Talking Taxes in a Truck Episode 47: Jared Walczak on the Wealth Tax Proposal That’s Forcing Californians to Flee

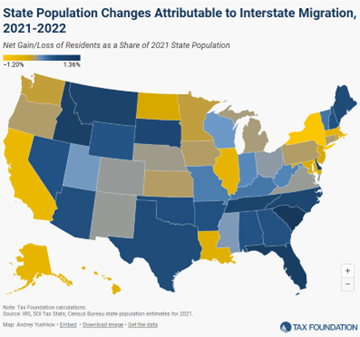

On the latest episode of Talking Taxes in a Truck, we’re joined by Jared Walczak, Senior Fellow at the Tax Foundation, to unpack California’s proposed wealth tax and what it signals for state tax policy nationwide. Walczak explains why the unprecedented 5 percent tax – particularly its aggressive valuation rules for founders with super-voting shares – could dramatically overtax entrepreneurs, invite serious legal challenges, and accelerate capital and job flight. Jared also zooms out to talk national migration patterns, as many states move to cut taxes and boost competitiveness while a small number double down on higher taxes, intensifying interstate tax competition and taxpayer mobility.

Tax Cuts Don’t Sell Themselves (But Big Refunds Help)

As tax season progresses, supporters of the Working Families Tax Relief Act are highlighting the provisions that made it possible.

That’s good news because tax cuts don’t sell themselves. As our friend David Winston pointed out in a recent op-ed, convincing Americans they benefited from tax legislation is often harder than passing it in the first place. Absent a concerted effort, the big refunds that are set to hit bank accounts in the months ahead won’t be connected back to the tax bill passed last summer.

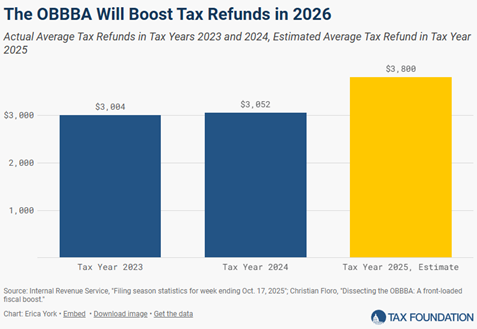

Just to be clear – there’s lots to sell. Tax filing season is officially underway, and by all accounts American families and businesses are in for a pleasant surprise. According to a new analysis from the Tax Foundation, the One Big Beautiful Bill is likely to deliver the largest tax refund season in modern history. Here’s the key chart:

That boost is thanks to the tax bill’s provisions aimed directly at individuals and families, including a more generous child tax credit and standard deduction, increased SALT cap, and new deductions for tips and overtime, among others. The relief was also enacted on a retroactive basis to the start of 2025, so taxpayers will see a full year’s worth of benefits when they file this spring. We previewed this dynamic back in October. As the report reads:

Tax Foundation estimates that, altogether, these seven provisions cut individual income taxes by $129 billion in 2025. In each of the past two tax years, more than 100 million taxpayers have received refunds averaging around $3,000, totaling more than $300 billion in each tax year. Private-sector economic analysis suggests the OBBBA will result in up to $100 billion in higher refunds in 2026 overall, with average refunds up between $300 to $1,000 compared to a typical year.

On Main Street, the bill prevented a massive tax hike on tens of millions of pass-through businesses by making permanent the critical Section 199A deduction, locking in the fair treatment of pass-through SALT payments, and avoiding treating pass-through losses worse than any other form of loss. Those provisions add up to more than $100 billion a year in savings for Main Street employers. That’s real money they can invest right now in new equipment, new workers, and higher wages.

S-Corp and its Main Street Employers Coalition allies championed these policies from the start. We educated stakeholders about why Section 199A matters, hosted several roundtables bringing together experts from across the tax policy world, commissioned economic studies demonstrating the jobs and growth supported by 199A, and built a broad coalition of hundreds of trade associations backing permanence.

Now it’s time to follow through. That means telling the story of Main Street businesses using their tax relief to support their workers and their communities. It also means connecting the dots between the refunds people see this spring and the policies that made them possible. That’s going to be our focus for the next several months.

Wage Taxes are Destructive – Let’s Ditch Them

Last week’s circuit court decision on the meaning of “limited partner” has broad implications for S corporations in the coming tax battles. As noted in the court’s ruling:

This case turns on the meaning of “limited partner” in 26 U.S.C. § 1402(a)(13). The Tax Court interpreted “limited partner” to refer only to passive investors in a limited partnership. It therefore upheld the IRS’s upward adjustment of Sirius Solutions’s net earnings from self-employment. We disagree. A “limited partner” is a partner in a limited partnership that has limited liability. So we vacate and remand.

The court further noted:

So, to review, the pass-through share of partnership income (or loss) of a limited partner is not subject to Social Security and Medicare taxation; but neither does it count toward the Social Security benefits the person may receive later in life.

The ruling comes in the face of efforts by the IRS to expand payroll tax collections to include the pass-through earnings of limited partners, arguing that “that for purposes of the § 1402(a)(13) exception, the term “limited partners” only “refer[s] to passive investors.””

One little problem — that’s not the rule:

The sole issue on appeal is the meaning of “limited partner” in § 1402(a)(13). We hold that a “limited partner” is a partner in a limited partnership that has limited liability. This is confirmed by (A) the text, and (B) the Social Security Administration (“SSA”) and IRS’s contemporaneous and longstanding interpretation of the term.

As you can imagine, this is a critical distinction, and we’re glad the court sided with workers and employers. The effort to expand the payroll tax base to include business profits goes way back and, if successful, it would deepen the wedge between tax rates paid by pass-throughs and corporations. (See here, here, and here)

It also begs the question – why tax wages at all?

The simple reality is that wage taxes hurt workers. They lower real wages, reduce employment levels, and impose expensive complexities on employers. Not convinced? Here’s a sample of recent economic literature highlighting the damage wage taxes inflict on the economy:

- Gruber (1997), The Incidence of Payroll Taxation: Evidence from Chile: Finds the full cost of wage taxes falls on workers through lower pay

- Kugler & Kugler (2008/2009), Labor Market Effects of Payroll Taxes in Developing Countries: Evidence from Colombia: Finds a 10 percent rise in payroll taxes reduced wages between 1.4 and 2.3 percent and employment by between 4 and 5 percent.

- Anderson & Meyer (1997), The Incidence of a Firm-Varying Payroll Tax: Uses firm-specific unemployment insurance tax variation to show that workers bear most of the tax but there is employment reallocation.

- Antón (2014), The Effect of Payroll Taxes on Employment and Wages under High Labor Informality: Finds that reforms reducing payroll taxes increased formal employment and wages.

What would be better than wage taxes? How about a VAT or border adjusted tax? Replacing a wage tax with a VAT could help address Social Security’s pending insolvency, increase wages, increase employment, and actually benefit the economy as a whole. Here’s a sample of the literature exploring the value of such a swap:

- Laszlo Goerke (1999), Value-Added Tax Versus Social Security Contributions: A budget-neutral shift from payroll taxes to a VAT can increase employment.

- OECD Taxation Working Paper (2012): Shifting from Social Security Contributions to Consumption Taxes: Shifting social security contributions toward VAT in European countries could increase work incentives for low-income workers at both participation and hours-worked margins.

- Toder & Rosenberg (2010) Tax Policy Center / Urban Institute (2016), Swapping the Employer Share of the Payroll Tax for a Consumption Tax: A detailed analysis of the efficiency gains of replacing the employer payroll tax with a VAT/GST. All but the highest earners benefit.

- Nunns & Rosenberg (2016) Urban Institute / Tax Policy Center, A Federal Consumption Tax as Replacement for the Employer Payroll Tax: Explores why a consumption tax base is well-suited to replace employer payroll taxes and how it interacts with the labor market and existing tax system.

So definitely something to think about.

But don’t expect a whole lot of thoughtful analysis in response to last week’s court decision. The pro-tax crowd will ignore the law and complain that their efforts to “tax the wealthy” are being thwarted, while the anti-tax crowd will reflexively reject VATs, ignoring their relative superiority to existing payroll taxes. In the meantime, Social Security will continue its inevitable march towards insolvency.

Finish the Job on CTA

Earlier today, more than 100 trade associations urged Treasury to take immediate action to protect small business owners from unnecessary privacy and cybersecurity risks stemming from the Corporate Transparency Act (CTA).

The letter was led by the Main Street Employers Coalition and calls on Treasury to purge the CTA database of beneficial ownership information submitted by domestic entities that are no longer required to file. It also asks Treasury to quickly finalize the rule formally exempting U.S. businesses from the reporting requirement.

As the letter makes clear, the CTA was designed to combat illicit finance, not to warehouse sensitive personal information from small business owners who pose no risk to national security:

Last year, the Administration took the important step of narrowing the CTA’s scope to apply to foreign entities only. That action provided much-needed relief to over 32 million domestic businesses swept into a regime intended to target international money laundering and terrorism financing, not law-abiding American business owners.

Before Treasury corrected course, some 16 million domestic entities had complied with the CTA’s reporting requirements. These beneficial owners’ sensitive personal information – including their names, addresses, and passport or driver’s license numbers – remains in a database managed by the Financial Crimes Enforcement Network, exposing them to ongoing cybersecurity and unauthorized disclosure risks.

So while domestic reporting is no longer required, the risk to those business owners who already filed hasn’t disappeared. Meanwhile, there is no legitimate justification for continued retention, a point raised by more than 90 members of Congress a few months back.

The letter also highlights the urgency behind the request, particularly in the context of recent activity in the courts:

The legal landscape surrounding the CTA reinforces the urgency of this request. There are now twelve federal cases challenging the validity of the CTA, including two that have ruled at the District Court level that the CTA is unconstitutional – National Small Business United v. Yellen and Small Business Association of Michigan v. Yellen in the Western District of Michigan. While the Eleventh Circuit recently reversed the NSBA ruling, that case is headed to the Supreme Court and the constitutional questions surrounding the CTA are far from settled.

Main Street employers shouldn’t be asked to “trust the process” while their personal information sits in limbo. Treasury took a welcome step when it narrowed the CTA’s scope last Spring. The next step is clear: purge the database and finalize the rule so Main Street businesses can move forward with confidence.

You Can’t Fix Stupid

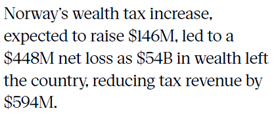

When Norway recently enacted a new wealth tax, it was billed as an easy way to make the rich “pay their fair share.” They packed their bags instead.

Within a year, hundreds of high-net-worth Norwegians fled the country, taking with them billions in capital, thousands of jobs, and a massive portion of the tax base. The exodus has been so severe that government revenue declined, serving as a case study in the inevitable response to bad tax policy.

Learning nothing, California is flirting with the same economic poison. A proposed “billionaire tax,” backed by the regional SEIU union, would impose a five percent levy on individuals and trusts with a net worth over $1 billion. While it’s billed as a one-time stopgap emergency measure to bolster safety net services, the proposed initiative is already hurting the California economy. As the New York Post reports:

The threat of a steep new wealth tax in California has reportedly prompted at least six billionaires including Larry Page and Peter Thiel to cut their ties with the state — and as many as 20 others could be heading for the exits.

The half-dozen billionaires made their moves before New Year’s Day — the cutoff date to avoid a potential one-time tax of 5% on fortunes exceeding $1 billion — which California residents will vote on in November, according to Bloomberg News.

David Lesperance, a tax adviser who specializes in relocating ultra-wealthy clients out of high-tax jurisdictions, told the outlet he personally helped four billionaires end their California residency before the proposal’s Jan. 1 cutoff date.

This exodus of capital and tax revenue comes on top of the outmigration of taxpayers already taking place in California. Over the past three decades, California has lost an eye-popping number of employers and businesses seeking to escape the state’s highest-in-the-country tax rates and general hostility to businesses and investment.

The result of these destructive policies is California is now the most economically imbalanced state in the country – lots of poor people, some very, very rich people, and a disappearing and distressed middle class. If this wealth tax moves forward, say goodbye to the wealthy, more angst for the middle, and more poverty for everybody else.

The shortsighted allure of easy revenue is not confined to The Golden State. Illinois recently considered going down this same road, floating a “tax on unrealized gains” that would have hit businesses and investors alike. The idea was ultimately shelved, but only after loud opposition.

Two years ago, we saw coordinated campaigns in Washington, New York, and other states where legislators introduced copycat wealth tax proposals aimed squarely at family businesses. As we warned at the time, it is as if they were intentionally trying to drive high-wealth taxpayers out of their states.

Just ask Connecticut, New Jersey, or New York, where each has seen an outmigration of high earners and business investment following their adoption of anti-investment policies.

The broader lesson is simple — there’s a reason our tax system focuses on taxing income, not wealth. Wealth taxes punish savings, the very fuel that drives innovation, creates jobs, and sustains communities. As we wrote a few years back, taxing wealth isn’t just bad economics – it’s administratively unworkable, constitutionally dubious, and economically destructive.

High-income entrepreneurs and investors in California already face the highest combined federal and state tax burden in the nation. Add a wealth tax to the mix, and more California taxpayers will do what the Norwegians did – move.

In the end, it won’t be the billionaires who pay the price. The businesses they finance, the workers they employ, and the communities they support will all feel the loss. California would do well to study Norway’s experience before repeating it. It is a really bad idea.