One BIG Main Street win in the One Big Beautiful Bill (OB3) was what didn’t happen: Congress rejected ill-considered proposals in both the House and Senate drafts to limit pass-through entity (PTET) deductions for state and local taxes (SALT).

That was huge for many reasons, but primarily because the C corporation down the street continues to fully deduct their SALT. In what rational world is Home Depot allowed to deduct its SALT, but your local hardware store is not?

In place of limiting PTET deduction, Congress instead voted to temporarily raise the individual SALT cap from $10,000 to $40,000. What impact does that have on state PTET laws, particularly for smaller pass-throughs? Here’s what S-Corp President Brian Reardon recently told Law360:

“Treating PTET as a business expense helps ensure business owners get deductions for 100% of the taxes they pay,” he told Law360. “It can also simplify their returns by consolidating all those tax payments.”

Reardon said the new law levels the playing field for pass-throughs with their C corporation competition on SALT, but the group plans to push for greater use of PTETs.

So Treasury blessed PTET deductions back in 2020, and now Congress has elected to leave them in place following a rigorous debate. That’s good news for the Main Street community and it begs the question – what’s next for our SALT Parity efforts? Here’s the plan.

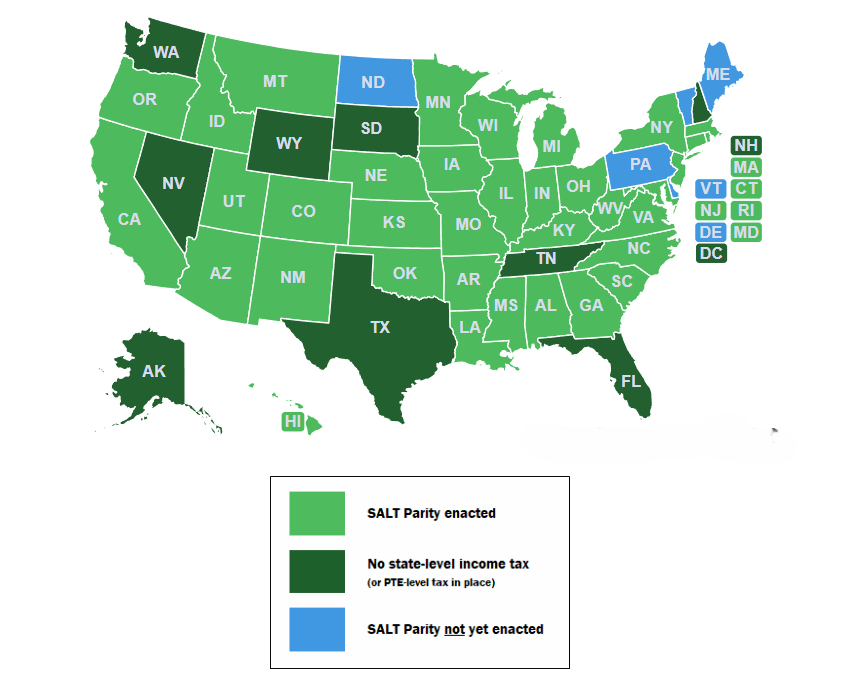

First, we need to finish the job. Through our Main Street Employers Coalition, we successfully enacted SALT Parity statutes in three dozen states, unlocking around $20 billion in savings for pass-through businesses each year.

Businesses in states that have failed to act, however (Pennsylvania, North Dakota, Vermont, Maine, and Delaware), remain at a disadvantage, unable to claim the same full SALT deduction available to their competitors. This makes no sense, so we will start by getting SALT Parity enacted in those states.

Our next priority will be to ensure that existing PTET laws are made permanent. A number of state PTET laws – including California, Illinois, and Oregon – were either tied to the federal SALT sunset or are otherwise scheduled to sunset next year. Absent action, employers in some of these states could lose access to their PTET deductions even as federal rules continue to allow them.

Third, we need to improve or fix some existing PTET laws. While most SALT Parity laws enacted in recent years follow the basic framework outlined in our initial 2018 model legislation, every law is different and some states added provisions that needlessly limit the deduction:

- In Oregon, the Department of Revenue disallows the PTET election if a trust owns any portion of the business, effectively excluding many family businesses from participating.

- In Maryland, recent changes have jeopardized S corporation eligibility and will need to be fixed.

- In California, businesses must pre-pay 50 percent of their anticipated PTET liability early in the tax year, resulting in liquidity challenges for many businesses.

- Many states made the election process needless complex and/or difficult. Our model bill argued for annual elections made when the business submits its tax return. That’s still the best approach.

Finally, we will work in Washington to make sure PTET deductions benefit real businesses only and are not used as a tax dodge or a tool for states to raise revenues at the expense of the federal taxpayer. During the OB3 debate, concerns were raised regarding the potential misuse of PTET deductions. We address many of those, but there remains the potential for states to take advantage (looking at you, Massachusetts). We plan to work with Congress to address that.

The bottom line is OB3 preserved SALT Parity for pass-through businesses and opened the door for us to move on to the next step – finishing the map and improving the rules so Main Street business owners can fully benefit from this hard-won victory.