The President is set to release his third budget later today and, as in the past, it’s sure to call for higher taxes on family-owned businesses. The Administration already circulated a fact sheet on its Medicare plan which includes a $300 billion-plus tax hike on S corporations and partnerships (see below). Meanwhile, the President has been talking for weeks about making “super-wealthy tax cheats” pay more in taxes. That’s code for raising taxes on private companies that already pay lots of taxes.

Here’s what S-Corp members should look for in today’s release, and what it all means for them and their businesses.

Not On Their Watch

Republicans underperformed in last fall’s elections, but they did succeed in taking the House. That means that Main Street can take a breath and know that whatever the President proposes today is not going anywhere in a Republican-controlled House. While we can always expect lots of so-called “headline risk” – as in breathless articles highlighting the merits of these policies – there’s very little danger of the actual tax policies being enacted anytime soon.

No bad idea ever dies in Washington, however, so we will need to respond fully now because, like the Terminator, we know these proposals will be back.

Expanding the Expanded NIIT

Speaking of bad ideas, the Administration is back with its plan to expand the Net Investment Income Tax to include the active income of pass-through business owners. We’ve written about this many times (here, here, and here), but it bears repeating – the original NIIT purposefully excluded the business income of active owners. The Obama Administration didn’t want to be accused of raising taxes on small businesses. Now President Biden wants to include that income so he calls it a “loophole.” Simply not true.

New this year is the increase of the NIIT’s rate from 3.8 percent to 5 percent. That would raise the top rate paid on all S corporation income to 42 percent, or twice the current rate on large public companies. When rates go up in 2026, the top S corporation rate would rise to nearly 45 percent. The JCT scored the NIIT expansion as raising $252 billion dollars over ten years. With the rate hike, we’re looking at a tax increase on small businesses that exceeds $300 billion.

Record Revenues

Meanwhile, federal revenues are up substantially in recent years. Measured against national income, they reached their second highest level since World War II. To argue that revenues are the problem now is just not credible. As the Tax Foundation notes:

As a share of GDP, federal tax collections are at a multi-decade high of about 19.6 percent in FY 2022, up from 17.9 percent last fiscal year and approaching the last peak of 20 percent set during the dot-com bubble in FY 2000. There are only two other years in U.S. history when federal tax collections exceeded this year’s level, both during World War II….

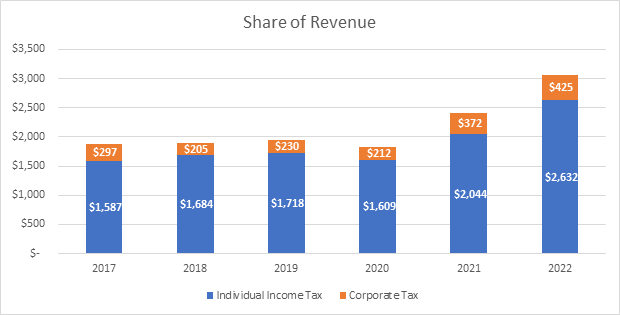

We discussed this in a recent post, but neglected to highlight that most of this increase is coming from individuals and pass-through businesses. As you can see from the table, individual tax receipts remained strong immediately following the TCJA and simply exploded in recent years.

Non-Cheating, Non-Billionaires

The Administration will sell its plan as an effort to undo the Trump tax cuts and the need to make “tax cheating billionaires” pay their fair share, but that’s all hooey. As the President noted the other day, there are only 1,000 or so billionaires while these tax hikes will apply to anyone making more than $400,000 a year. According to IRS data, there are more than 1 million small business owners who make that much. So 999,000 non-cheating, non-billionaires will pay higher taxes?

8 is the New 25

The President likes to say that billionaires don’t pay their fair share. Here’s an example:

I’ve also called on Congress to pass my proposal for a billionaire minimum tax. We had — we — when we started this administration — about 720 billionaires. Now we have about a thousand. You know what their average tax they pay is? About 3 percent. Look, no billionaire should pay a lower tax than a schoolteacher or a firefighter.

The Administration later indicated the President misspoke and that he meant to say 8 percent, based on this study from his Council of Economic Advisors. But as Politifact noted, that study uses a definition of income that includes unrealized capital gains. Unrealized gains are not income, so they rated the statement “false.”

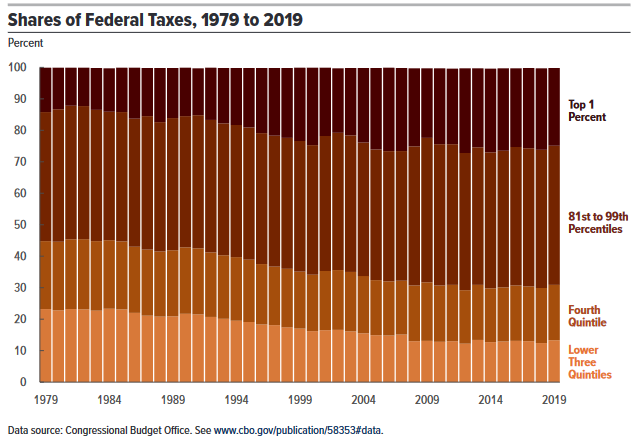

But what about the million business owners who aren’t billionaires, but will still get hit with higher taxes? How much do they already pay? The latest CBO analysis shows that the top 20 percent of income earners – those making over $330,000 — pay average rates of about 25 percent, while middle income taxpayers paid rates under 15 percent.

This table strengthens the impression of just how progressive our tax code is. Over the last 40 years, the total tax burden on top earners has risen sharply so that today, the top 20-percent of earners pays nearly 70 percent of all federal taxes. The tax code has become more progressive over time, despite what you might hear.

Another Reason to Dislike Inflation

Oh, and none of this is indexed for inflation. That might not have mattered much when inflation was consistently under 2 percent. But under President Biden, it has been in the 5- to 9-percent range. That means thousands of taxpayers will be pulled into these tax hikes every year, despite the fact that in real terms, they aren’t making any more income.

Think about it this way. A Main Street business owner with lots of employees and capital equipment makes $400,000 a year. As promised, her taxes are not supposed to go up under the Biden plan. But her costs are going up – she’s paying higher wages and her supply chain costs are rising. So she increases her prices just to stay even. In a 6-percent inflation environment, she’ll need to make $424,000 this year to equal her real income from last year. Suddenly she is subject the higher NIIT and probably some other taxes hidden in the Biden Budget. For the President’s promise about not taxing people making $400,000 or less to be real, they need to index these policies for inflation.