Politico recently ran a story about the soul-searching taking place in the polling community, whose 2020 projections predicted a landslide victory for Joe Biden and an significant expansion of the Democratic majority in the House.

“Twenty-twenty was an ‘Oh, s—‘ moment for all of us,” said one pollster involved in the effort, who was granted anonymity to discuss the process candidly. “And I think that we all kinda quickly came to the point that we need to set our egos aside. We need to get this right.”

That’s about where the answers end. The collaboration’s first public statement acknowledges that their industry “saw major errors and failed to live up to our own expectations.” But the memo also underscores the limits of the polling autopsy, noting that “no consensus on a solution has emerged.”

Meanwhile, as Axios observed, the Biden Administration is relying on polling to promote its massive, $3 trillion tax package.

The top pollster for Joe Biden’s presidential campaign is advising the White House to do something that often makes Democrats nervous: Talk loudly and proudly about raising taxes on the rich.

John Anzalone tells Axios his extensive polling and research has found that few issues receive broader support than raising taxes on corporations and people earning more than $400,000 a year.

In other words, the very pollsters who assured us that Democrats would run up the score in November are now advising Biden to push hard on tax hikes. They admit they don’t really have an answer for how they got 2020 so wrong, but that isn’t slowing their roll in 2021.

Is it possible they are, once again, misjudging Americans’ views, this time on taxes? We think so.

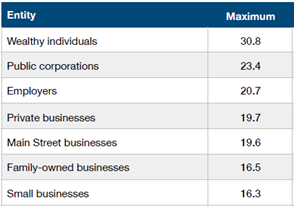

The reality is that Americans consistently oppose high tax rates, regardless of who’s paying them. Back in 2019, the Winston Group asked voters: “For each of the following, what is the maximum rate at which you think they should be taxed?”

Categories included the wealthy, family businesses, and public corporations, and the average responses were all consistently low, topping out at 31 percent for the wealthy and coming in as low as 17 percent for small and family-owned businesses.

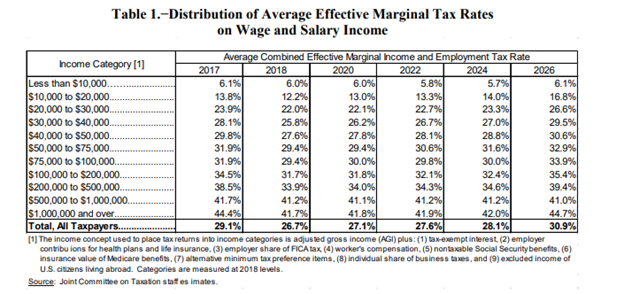

The irony here is that wealthy Americans already pay more than 31 percent of their income to the federal government. This table from the Joint Committee on taxation shows the effective marginal tax rates – the average tax paid on new income — paid by different income classes. According to the JCT, top income earners pay an EMTR of 42 percent, or about eleven percentage points higher than the maximum Americans think they should pay.

The results gap between John Anzalone’s “extensive polling and research” and the Winston Group’s survey ultimately boils down to the fact that most Americans are unaware of real tax burdens — what Americans think is fair verses what they think businesses and individuals actually pay.

That’s no surprise as most press coverage tends to focus on tax havens, loopholes, and tax cheats rather than taxes paid, but it does present the business community with a unique challenge. In the fight over tax policy, one priority needs to be educating the American people on who pays what.

For the Biden Administration, their challenge is to view those rosy tax hike poll numbers with a little more skepticism. They are brought to you by the same folks who blew the 2020 elections, after all.