More good news on the SALT Parity front. New York has become the 10th state to adopt our reform legislation while a similar bill is sitting on the desk of the Georgia Governor awaiting his signature, which would make 11.

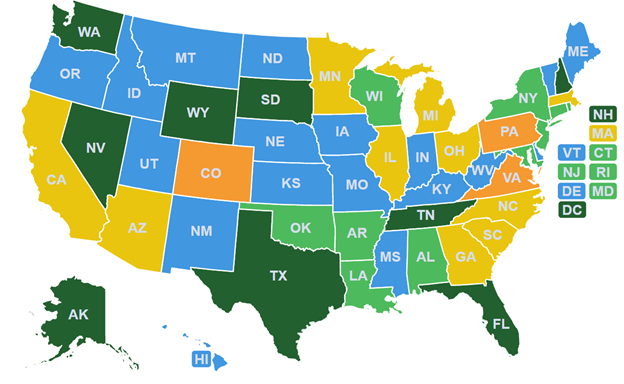

Those states join Connecticut, Wisconsin, Oklahoma, Louisiana, Rhode Island, New Jersey, Maryland, Alabama, and Arkansas in passing SALT Parity, while a dozen others are actively considering similar bills. Illinois is new to this list, following yesterday’s unanimous vote in favor of S.B. 2531 in the state Senate. The map below shows the current status of SALT Parity legislation.

So of the 41 states that tax pass-through businesses at the owner level, more than half have either adopted our SALT Parity reform or are actively considering it.

This is a big deal to the S corporations and partnerships in those states. The disparate SALT treatment they experience puts them at a significant disadvantage compared to their C corporation competitors and compared to entities operating in states with no income tax, like Texas and Florida.

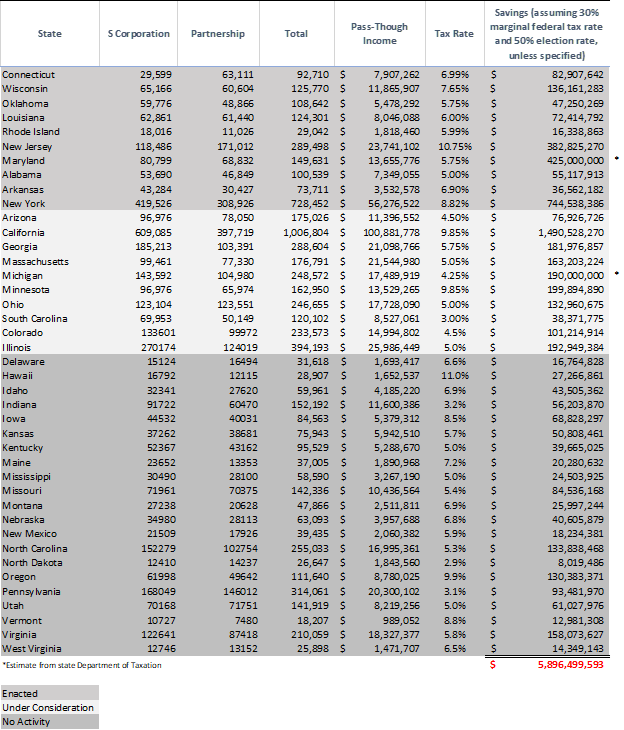

Billions are at stake. The Michigan Department of Taxation, where a SALT Parity bill is moving, estimates the legislation would save Michigan S corporations and partnerships $190 million per year. Using IRS data and the fiscal notes published by other state revenue agencies, we roughly estimate that more than three million S corporations and partnerships would benefit from $5.9 billion in annual relief.

Even for smaller firms, those savings can amount to several thousands of dollars each year. That’s a significant amount, particularly as those affected by the cap are often the same businesses that have been hardest hit by the pandemic.

Our SALT Parity map tracks the progress of states across the country in moving SALT Parity legislation. If your state is in green on this map, congrats. If your state is in blue, that means there’s no legislation under consideration. If you want to change that, give us a call. Your state’s inaction is literally leaving money on the table and costing your Main Street employers millions.