For years we’ve been sounding the alarm over the 2025 “fiscal cliff,” a watershed moment that will force lawmakers to address a litany of expiring tax provisions or risk a massive tax hike on families and Main Street businesses. Below is a look at what’s at stake for Main Street businesses and our bull case for Congress taking action next year.

Sunsets and Families

One TCJA myth is that it benefited big corporates and billionaires only. That’s simply not true. Much of the tax relief targeted at corporations and wealthy individuals was paired with significant revenue raisers, while the tax relief targeting low- or modest-income families was largely free of offsetting provisions. The result was a clean tax cut for families of modest means but a mixed bag for wealthier taxpayers.

Low-income families benefitted from lower tax rates, a higher standard deduction, and a larger child tax credit. The recent CBO analysis put the cumulative benefit of those provisions at over $4 trillion. Subtract out the rate relief going to higher-income taxpayers and still you’re left with a multi-trillion-dollar tax cut for taxpayers of modest means, largely devoid of any offsetting raisers.

The benefits accruing to upper income taxpayers, on the other hand, are more complicated. The lower rates and individual AMT relief they got were substantially offset by the new SALT cap, the loss of Section 212 deductions, a cap on the mortgage interest deduction, and other provisions. For those taxpayers, how they fared depended on many factors, including where they live, how many children they have, and how they make their money. Some did well, but others saw their taxes go up.

This means allowing the TCJA provisions to expire as scheduled would result in tax cuts for many high-income taxpayers but significant tax hikes for families of more modest means. This reality is the first reason we are confident that Congress will act next year to prevent us from going over the cliff.

The Main Street Time Bomb

We all know the Section 199A small business deduction and lower pass-through rates are scheduled to sunset at the end of 2025. If they do, any semblance of parity between pass-throughs and public C corporations will be eliminated, inflicting large tax increases on millions of Main Street businesses located in every single community in America.

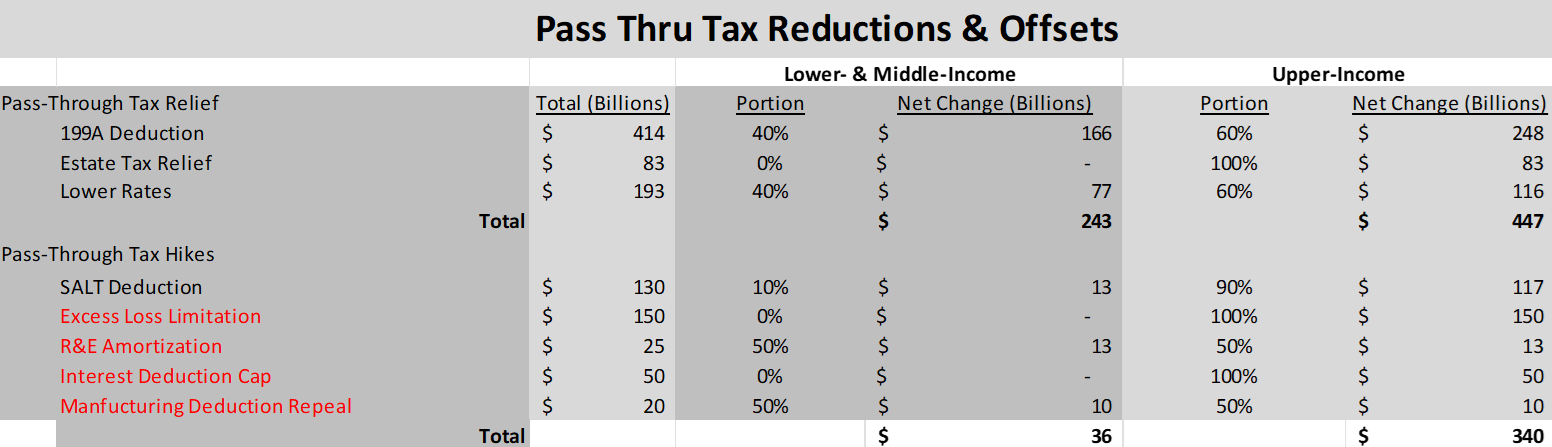

As with the individual relief, however, the pass-through discussion is more nuanced than the headlines would suggest. That is because, as with the individual tax provisions, the lower rates and 199A deduction were largely offset – this time by the SALT deduction cap, the elimination of the old 199 manufacturing deduction, the new excess loss limitation, the new 163(j) cap on interest deductions, R&E amortization, etc.

This chart using the JCT’s 2017 estimates is a rough effort to illustrate how the benefits and costs were distributed.

These are back-of-the-envelope estimates, but you get the picture. Smaller enterprises got a clean tax cut while the results for larger enterprises depended on a multiplicity of factors, including where they operate. (It was this result that motivated S-Corp to engage in our successful SALT Parity campaign.)

Moreover, the revenue raisers in red stay in place post 2025. We’ve written about this dynamic for over a decade now (here, here, here, here, here) but it continues to be neglected in the general tax conversation. The Main Street Employers Coalition got its start not to advocate for tax cuts, but rather to avoid the very tax hikes we now face post-2025.

The bottom line is if we go over the cliff, businesses of all sizes will see their tax burden go up – not just relative to today, but relative to the pre-TCJA Tax Code. That’s the second reason we are confident Congress will act next year.

Not Just Business Relief

Finally, there’s more at stake next year than expiring tax relief, including the pending sunset of expanded Obamacare tax credits. Here’s Forbes on the expiration of these credits:

In early 2021, Congress significantly increased subsidies for people who purchase coverage through the exchanges. In the Inflation Reduction Act, Congress maintained these higher subsidies through 2025. These higher subsidies present several major problems, but they have led to about 3 to 4 million additional exchange enrollees. Since nearly 2 million people who lose Medicaid from the redeterminations are projected to enroll in subsidized exchange coverage, CBO projects that overall Obamacare exchange enrollment will rise to 17.9 million people in 2025 (up from 15.2 million this year). CBO projects that the loss of the enhanced subsidies will cut exchange enrollment to 12.8 million in 2027.

Five million people losing their health coverage is bound to get somebody’s attention.

So is the expiration of WOTC and other worker, community, and renewable energy deductions and credits. The recent CBO report on next year’s cliff highlighted $199 billion of these, including credits for advanced manufacturing, clean fuel production, clean vehicles, energy efficient home improvements, among others. These expiring provisions enjoy bipartisan support and are the third reason we are optimistic Congress will act next year.

Bipartisan Reasons for Action

The point of all this is that there are strong reasons why members of both parties will act to avoid next year’s fiscal cliff. A failure to act would result in tax hikes on millions of low-income families, tax hikes on millions of Main Street businesses, and the loss of health insurance for millions more. It’s a pretty compelling set of incentives for action.