Ways and Means Republicans held a panel discussion on the Build Back Better (BBB) Act’s impact on individually and family-owned businesses yesterday morning, and just in time. Main Street is panicked over the possibility that the House-passed bill will be signed into law, and new numbers from EY demonstrate why.

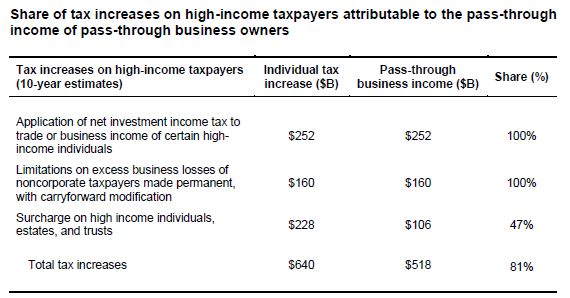

The BBB would raise taxes on businesses organized as S corporations, partnerships, and sole proprietorships by more than $500 billion over ten years.

The BBB is advertised as going after only the very wealthy, but 81 percent of its individual tax hikes fall on pass-through businesses instead. This massive tax hike is focused on relatively few Main Street employers, resulting in extremely high marginal rates on family businesses when they earn $400,000 or more.

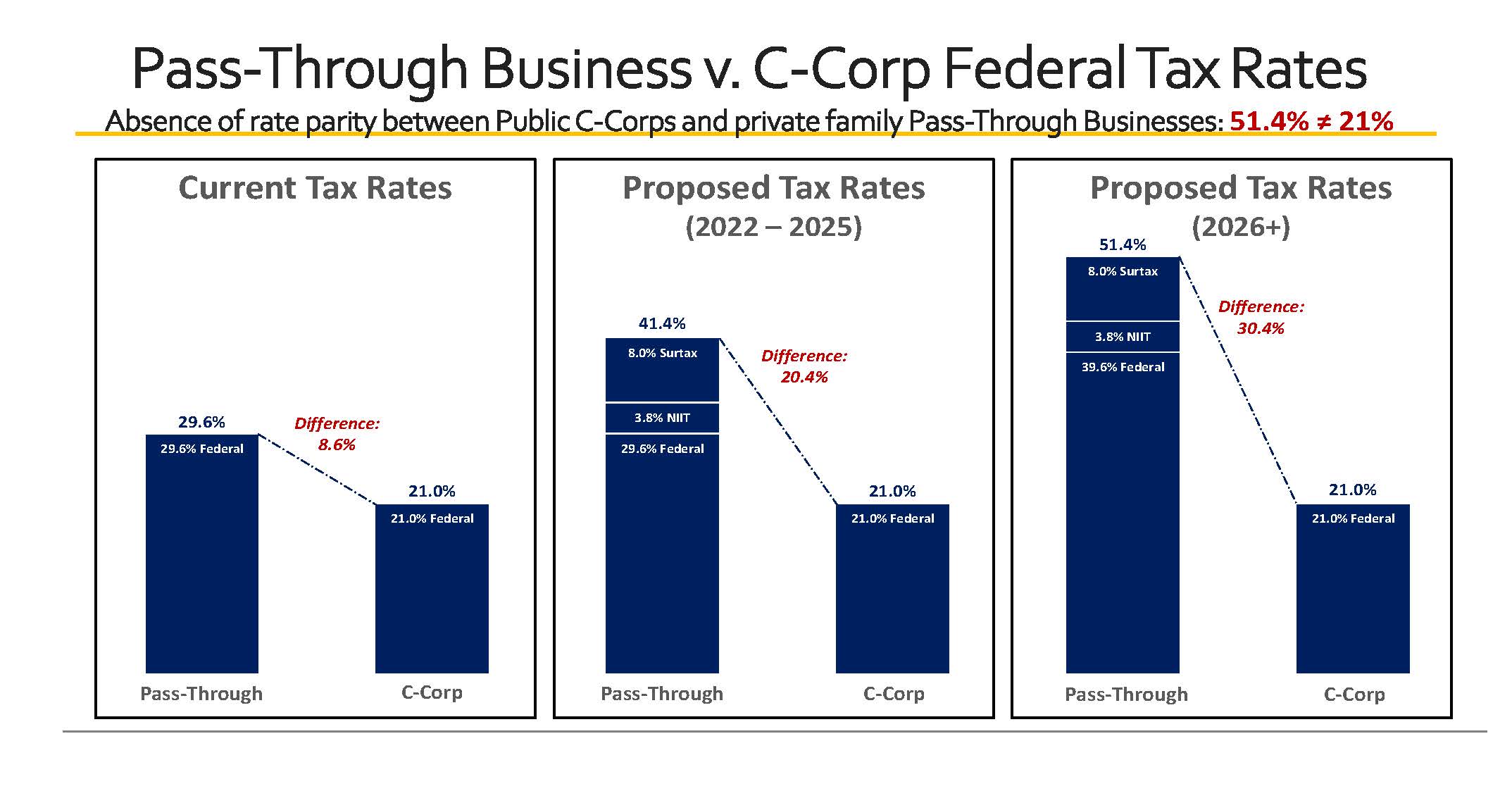

Starting in 2022, those top rates would rise by 12 percentage points, to over 40 percent. In 2026, they rise to over 50 percent. Combined with state taxes, those rates would be the highest in the OECD. Meanwhile, corporate rates under the BBB remain unchanged at 21 percent.

Those top rates aren’t reserved for millionaires. They hit family businesses with trusts earning as little as $13,000 for the NIIT and $200,000 for the new surtax. Lower thresholds on family businesses are one reason nearly half the revenue from the surtax falls on pass-through businesses.

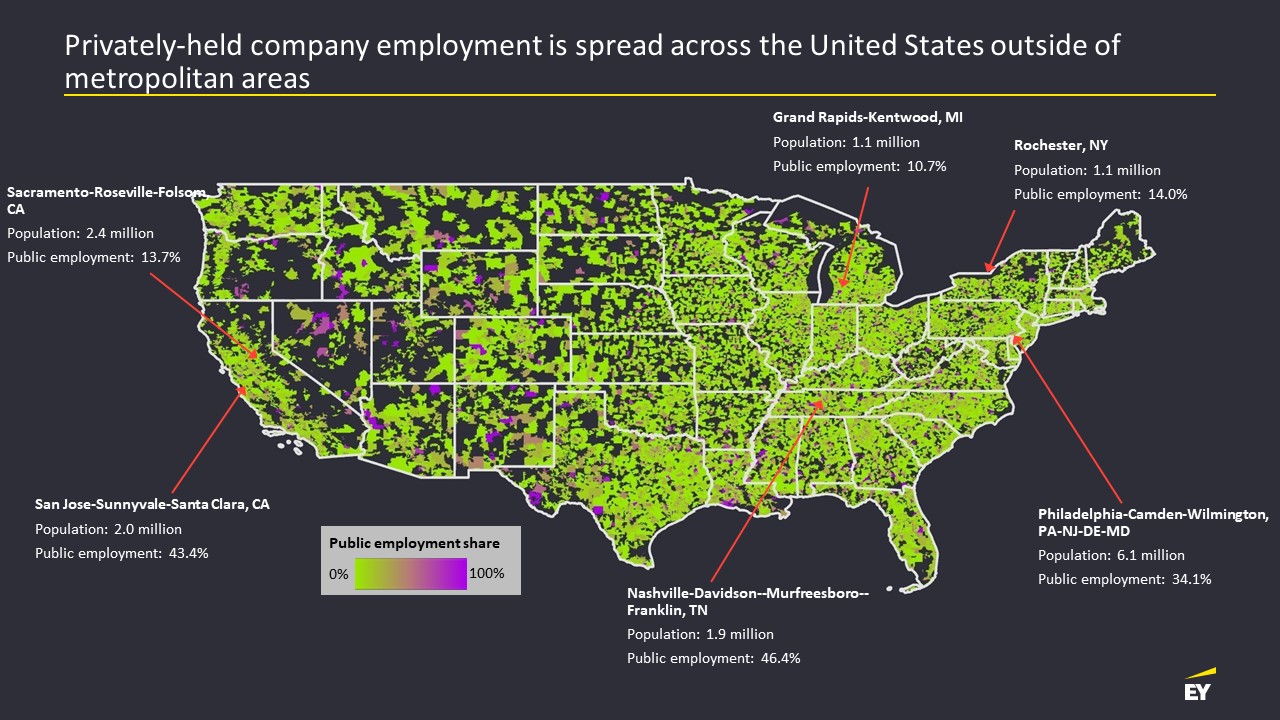

Family businesses organized as pass-throughs employ nearly 6 out of 10 workers and make up the economic and social fabric of towns and communities across the country. Imposing 50 percent tax rates on them will accelerate the economic consolidation already taking place in our country, resulting in more cities and towns where the plywood outnumbers the windows.

These tax hikes will drive up prices too, and the voters know it. Our recent Winston Group survey showed a majority of voters believe the BBB’s tax hikes will increase the prices they pay. Moderates are even more convinced, agreeing 55-17. Rising prices are on everybody’s mind right now, so enacting inflationary tax hikes on family businesses simply makes no sense.

The BBB will hit family businesses hard, it will tax them at rates that are the highest in the OECD, it will drive up prices on families and businesses alike, it will accelerate economic consolidation, and it will endanger the jobs of tens of millions of workers. Main Street should be panicked.