The House last week signed off on a Senate-approved budget resolution that uses a “current policy baseline” method of tallying up the bill’s deficit impact. One quirk of this approach is any existing policies must not be simply renewed but would need to include a substantive change from current law. That means lawmakers using a current policy baseline will need to make tweaks to the Section 199A deduction to stay compliant.

Section 199A(c)(2) bars a pass-through business from claiming the 199A deduction until it recoups 199A qualified losses from prior years—so-called “199A Deficits.” That provision has proven to be deeply unfair to many family businesses, particularly those that incurred losses during the pandemic to keep their workers employed and their doors open.

Today, many of those businesses are turning a profit again but they’re blocked from the 199A deduction because of these losses. Add to that the exclusion of foreign income and certain capital gains from Qualified Business Income (QBI) and many Main Street employers find themselves in a double bind: significantly higher taxes and no 199A deduction.

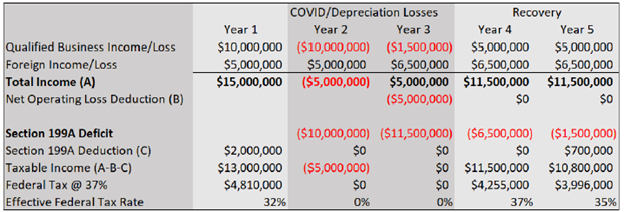

The table above helps illustrate this dynamic. The hypothetical business is being penalized for incurring losses during a time when much of Main Street was forced to cease its operations. Worse yet, this adverse outcome is not a one-time event as those deficits carry over and increase the company’s tax burden for years to come.

C corporations, by contrast, face no such hurdles. NOLs incurred by C corporations apply to all forms of income, so a C corporation with NOLs doesn’t pay tax. They enjoy a flat 21 percent rate, unlimited in scope and free from these types of constraints — regardless of whether the income is foreign or domestic.

For these reasons, Main Street supports a two-step fix that’s practical and Byrd Rule compliant. Step one is a one-time election to allow businesses to zero out their 199A deficit balances, thus giving them immediate access to the 199A deduction as Congress intended. Step two is allowing foreign-sourced income to be included in QBI. There’s simply no valid reason to exclude this income from 199A.

Adopting these two steps would make Section 199A more accessible, more effective, and more aligned with the policy’s original intent. Most importantly, they would help millions of family businesses recover, reinvest, and grow faster.