We like Marty Sullivan. He always has something interesting to say. His latest piece criticizing Section 199A is a bit of a disappointment, however.

Where to start? Marty says the pass-through community was “seething” following the resolution of the 2012 fiscal cliff – we weren’t. He says family businesses can just elect to be C corps if they don’t like paying higher rates – except they pay more either way (we’ve covered that one many, many times). And he says we should reject 199A because it excludes certain industries – wasn’t our idea.

But those are quibbles. The big issues are listed below, together with our response.

Sullivan: “[An] inconvenient fact for the passthrough lobby is that the bulk of section 199A tax benefits goes to high-income taxpayers. In 2021, as shown in Table 1, individual tax returns with adjusted gross income between $500,000 and $10 million got more than one-third of the total deductions claimed.”

Large pass-throughs do get the 199A deduction, but only if they employ lots of people or make significant investments. That’s because 199A imposes so-called guardrails on large pass-through businesses so, for example, they only get the deduction up to 50 percent of the W-2 wages they pay, or a similar cap tied to capital investments. This Treasury study shows how these guardrails exclude about 40 percent of pass-through income from the 199A benefit.

Meanwhile, a recent CRS report observes that the 199A deduction is neutral regarding progressivity. As the report notes: “The Section 199A deduction appears to have little effect on vertical equity, as it does not appear to diminish the progressivity of the federal income tax.”

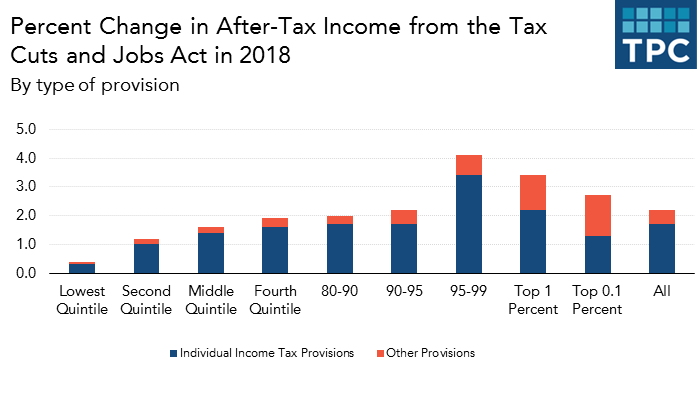

The same cannot be said for the corporate rate cuts. Critics argue the TCJA primarily benefited wealthy taxpayers but that is mostly due to the corporate rate cuts. This table from the Tax Policy Center shows that as income rises, so does the benefit from the corporate rate cuts.

This reality doesn’t help pass-through business owners, and it doesn’t stop critics from blaming 199A anyway. You can see this slight-of-hand play out in real time at a recent Tax Foundation panel where Bill Gale argues against 199A because the TCJA reduced taxes on the rich, admits that this is mostly due to the corporate rate cuts, then concludes that we should keep the corporate rate cuts anyway.

This reality doesn’t help pass-through business owners, and it doesn’t stop critics from blaming 199A anyway. You can see this slight-of-hand play out in real time at a recent Tax Foundation panel where Bill Gale argues against 199A because the TCJA reduced taxes on the rich, admits that this is mostly due to the corporate rate cuts, then concludes that we should keep the corporate rate cuts anyway.

Finally, we’d be remiss by not pointing out that Sullivan made his name highlighting how little tax large multi-national corporations paid. Nobody ever said the same regarding large family-owned businesses. As our studies have made clear, these businesses pay the highest rates regardless of how they are organized.

Sullivan: Extending the deduction will add significantly to our ever-growing, record-level federal debt. The staff of the Joint Committee on Taxation estimates the 10-year cost at $684 billion.

The 199A deduction does reduce revenues but it wasn’t adopted in a vacuum. It was packaged with numerous offsetting provisions that raise lots of money – more than 199A costs – and they primarily target upper-income business owners:

- SALT Cap

- Section 461(l) Excess Loss Limitation Rules

- Section 174 R&E Amortization

- Section 199 Manufacturing Deduction Repeal

- Section 163(j) Interest Deduction Cap

- Section 212 Deduction Limitations

Moreover, these provisions (save the SALT cap) will stay in the tax code even as 199A expires, resulting in a significant tax hike on pass-through businesses – not relative to the TCJA, but rather the tax code that preceded it. Avoiding a tax hike is how the Main Street Employers coalition got started in the first place. You can read about it here, here, here, here, and here.

Sullivan: [P]omerleau’s calculations tell us that without a section 199A deduction, passthroughs on average would have a slightly higher effective statutory rate than corporations — 44.5 percent for passthroughs versus 42.3 percent for C corporations. However, section 199A reduces that 2.2 percentage point average disadvantage for passthroughs to a 5.2 percentage point advantage.

Exactly where rate parity lies is at the heart of this debate, yet Sullivan relies on a single source with a long history of 199A hate. Kyle Pomerleau’s preferred tax code would eliminate all pass-throughs and tax everybody as C corporations.

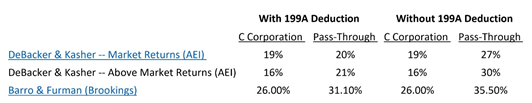

Focusing on a single source ignores effective rate estimates by Treasury, CBO, EY, and others which show the TCJA resulted in rough parity between business forms. Here’s Barro-Furman and DeBacker-Kasher:

Meanwhile, the folks at Penn-Wharton predicted that one-sixth of all pass-through activity would shift to C corporations following adoption of the TCJA:

Prior to the TCJA, pass-through businesses were growing remarkably over time. We project that the TCJA will reverse this trend. In particular, we project that 235,780 individual business owners—especially higher income business owners or service providers—will switch from owners of pass-through entities to C-corporations, representing about 17.5 percent of Ordinary Business Income from pass-throughs.

Keep in mind, this migration was supposed to occur with the 199A deduction.

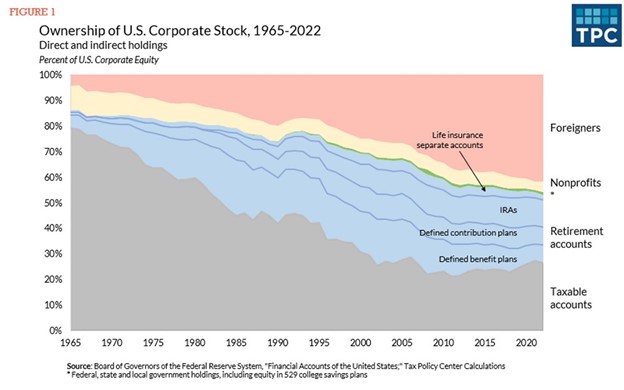

The reason Kyle’s estimates are outliers is he ignores perhaps the most salient feature of this debate – that most public C corporation shareholders don’t pay taxes. Here’s the Tax Policy Center’s latest on that front:

Why is this important? Tax burden comparisons must estimate the portion of corporate earnings that are subject to shareholder-level taxes. If three-quarters of C corporation profits are earned by shareholders who pay little or no tax, then the overall effective rate paid by C corporations is significantly lower. Kyle, meanwhile, just assumes the applicable corporate rate is 40 percent for everybody. As the TPC graph makes clear, that’s no longer a tenable position.

Sullivan: “Even though in tax circles it is widely known that many passthrough businesses are large, proponents of section 199A won’t be able to resist implying that tax cuts for passthroughs flow exclusively to small businesses.”

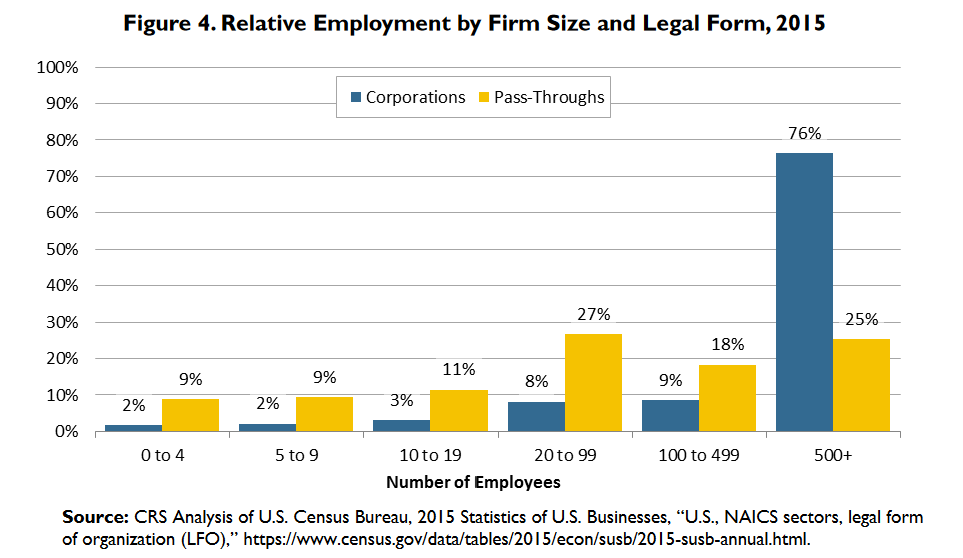

Nobody claims 199A goes “exclusively” to small businesses. All of our materials highlight the importance of 199A to businesses both large and small. And while many advocates do refer to 199A as the small business deduction, that’s because pass-throughs are small. It’s a relative thing. A 2018 Congressional Research Service report found that 99% of pass-throughs had fewer than 100 employees and were, in just about every measure, smaller than their C corporation counterparts:

So Sullivan supports the “worthy cause” of enacting large tax cuts for massive public corporations, but opposes efforts to ensure pass-through businesses aren’t disadvantaged in the process? Doesn’t seem reasonable. The good news is we have the facts on our side and we have time to educate policymakers on why pass-throughs are an important part of the economy, and why 199A is important to pass-throughs. In the meantime, we will continue to read Marty’s work. He’s always interesting, even when we disagree.