The S Corporation Association took center stage on Capitol Hill yesterday at a Tax Day hearing before the House Small Business Committee.

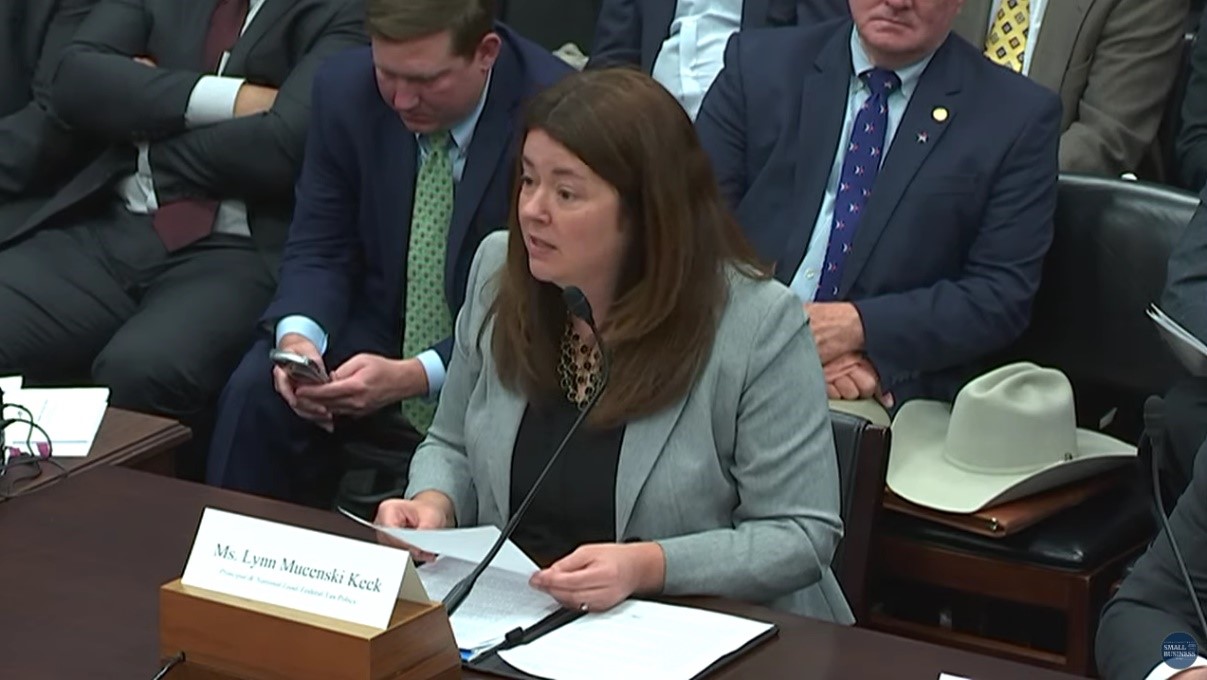

Lynn Mucenski-Keck, an S-Corp Advisor and Principal at the national accounting firm Withum did a great job representing the pass-through community at the hearing focused on business tax issues and the impact they have on the small business community.

As S-Corp readers know, Lynn is a long-time advocate for, and prolific writer on good tax policy. She is also a past (excellent) guest on our “Talking Taxes in a Truck” podcast, raising awareness regarding the dangers posed by the now-defunct Build Back Better Act.

You can read her full testimony here but from its beginning, Lynn focused on the high notes of S-CORP advocacy:

While business owners understand the need to pay their “fair share” of federal income taxes, there is an overriding concern that coupling an already expanded tax base with the proposed increases in tax rates could cause a crucial tipping point where businesses are no longer be able to invest back into the economy and secure growth. The significant increase in federal tax payments will continue to cause negative effects on savings, investment, and entrepreneurship that could ultimately have a much broader impact on the United States economy. The challenge for Congress is to determine what is indeed a “fair share” of taxes while not negatively impacting a teetering economy and exhausted business community.

Lynn went on to highlight several recent changes to the tax code that hamstring Main Street businesses, including the cap on interest expenses, the punitive capitalization regime for research and development costs, and the tiered decrease of bonus depreciation.

Starting with Section 163(j), which limits the amount of interest expense businesses can write off, Lynn’s written testimony shows how the more stringent cap – which went into effect this year – coupled with higher interest rates can severely limit small business’ access to much-needed capital:

As we pointed out last week, the pain is even worse for businesses going through a rough patch, as any decline in revenue necessarily increases the bite of the cap.

Another change Lynn highlighted was the requirement that companies amortize their research and experimentation expenses over five years, rather than write them off immediately. Here’s how she put it:

For the 2022 taxable year, domestic R&E expenditures are not only required to be amortized over a 5-year period, but taxpayers can only begin at the midpoint of the taxable year, resulting in a 10% deduction…This is in drastic contrast to many OECD countries that provide for a “super-deduction,” allowing businesses an additional fictitious deduction for eligible research expenses.

Finally, Lynn emphasized the importance of the 199A small business deduction and the need to make it permanent:

If taxpayers are no longer allowed the pass-through deduction their effective tax rates will increase by as much as 7 percentage points. For small business owners who are immediately paying tax on their earnings (though not necessarily receiving a distribution of the cash from the pass-through entity), a 7 percentage point increase in an effective tax rate is severe. In addition, the original intention to provide some equality between small business owners and C corporation would no longer exist. I strongly encourage the committee to remember the reasoning for the pass-through deduction implementation and continue to ensure that pass-through businesses can retain this benefit to ensure closer parity to C corporations.

Witnesses (also members of our Main Street Employers Coalition!) Warren Hudak of NFIB and Russell Boening of the Texas Farm Bureau, an affiliate of the American Farm Bureau, also focused on the threat posed by the tax policies included in the President’s recent budget and how they move in the wrong direction.

The hearing was standing room only and included more back-and-forth than usual for these types of meetings, signaling the importance of this topic and the seriousness of the debate. This exchange between Lynn and Ranking Member Velazquez at 1:12:00 in the hearing is a likely precursor of the debate to come.

Yesterday’s hearing in the House of Representatives is the first of what we hope and expect will be many meetings raising awareness of the challenges faced by the Main Street employers and how Congress and tax policy can play a role in helping them succeed and grow. More to come.