Lynn Mucenski-Keck, an S-Corp Advisor and Principal at the accounting firm Withum, is out with new Forbes piece highlighting how punitive the new research and experimentation (R&E) tax regime is to businesses in New York and across the country.

With New York already fighting to retain businesses, the capitalization of federal R&E expenditures may result in more companies moving out of New York to balance their federal and New York State tax bills. One of the attractions for New York businesses is our highly educated and talented workforce. New York is consistently rated as one of the top ten most highly educated states in the United States. However, if out-of-the-box thinking, innovation, and growth is impeded by forced R&E capitalization, New York could cease to be a place to innovate and grow.

Since its inception, Section 174 allowed businesses to deduct their R&E expenses in the same year they were incurred. Congress enacted the provision to spur innovation while allowing domestic companies to better compete on the international stage.

Beginning in 2022, however, business must amortize their domestic R&E costs over a five-year period. (For 2022, taxpayers could only begin at the midpoint of the taxable year, resulting in a still lower 10-percent deduction.) On its face, the change may seem like a simple matter of timing. A deduction claimed over multiple years versus a full deduction claimed in year one. In practice the policy saddles innovative companies with massive, unexpected tax bills.

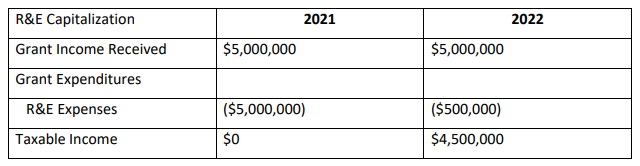

This example from Lynn’s earlier testimony before the House Small Business Committee shows how. A company receiving research grants that spends the full amount on R&E within the year (a common requirement) would see its taxable income increase from zero to $4.5 million:

But the new regime doesn’t just target high-tech and large companies. Because the definition of R&E expenses is broad and includes labor costs, a surprising number of small- and mid-sized businesses are affected as well. As Lynn explains, the incentive has been transformed into a deterrent, stripping much-needed cash away from companies just because they made certain investments:

…The cash impact on these New York companies is extreme. For example, the clothing designer reported a financial statement loss of $ 2 million, but primarily due to the R&E capitalization requirement of the eCommerce platform drove their taxable income up by $1.7 million, resulting in additional tax due of over $350,000. The software development company reported a financial statement loss of approximately $1 million, but due to the required R&E capitalization increased their federal taxable income by $2.2 million resulting in an additional $462,000 of federal income taxes. For two companies that would have paid little to no federal income tax due to their investment in their businesses, and actual cash outlay for research expenditures, they are now struggling with where to find the cash for their federal income tax payment.

R&E expensing may be viewed as a big business problem, but the reality is that many smaller companies are heavily invested in research and innovation too.

The House Ways & Means Committee recently advanced the American Families & Jobs Act which includes a return to the old R&E expensing regime. While some view the bill as a messaging vehicle, we think there’s more to it. Just as the House-passed debt limit bill led to a compromise package enacted into law, a tax package passed by the House might have a similar effect. For Main Street businesses in New York and elsewhere, the sooner those negotiations take place the better.