Tonight’s State of the Union address will call for increased stock buyback taxes and a billionaire minimum tax, among other items. Neither is going anywhere.

Business owners should focus instead on the pending debt limit debate, which has begun in earnest and has the potential to establish the tax and spending battlelines for the coming decade.

The simple fact is the federal government is entering into unprecedented territory when it comes to our deficits and debt, which should signal the end of the last decade’s laissez-faire approach to Federal deficits. That in turn could force Congress to make big decisions about taxes and spending sooner rather than later. Here’s the background and some thoughts.

Debt Limit

The U.S. ran up against the debt limit on January 19th, at which point Treasury began taking what’s known as “extraordinary measures” to keep the Federal government running. Those measures should be sufficient to keep things going until this summer, but an actual “drop dead” date for action is, as always, not really how it works. Instead, once we reach this summer, the options are 1) for Congress to raise the limit, 2) we default on new debts coming due, or 3) for Treasury to take additional action of an increasingly legal grey area to stay under the limits.

So Treasury incurs all the pain, but it’s Congress that needs to act. Not a great way to structure the rules.

As with the recent debt debates, this fight is starting early and at high volume. The financial media are running daily stories highlighting the dangers of default. Members of Congress are accusing each other of holding the country “hostage” over their demands. And the President has announced he would not negotiate with terrorists…er, Republicans, just before meeting with Speaker McCarthy to discuss the debt limit.

This intensity is a good thing, actually, as our debt issues are historically significant and need to be addressed. The real threat to our future is not some technical government default, but rather that we continue to pile trillion-dollar deficits one upon the other, and that this will go on for the rest of our lives. That’s the baseline and it needs to change.

Unprecedented Challenge

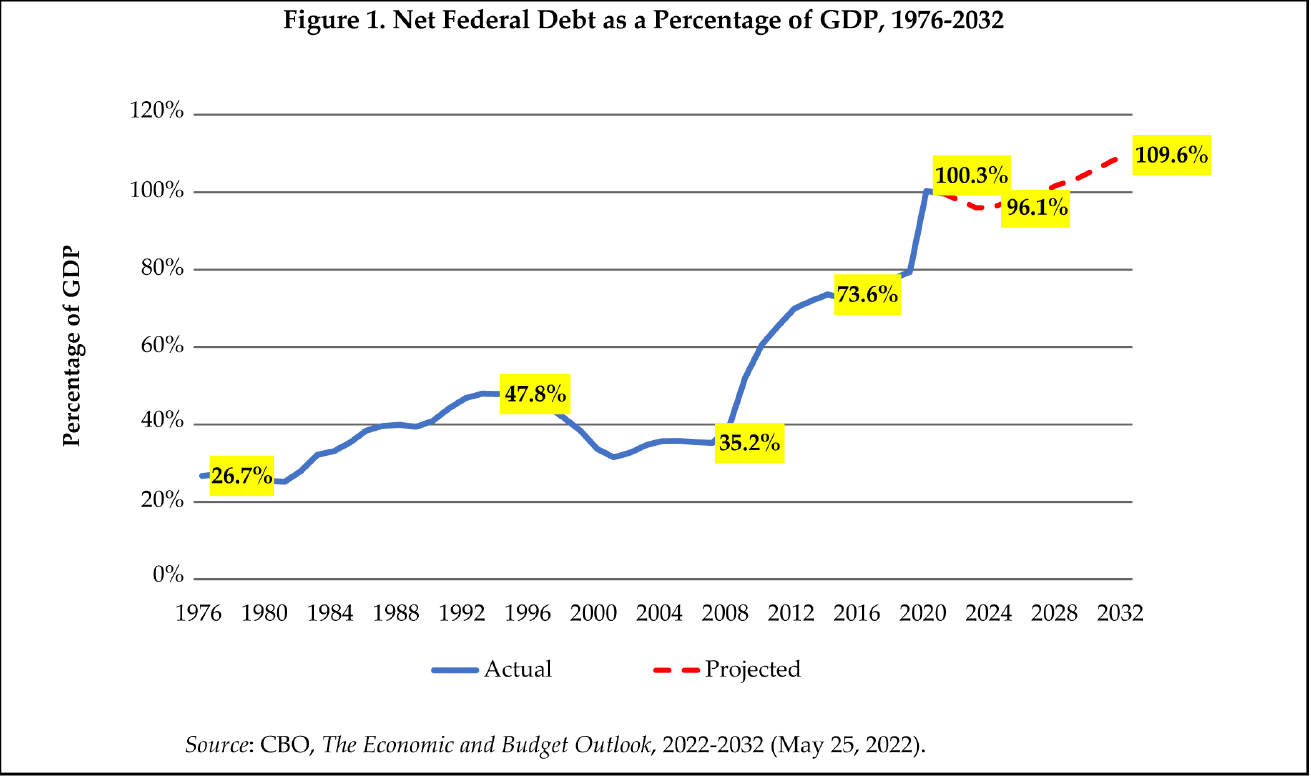

S-Corp friend Martin Sullivan has a great piece in Tax Notes this week outlining the fiscal challenge we face. Net debt is now up over 100 percent of our national income and growing. Here’s Marty’s chart:

So our debt levels are at unprecedented levels and rising. That’s bad, but not the worst thing. Japan has functioned for decades with higher debt levels, after all, and nobody thinks the U.S. can’t shoulder this level of debt.

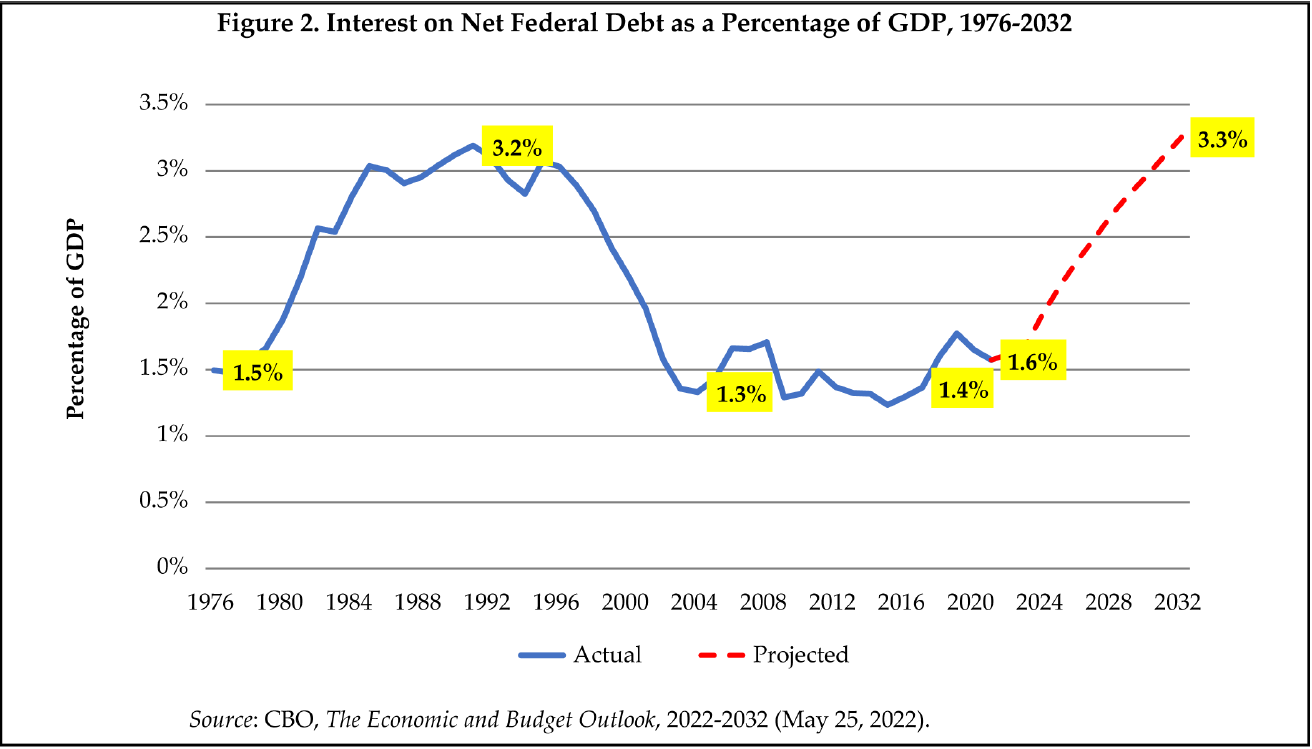

But the real challenge is that with rising interest rates, the service on our debt is going to reach record heights soon. Here’s Marty’s write-up:

Figure 2 provides another view of U.S. debt burden. It shows net interest payments paid by the federal government as a percentage of GDP. Unlike the relatively dull story in Figure 1, Figure 2 provides drama. While the debt-to-GDP ratio could increase by only about 10 percent, the interest-to-GDP ratio will more than double — from 1.6 percent to 3.3 percent.

To put that in perspective, three percent of GDP is how much we spend on our national defense. All of it. Here’s the graph Marty refers to:

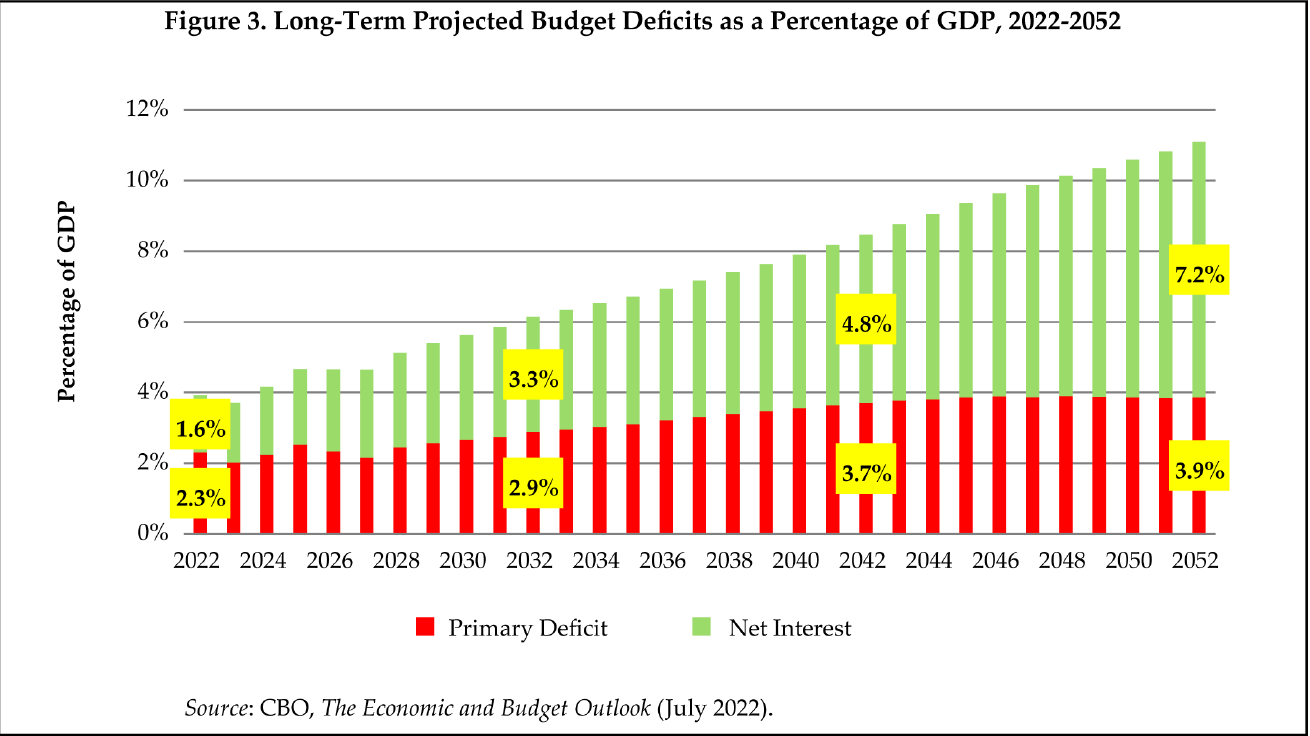

Finally, time is not our friend on this. If we look further out, we see that net interest just keeps growing and taking an increasing share of our national income.

The big question here is at what point is it simply too much?

Spending or Taxes?

In simple terms, the debate over the debt limit is between those who want to raise taxes and those who want to cut spending. Weighing in for team “Raise Taxes,” Senator Elizabeth Warren (D-MA) recently argued:

“If Republicans hadn’t spent nearly $2 trillion on the Trump tax cuts, and if they hadn’t made it easier for rich people to cheat on their taxes, the US wouldn’t need a debt ceiling increase this year. Or next year.”

Republicans, on the other hand, argue that spending increases in recent years have totally eclipsed the TCJA tax cuts, and that spending should be the focal point of any effort to reduce future deficits.

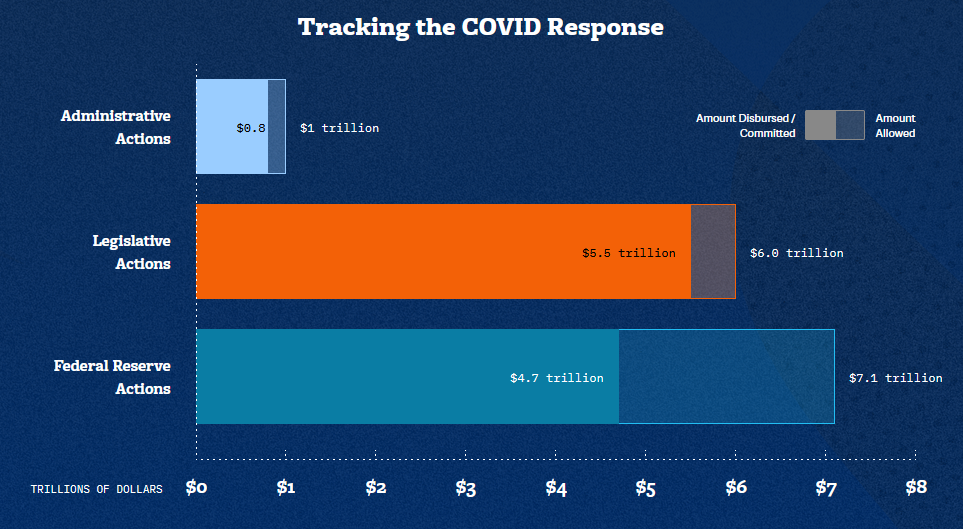

Republicans have a point. According to the Covid Money Tracker, Congress has authorized $6 trillion in new spending to respond to the pandemic, of which $5.5 trillion has been spent.

So that’s $5.5 to $6 trillion in new spending spread over three years, compared to the TCJA’s $2 trillion in tax relief spread over 10 years, or $2 trillion/year compared to $200 billion/year, respectively. New spending was literally 10 times the size of the TCJA in recent years.

We’re confident that if the Biden administration offered Speaker McCarthy a deficit reduction package weighted 10-to-1 in favor of spending cuts, he’d take it in an instant. We’re not holding our breath.

Exploding Revenues

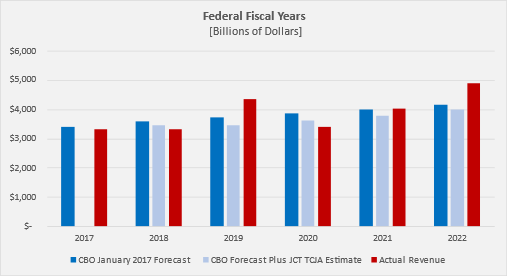

An additional reason that taxes are not the culprit here is that revenues have exploded in recent years. Earlier this year, the JCT published a slide deck measuring how their estimates held up post-TCJA. As you can see, revenues consistently under-preformed compared to the JCT estimates:

But that table excluded the last two years, so we added them in. With 2021 and 2022 included, the story changes. Overall, revenues have outperformed estimates and have grown dramatically in the last two years, easily exceeding pre-TCJA predictions even after accounting for inflation:

The recent increase can be attributed to several factors. Inflation certainly played a role, as did policies encouraging the recognition of revenues later rather than earlier in the pandemic. Business collections are up too as businesses returned to profitability after two years of shutdowns and supply chain disruptions.

Nonetheless, when revenues are up 43 percent in just two years, approach $5 trillion in total collections, and represent a near-record 19.6 percent of the economy, it’s hard to argue they are to blame for the massive deficits we’re running.

You’d have to look at spending for that.