Big Main Street Win on SALT

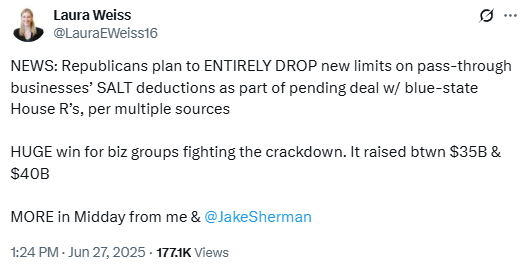

Here’s a good news story to kick off the weekend – Punchbowl News reports that lawmakers are striking the onerous SALT limitation from the reconciliation package as part of a broader compromise between the House and Senate:

The outlet also reports that the White House played a key role in helping broker the deal:

Treasury Secretary Scott Bessent is briefing Senate Republicans behind closed doors at their lunch now about a SALT deal he clinched with the White House and blue-state House Republicans…Speaker Mike Johnson and James Braid, the White …

(Read More)