Americans are correctly alarmed by the recent spike in prices, while Senator Manchin has made rising prices a key rationale for his opposition to the massive Build Back Better Act (BBB). Both believe the BBB, particularly the tax hikes, will drive up prices even further.

President Biden and others, on the other hand, push back on the idea that the BBB will drive up prices. As the President said in his press conference the other day:

My Build Back Better plan cuts the price of drugs…it cuts the cost of elder care and it will do all of this without raising a single penny in taxes on people making under $400,000 a year, or raising the deficit. In fact, my plan cuts the deficit and boosts the economy by getting more people into the workforce. Bottom line – if price increases are what you are worried about, the best answer is my Build Back Better plan.

So how valid is the President’s counter-argument that the BBB will reduce prices, not raise them? Not very. Here’s why.

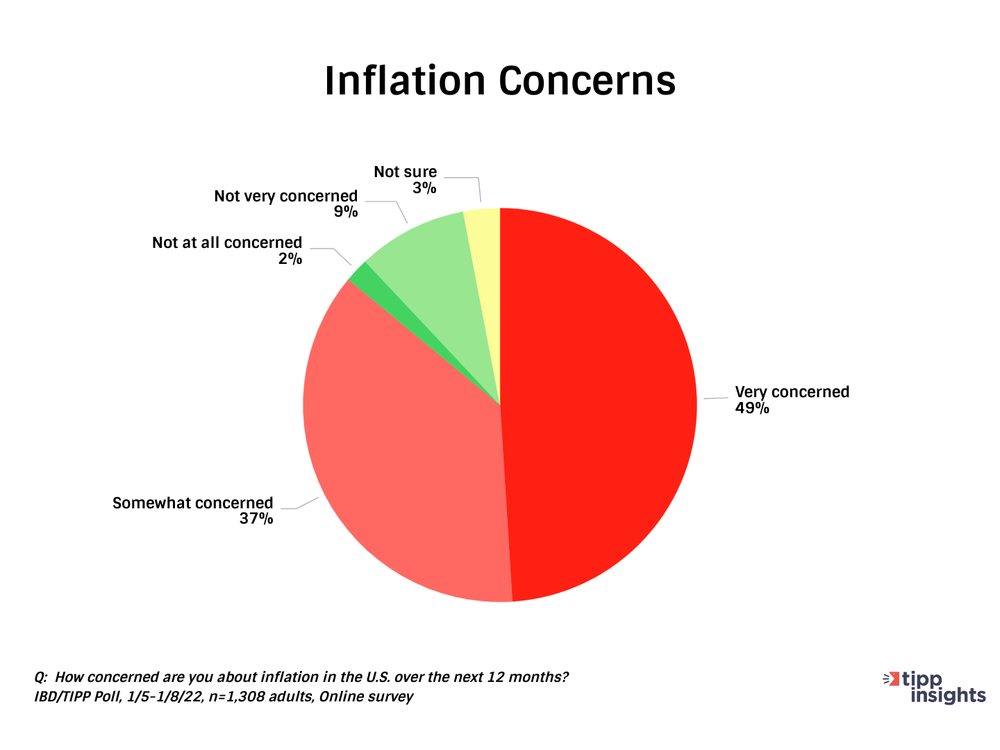

Americans Alarmed by Inflation

A new poll by Tipp Insights shows why inflation has the BBB’s supporters worried. According to Tipp Insights, an astounding 86 percent of survey respondents were “somewhat concerned” or “very concerned” about inflation over the next twelve months.

Americans have good reason to worry about inflation. As the survey’s authors point out:

Compared to a year ago, Americans are paying 50% more for gasoline, 29% more for energy, and 24% for natural gas. Officially, food prices have increased by 6.5%, while experts say it may be closer to double digits.

And while wages have risen by 4.7 percent over the past year, those gains have been completely wiped out by the 7 percent increase in consumer prices. Thanks to inflation, workers are literally worse off today than they were a year ago.

Manchin Singles Out Inflation

In remarks to reporters yesterday, Senator Machin repeatedly highlighted rising prices as the core of his opposition to the BBB. In a series of tweets, CNN’s Manu Raju summarized the Senator’s comments:

Just caught up with Manchin, who set a very high bar for passing ‘chunks’ of Build Back Better plan. In short, he wants to see inflation, covid and the national debt dealt with first. Also said they’ll be ‘starting from scratch’ and his December offer isn’t on table.

“The main thing we need to do is take care of the inflation,” Manchin said. “Get your financial house in order. Get a tax code that works and take care of the pharmaceuticals that are gauging the people with high prices. We can fix that. We can do a lot of good things.”

Manchin added that Washington first needs to “get your financial house in order. Get this inflation down. Get covid out of the way. Then we’ll be rolling…We will just be starting from scratch,” Manchin said, adding that it will be “clean sheet of paper.”

So Americans and Senator Manchin agree inflation is a problem that needs to be addressed. Would the BBB help reduce prices, as the President argues? No. Here’s why.

Build Back Better Will Make Things Worse

Whether tax increases cause prices to rise or fall depends on what you’re taxing. A tax on wages would cause prices to fall, for example, as it would reduce the level of demand in the economy.

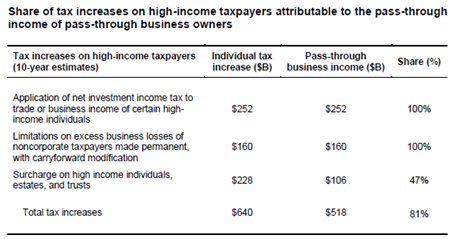

Nearly all the tax increases in the BBB, however, are on business income. The $800 billion in corporate and international tax increases fall entirely on the business sector, as do most of the taxes targeted at “High-Income Individuals.” Our recent EY analysis showed how 81 percent of the three “individual” tax hikes in the BBB will be paid by pass-through businesses:

So of the total $1.45 trillion tax increases in the BBB, $1.3 trillion fall on business income. These tax hikes will reduce employment and output, resulting in higher prices for families. In an economy where supply is already sharply constrained, the effect could be substantial.

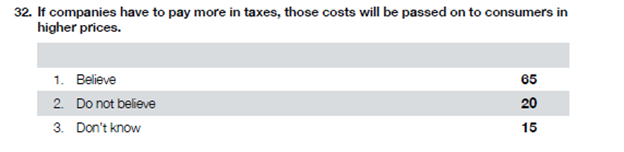

Voters Believe Tax Hikes Raise Prices

As our Winston Group survey from last summer demonstrated, voters understand this dynamic. Nearly two out of three respondents agreed that taxes on businesses will be passed on to consumers through higher prices.

Counter-Arguments Fall Short

The President’s claim that the BBB will reduce prices is based on a narrow analysis of the bill that ignores the overall impact of the $2 trillion spending and tax package. A recent report by the majority members of the Joint Economic Committee is a good example. The report argues that the BBB will help families better afford childcare, college, and other expenses:

The Build Back Better Act would directly reduce healthcare and prescription drug costs—with Medicare negotiating lower drug prices for seniors—while cutting taxes for families with children. The bill would also cut driving costs for millions of Americans, make commuting costs more predictable and dramatically lower child care costs, especially for the newest parents.

But subsidizing certain expenses is not the same as reducing prices. And many of those subsidies, while they might help the families who receive them, are likely to drive up prices for everyone else.

For example, allowing Medicare to dictate prices would certainly help reduce prescription drug prices for Medicare beneficiaries. But drug prices for everybody else would likely go up, so the overall impact on prices from the policy is unclear.

The same analysis applies when it comes to the report’s claims about the bill’s childcare subsidies. Providing childcare benefits without a corresponding increase in the supply of childcare services will help the families receiving the subsidies, but it also will increase overall childcare costs.

The bill’s enhanced Child Tax Credit would help families, but it also would reduce employment and output. The Tax Foundation used its General Equilibrium Model back in August and estimated the credit would decrease full time equivalent jobs by 38,000. Increasing demand while reducing output would raise prices, not the other way around.

The National Association of Business Economists held a panel discussion back in November where these questions were fully discussed. As Bloomberg reports:

The roughly $2 trillion tax and spending bill being championed by President Joe Biden will act to push up inflation next year if passed by Congress.

That’s according to three senior economists — Mark Zandi at Moody’s Analytics, Douglas Holtz-Eakin of the American Action Forum and Harvard University professor Doug Elmendorf — who appeared on a virtual panel sponsored by the National Association for Business Economics on Wednesday.

While they all agreed the bill as presently constituted would add to inflationary pressures in the short run, they differed over how worrying that would be — with Zandi exhibiting the least concern and Holtz-Eakin the most.

Bottom Line

The BBB would impose more than $1.3 trillion in new taxes on employers and give much of that money to workers in the form of checks and subsidies. In basic terms, it would tax output and subsidize demand. Senator Manchin is correct that the result will drive up prices. At a time when prices are already going up and supply lines are already constrained, that’s not a good idea.