Note: the first table shown below has been modified to correct a previous error.

A key aspect of the Biden “framework” under consideration in the House is how it targets family businesses with modest incomes through the discriminatory treatment of taxable trusts.

That’s because the rate hikes on trusts in the bill have income thresholds well below the headline levels that would apply to individuals. These lower levels are an apparent attempt to discourage gaming, but they hit existing trusts that predate the new rules, as well as modestly-sized family businesses that are not the advertised targets of the new policy.

These S corporations and partnerships would start paying higher rates on just $13,000 in income, violating the President’s pledge to not increase taxes on those making less than $400,000.

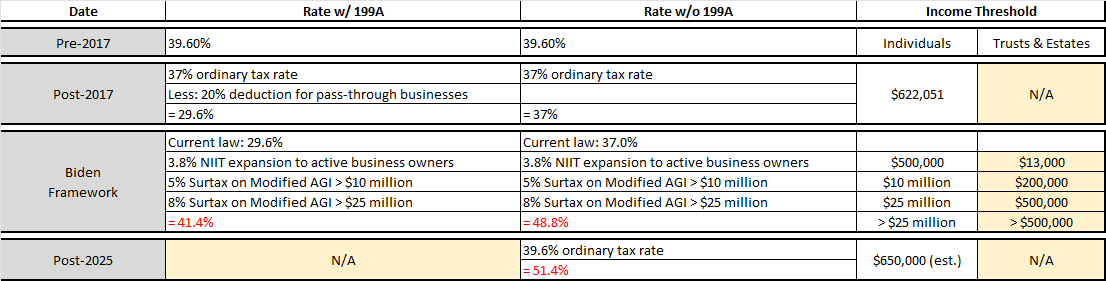

And they would pay a new top rate of between 41.4 and 48.8 percent on just $500,000 in business income. Starting in 2026, those top rates would be 44.0 and 51.4 percent, respectively. Combined with state levies, these businesses would face the highest marginal rates in the OECD.

That compares to an average top rate of around 30 percent for public C corporations when you include both the corporate rate and the tax on dividends and capital gains.

Put differently, family businesses organized as pass-throughs face two new rate hikes under the Biden framework, while C corporations face none. Those tax hikes are:

- A new surtax on all forms of income, applied against a modified version of Adjusted Gross Income, equaling 5 percent over $10 million and 8 percent over $25 million. For family businesses with taxable trusts, those thresholds are $200,000 and $500,000, respectively.

- An expanded application of the 3.8 percent Net Investment Income Tax to include the S corporation and partnership income earned by active owners of the business. Currently, active owners of these businesses do not pay the NIIT on their business’ profits. This expanded tax applies to owners with incomes exceeding $400,000 (single) and $500,000 (joint), but for business shares held in trust, the expanded tax applies to income over just $13,000.

Meanwhile, under current law the top rate applying to pass-through businesses rises from 37 to 39.6 percent starting in 2026, further adding to the rate disparity between pass-throughs and C corporations.

The result is the top pass-through rate will be more than double the statutory C corporation rate.

Finally, while the current framework doesn’t cap or repeal 199A, it does negate its benefits for businesses paying the surtax. That’s because the surtax applies to AGI, not taxable income, so the 199A deduction has no effect on the tax base of the surtax. It’s as if Congress repealed 199A for purposes of the surtax and an important feature of the surtax that supporters of the 199A deduction need to understand.

At this point, you’re probably asking, “If the rate disparity is so large, why don’t these family businesses just convert?” The answer is simple – it wouldn’t help.

The key feature of modern corporate finance is that three out of four public C corporation shareholders don’t pay taxes or pay significantly reduced amounts of tax. Moreover, because the second layer of tax on C corporations is in many cases discretionary – it is only incurred when the stock is sold or dividends are paid — even those shareholders who do pay taxes end up paying less than the statutory rate.

The result is that public C corporations are largely immune to the double tax. So Warren Buffett pays a 21 percent effective marginal rate on his Berkshire-Hathaway shares because BK doesn’t pay dividends and Buffett doesn’t sell any of his shares.

Shareholders of a private C corporation, on the other hand, don’t have that option. There’s no market for minority stakes in private companies, so the only way to reward shareholders is to either 1) pay dividends and shoulder the full double tax, or 2) reinvest the earnings, grow the business, and then sell the entire business at some point in the future. Either way, private C corporations get hit with the double tax and are at a disadvantage compared to their publicly-traded competitors. That’s why Congress created the S corporation in the first place.

The Biden framework is an anti-Main Street bill that would knee-cap family businesses just when they are emerging from the pandemic and resulting shut-downs. It will raise rates on family businesses to the highest levels in the OECD and hurt the very communities it is supposed to help. The Senate needs to take a long look at this bill before they rush to pass it.