totaling more than $40 billion. Even assuming a 25% average federal tax rate, likely low for business owners who are concentrated at the top of the income scale, that reaches $10 billion a year.

An accompanying table shows how much tax is being paid in the reporting states:

As the table shows, these are actual tax payments made to states under the PTE election. Assuming a 25 percent marginal rate on these payments is likely low, not because all the taxes are being paid by billionaires (they are not), but because federal rates on pass-through income are 32 percent for incomes exceeding $170,050 (single). While some of that income may benefit from the 199A deduction, much of it will not, as noted by Treasury.

The WSJ identifies other reasons why the savings is likely larger than $10 billion:

The estimate is conservative in another way. Data weren’t available from some states with 2021 pass-through taxes, including Maryland, Louisiana, Oklahoma and Alabama. More large states, including Arizona, North Carolina and Georgia, enacted pass-through taxes for 2022, so the totals will likely grow.

Yes they will. The WSJ table includes just 11 out of the 27 states that have enacted SALT Parity, so the total taxes paid under the PTE tax last year is well over $40 billion. As more states adopt the reform, that number will grow.

Finally, the take-up rate will grow over time as eligible pass-through businesses realize that they are missing out. For example, the latest data out of Wisconsin shows a steadily-increasing take-up rate among S corporations from 2 percent in 2019 (pre-COVID) to 4.5 percent in 2021. The longer these reforms stay in place, the more businesses will make the election.

So let’s take a moment to praise those states that acted early to adopt SALT Party – Connecticut, Wisconsin, Oklahoma, Louisiana, Rhode Island, New Jersey and Maryland. Businesses in some of those states have had their full SALT deduction restored going on four years now.

And let’s focus our encouragement on those states who still need to take this up – Ohio, Pennsylvania, Vermont, Montana, North Dakota, Nebraska, Iowa Indiana, Kentucky, and West Virginia. Your inaction is costing the businesses in your state billions. Exactly what are you waiting for?