Progress on S-Corp SALT Parity Efforts

The House Select Revenue Subcommittee held a hearing today entitled “How Recent Limitations to the SALT Deduction Harm Communities, Schools, First Responders, and Housing Values.” Missing from the list are Main Street Employers, many of whom lost the ability to deduct the State and local taxes they pay on their business income.

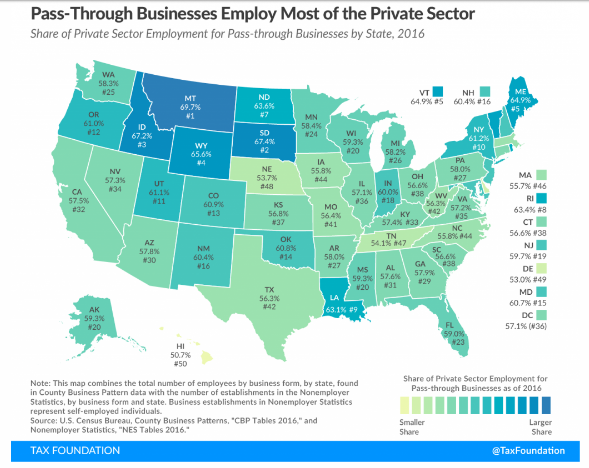

That’s because tax reform subjected deductions on state and local taxes (SALT) paid by pass-through business owners to the same $10,000 cap as taxes paid on wages and property. Taxes paid by the business entities themselves, like C corporations, remain fully deductible.

Since most states tax pass-through businesses at the …

(Read More)