The House-passed Build Back Better Act represents an existential threat to many S corporations. Not only would the bill raise their rates to the highest in the OECD, it would impose limitations to deducting their active business losses that are worse than those that apply to passive losses. If your goal is to force all large pass-through businesses into the C corporation model, this is your bill.

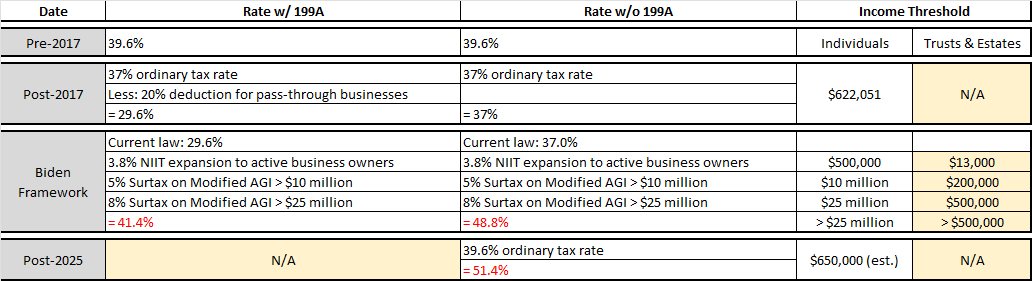

On the rate front, the BBB makes no attempt to balance out the tax treatment of pass-through businesses with C corporations. The bill’s new surtax and expanded NIIT, combined with the pending expiration of the 199A deduction and lower 37 percent personal income tax rate in 2026, would raise the top rate on pass-through businesses to over 51 percent. That’s more than 30 percentage points over the corporate rate.

But the hits keep coming. The BBB also includes an expanded, permanent version of the TCJA’s loss-limitation rules for the active losses of S corporations and partnerships under Section 461(l). According to the JCT, this provision raises $160 billion over the next decade, so it is a key part of the revenue title that raises taxes on pass-through businesses by over $500 billion. Despite that, with everything else going on, it hasn’t garnered nearly the attention it deserves.

The TJCA included Section 461(l) to limit the amount of active losses a pass-through owner could use to offset other forms of income. Under prior rules, an S corporation shareholder could take the active losses from her S corporation and, in the year those losses were incurred, use them to offset other forms of income. Under the TCJA, however, the ability to use these losses to offset other income was limited to $500,000. Any losses exceeding that amount were carried over into the next year and then treated as Net Operating Losses (NOLs). As with many provisions in the TCJA, this tax increase was scheduled to sunset beginning in 2026.

The BBB would make two changes to this policy. First, it would make the loss-limitation rules permanent. Second, it would further restrict the use of active business losses so that in future years, any excess losses could only be used to offset other active business income. This new limitation creates the possibility that a pass-through owner may never be able to deduct these losses — they would just get carried over year after year. As our October 28th letter to tax writers argued:

As damaging as making permanent the onerous EBL limitation rule would be, H.R. 5376 also includes modifications that, if enacted, would double down on that damage. By further restricting the use of all active business losses for passthrough entities within a new category of active business losses, these modifications carry the potential effect of permanently disallowing losses that result from ordinary and necessary trade or business expenses. In so doing, the proposed modifications undermine the fundamental tax accounting principle of matching expenses and revenue. To cap it off, active business losses would be treated more adversely than passive activity losses. For instance, the passive activity loss rules allow the use of suspended losses once an entire interest in an activity is disposed. No analog exists in the revised version of section 461(l). The potential harm of this provision is so extensive that the American Institute of Certified Public Accountants (“AICPA”), a leading tax practitioner group, has stated that “(i)f this provision is ultimately adopted, there are several collateral matters that must be addressed in the legislation to make the provision fair and administrable.”

So, record high rates when S corporations make money, and punitive treatment of losses when they don’t. A vote in support of the BBB is a vote to kill Main Street. As unpopular as this legislation is right now, its enactment is only going to make it worse.