We promised more on Moore v. United States, and here it is. The pending court case is garnering lots of attention, including the WSJ, the Tax Policy Center, Tax Notes, former tax staffer George Callas, even former Senator John Breaux. What’s got them all worked up?

9th Circuit Goes Big

At issue is whether Charles and Kathleen Moore realized income even though the business they partially owned never distributed earnings. Before you start yawning, be advised this case could have implications for all sorts of tax policy, including mark-to-market proposals, wealth taxes, even pass-through tax treatment.

According to the brief, the Moores invested in a company that provides modern equipment to rural farmers in India. From the start, its business plan included reinvesting any profits rather than distributing them. The Moore’s described their investment as an act of goodwill.

But their goodwill turned into a tax burden when Congress enacted Section 965. That Section deemed the company’s retained earnings to have been distributed and imposed a tax on the deemed income. It required the Moores to pay tax on an ownership stake where they received no income.

The Moores are understandably unhappy with this result. They could try to sell their shares, but who wants to buy a stake in a business where all you get is tax bills? So they sued and here we are.

From S-Corp’s perspective, this case would be a nothing burger save for the remarkably broad ruling from the 9th Circuit. How broad? Here’s the dissent penned by Judge Bumatay:

We become the first court in the country to state that an “income tax” doesn’t require that a “taxpayer has realized income” under the Sixteenth Amendment. Instead, we conclude that the Sixteenth Amendment authorizes an unapportioned tax on unrealized gains because the “realization of income is not a constitutional requirement.” We thus endorse the constitutionality of a federal tax on the share of undistributed earnings of a foreign corporation owned by a U.S. taxpayer—despite (in this case) the U.S. taxpayer being a minority shareholder of the foreign corporation. In other words, we allow a direct tax on the ownership interest of a taxpayer—even when the taxpayer has yet to receive any economic gain from the interest and has no ability to direct distribution of gain from the interest.

This all seems pretty cut and dry. The 9th Circuit has a history of overreaching and this appears like another opportunity for the Supreme Court to reassert the law.

But Wait, There’s “Moore”

The Tax Policy Center is apparently on board with this overreach. To start, they quote Justice Oliver Wendell Holmes in a dissent to the case Eisner v. Macomber (1920):

I think that the word “incomes” in the Sixteenth Amendment should be read in “a sense most obvious to the common understanding at the time of its adoption.” For it was for public adoption that it was proposed. The known purpose of this Amendment was to get rid of nice questions as to what might be direct taxes, and I cannot doubt that most people not lawyers would suppose when they voted for it that they put a question like the present to rest. I am of opinion that the Amendment justifies the tax.

On the face of it, the Holmes dissent is obviously wrong. If the 16th Amendment were drafted to eliminate “nice questions as to what might be direct taxes,” it would have addressed the Constitution’s required apportionment of direct taxes. Instead, it allowed for the direct taxation of income without apportionment, which means we are now discussing nice questions as to what might be income.

More importantly, the Holmes quote is the dissent. What did the actual ruling say? You know, the law of the land? Here’s the court:

What is or is not “income” within the meaning of the Amendment must be determined in each case according to truth and substance, without regard to form….

Income may be defined as the gain derived from capital, from labor, or from both combined, including profit gained through sale or conversion of capital assets….

Mere growth or increment of value in a capital investment is not income; income is essentially a gain or profit, in itself, of exchangeable value, proceeding from capital, severed from it, and derived or received by the taxpayer for his separate use, benefit, and disposal. [emphasis added]

To be clear, the case cited by the TPC in their support of the 9th Circuit decision actually refutes it – “mere growth or increment of value in a capital investment is not income.” The TPC then moves on to Helvering v. Horst:

Twenty years later, the Court described the requirement that money or property be received as a rule of “administrative convenience,” not of constitutional import. Now, for more than one hundred years, the Court has respected Congress’s use of “income” for tax purposes.

But the facts in Helvering weren’t about a taxpayer who received no income. They were about a taxpayer who had his son receive the income that would have otherwise accrued to him, all in an apparent attempt to avoid tax. The Court was having none of it:

The tax laid by the 1934 Revenue Act upon income “derived from . . . wages or compensation for personal service, of whatever kind and in whatever form paid . . . ; also from interest . . . ” cannot fairly be interpreted as not applying to income derived from interest or compensation when he who is entitled to receive it makes use of his power to dispose of it in procuring satisfactions which he would otherwise procure only by the use of the money when received.

The court ruled the taxpayer received income and then disposed of it. Not the same thing as not receiving the income in the first place.

What About S Corporations?

It may seem odd to hear the S Corporation Association argue for a “realized income” standard of taxation when S corporations (and partnerships) do not follow that model. As the Tax Policy Center notes:

If the Court rules for the Moores, it… could force Congress to rewrite major parts of our international, pass-through, and financial tax regimes. The courts have permitted, for many decades, Congress to tax a corporation’s undistributed investment income to the controlling stock holders of personal foreign investment companies and CFCs (and Congress continues to tax these undistributed earnings). These rules prevent wealthy Americans and US multinationals from using foreign corporations like uncapped traditional Individual Retirement Accounts.

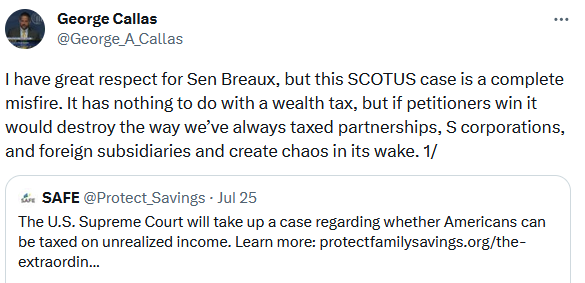

S-Corp friend George Callas made a similar argument in response to former Senator John Breaux’s recent piece critiquing the 9th Circuit:

Excellent points. The 9th Circuit decision does highlight our mixed history on the question of taxing income. In addition to S corporations, the TPC identifies a number of taxes that apply before any income is realized, including our new quasi-territorial international tax system, PFICs, zero-coupon bonds, and the treatment of some derivatives.

But just because Congress and the courts have a history of being inexact does not mean the 9th Circuit is right to dispose of the realization doctrine altogether. As Judge Bumatay noted in his dissent:

Neither the text and history of the Sixteenth Amendment nor precedent support levying a direct tax on unrealized gains. Ratification-era sources confirm that the prevailing understanding of “income” entailed some form of realization. And a hundred years of precedent establishes that only realized gains are taxable as “income” under the Sixteenth Amendment. While the Supreme Court has allowed flexibility in identifying “incomes,” it has never abandoned the core requirement that income must be realized to be taxable without apportionment under the Sixteenth Amendment. Simply put, as a matter of ordinary meaning, history, and precedent, an income tax must be a tax on realized income. And our court is wrong to violate such a common-sense tautology.

Conclusion

The Moore case involved a one-time tax and a small amount of money. As Tax Notes quoted the TPC’s Steven Rosenthal:

Rosenthal further observed that the Court isn’t addressing a split in the lower courts, that the amount of money at stake for the petitioners — just under $15,000 — is a relative pittance, and that the repatriation tax is a temporary transition rule, not a long-term, ongoing problem that would need to be rectified.

“So the case itself is rather modest, other than, does it breathe fresh life into the realization doctrine?” Rosenthal said.

If that’s the case, the consequences could be enormous, not just for future progressive policymaking, but for many areas of existing tax law.

While Rosenthal’s comments are directed at the Supreme Court’s actions, it’s the 9th Circuit that could have issued a narrow ruling and left the status quo intact. Instead, it appears to have used the case as a stalking horse to open the door for the broader list of tax proposals mentioned above, setting the stage for a show-down with the Supreme Court.

Can that court preserve the tax treatment of S corporations, partnerships and CFCs while also preserving the realization doctrine (or what’s left of it)? Let’s hope so. But if the SCOTUS does respond in kind to the breadth of the lower court decision, there’s nobody to blame but the 9th.