With the Build Back Better Act stalled in the Senate, states should resume efforts to enact our SALT Parity legislation this year. The SALT cap appears here to stay, at least through 2025, and the savings potentials for family businesses are substantial.

How substantial? As reported by Richard Rubin in the Wall Street Journal, new numbers out of New York show that that S corporations and partnerships paid $11 billion under the new Pass-Through Entity (PTE) tax the state adopted back in April, translating into between $3 and $4 billion in federal tax savings. $4 billion! That’s just one year and one state.

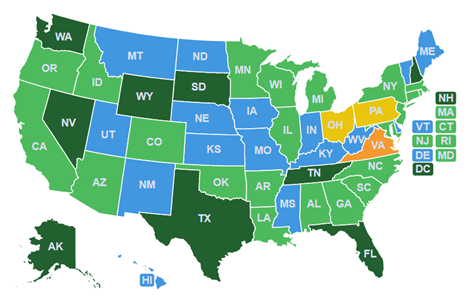

No wonder adoption of parity bills is accelerating. According to our Main Street Employers tally, 22 states (light green) have now adopted some version of our SALT Parity legislation, 15 of them just in the past twelve months.

That leaves another 19 states where the reform would be beneficial. We’re active in several of those states (yellow, orange) already. It’s time for the others (blue) to get busy.

Some additional points. First, the total PTE taxes paid in New York suggest total S corporation and partnership income in New York is about twice what’s reported in the IRS Data Book. The IRS says S corporations and partnerships earned $56 billion in New York in 2019. But $11 billion in PTE taxes at a top rate of 10.9 percent translates to more than $100 billion in pass-through income in 2021. What gives?

A couple explanations come to mind. Under the new bill, the tax imposed on S corporations includes only New York-source income attributable to shareholders who are subject to the New York personal income tax. For partnerships, the tax base is broader, including New York-source income attributable to nonresident partners and New York-source and non-New York-source income for resident partners. So the first explanation might be that some of the excess is out-of-state income that qualifies for the PTE tax. Another possibility is that, with the headline risk of higher rates under the BBB looming, taxpayers accelerated income into 2021 that would otherwise been realized in later years.

Still, with the IRS data off by a factor of two, it’s worth further investigation. The PTE tax is an election, so the $11 billion in tax payments represents just a subset of the total taxes paid on pass-through income to the state. Where’s all this extra pass-through income coming from?

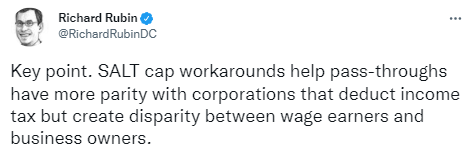

Another issue is the disparate treatment of business and individual income under the parity bills. As Rubin tweeted in relation to his article:

That observation is misplaced, as the correct comparison is not between earners and owners, but between the treatment of business income verses wage income. As Matt Levin from Bloomberg writes:

A basic rule of U.S. income tax is that a business pays tax on its net income, but a person pays tax on her gross income. A business takes its revenue, subtracts its expenses, and pays tax on the difference; business expenses are tax-deductible. A person takes her paycheck and pays taxes on that; personal expenses are not tax-deductible.

The TCJA violated this approach by disallowing pass-through businesses a legitimate business deduction – the tax they pay to states and localities on their business income. As readers know, S-Corp initiated the parity effort because under the TCJA C corporations could continue to fully deduct their SALT as a business expense, while S corporations and partnerships could not. The bills enacted in NY and elsewhere simply level the playing field for business income.

Finally, can we please stop pretending that the only beneficiaries of our efforts are law firms and hedge funds? It’s an embarrassingly partisan assumption that just doesn’t stand up to scrutiny. 95,000 New York pass-through businesses made the PTE election last year; there are only a few thousand hedge funds nationwide. Businesses making the election include manufacturers, contractors, and wholesalers: real businesses with real employees paying real taxes.

So it’s a New Year and the challenge of SALT parity continues. S-Corp’s New Year’s resolution is to finish the job we’ve started and get all 19 remaining parity states to take action this year. it’s a tall order, but as New York demonstrates, the savings to family businesses are worth it.