Tax Notes is out with a new piece that makes the case for expanding the Net Investment Income Tax (NIIT). The article quotes exclusively from individuals who would like to see the tax applied to a broader base of income. Absent is anybody from the business community, which is uniformly opposed to these tax hikes.

Instead, the article comes across as an advocacy piece highlighting people long opposed to the pass-through structure as a whole. The article starts off:

President Biden has proposed addressing a long-perceived flaw with the net investment income tax, but as with his predecessors, political considerations have stopped him from going further. That’s because active business income is carved out of the NII tax, and while Biden has proposed nixing that carveout, one of his campaign pledges has forced him to propose replacing one carveout with another, albeit much smaller, one.

“I think it’s politics at the end of the day,” Kyle Pomerleau of the American Enterprise Institute said May 4 at a conference sponsored by the District of Columbia Bar Taxation Community. “Passthrough businesses do a very good job of describing themselves as small businesses, and that ends up being a very good political maneuver for them.”

Couple things right off the bat. First, this effort is just the latest in a long con to destroy the underlying premise of Social Security and Medicare funding. In 1993, it was unfair and a “loophole” that the Medicare tax was capped and did not apply to wages exceeding a certain threshold. The Clinton administration eliminated the cap. In 2010, it was unfair and a “loophole” that Medicare taxes didn’t extend to unearned income. The Obama administration increased the tax and expanded its reach to include passive investment income. Now, it’s unfair and a “loophole” that the NIIT doesn’t apply to the business income of active business owners. The Biden administration is attempting – unsuccessfully, so far – to expand the NIIT to this income. They would go after Social Security too, except the Byrd Rule blocks them.

But is it really a “loophole”? No. The legislative history on this is clear. The NIIT was a late addition to the health care law that the Administration proposed in February of 2010, after both the House and the Senate had passed their respective health care reforms. From the beginning, the proposal excluded the business income of active owners. Here’s how National Journal reported on the provision at the time:

President Obama’s $950 billion healthcare reform plan released Monday exempts income derived from running a small, closely held business from a proposed new payroll tax on investments. The carve-out is a concession to a range of business groups and advocates for the self-employed.

That was the S Corporation Association. We led a broad coalition of business groups to oppose the provision when it was first floated, and we wrote extensively on the provision once it was released (see here, here, and here).

Congress made several key changes to the Administration’s proposal before enacting it – namely, they removed its connection to Medicare; the revenue goes into the general fund, not Medicare – and they increased the tax to 3.8 percent, but the exclusion on income of active business owners remained. As our Advisory Board Chair Tom Nichols summarized in his testimony back in 2012:

This net investment income tax is generally imposed on interest, dividends, annuities, royalties, rents and gains, with one very important exception. Congress recognized that this new imposition should not apply to income derived by owners directly involved in active businesses. Therefore, Congress excluded from the tax base all income derived from a trade or business unless the income was reported by a person who did not “materially participate” under the passive activity rules or the trade or business consisted of trading in financial instruments or commodities.

In short, exempting the business income of active owners from the NIIT was part of the plan from the beginning and is no way a “loophole.”

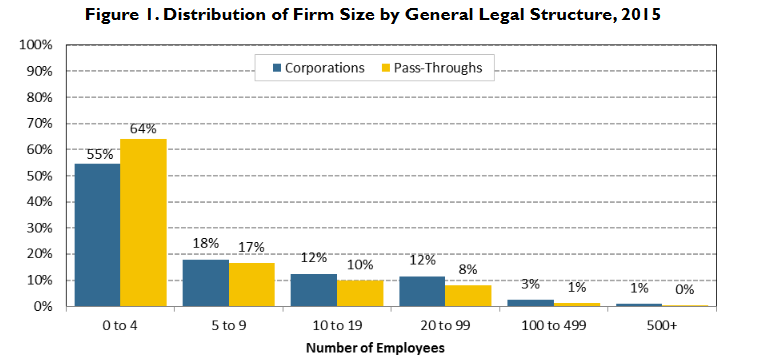

Second, pass-through businesses “do a good job of describing themselves as small businesses” because – wait for it – they are small. To illustrate, a 2018 Congressional Research Service report found that 99% of pass-throughs had fewer than 100 employees:

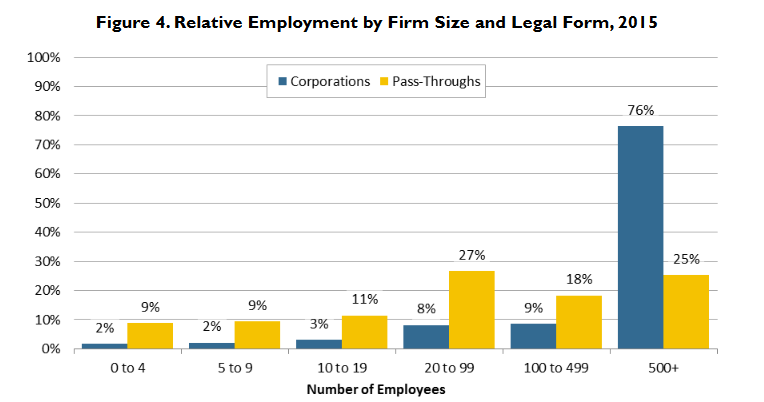

Moreover, the report found that while employment at C corporations is largely concentrated at the top, it was more uniformly spread around within the pass-through group. There are of course large pass-throughs, but even they tend to be smaller than their corporate counterparts, averaging about one-fourth as many employees as large C corporations.

The Tax Notes piece is just another example of the revisionist history we saw when lawmakers tried to claw back portions of the 2020 Covid relief bill. In that instance, the same members of Congress who championed the relief later called it a “special-interest giveaway” that was “tucked” into the CARES Act. Now they are using this same playbook in advocating for an expansion of the NIIT.

The Build Back Better Act may be going nowhere this year, but S-Corp members know that no bad idea ever dies in Washington. After more than a decade, we’re still fighting the false notion of a NIIT “loophole.”