More good news to report on the SALT Parity front! Just yesterday, South Carolina Governor Henry McMaster signed our parity legislation into law. As a result, more than 300,000 S corporations and partnerships in the state will have access to some $38 million in annual tax relief. That’s a big deal, especially for businesses that have been hardest hit by the pandemic.

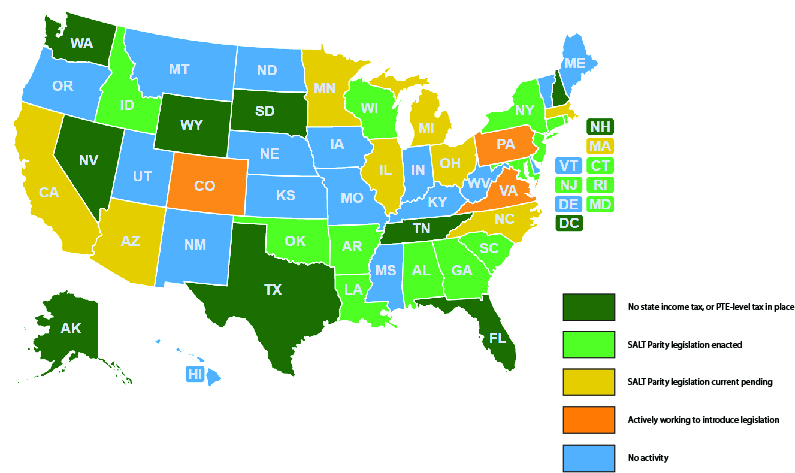

South Carolina now becomes the 13th state to enact our SALT Parity legislation, and joins Georgia, New York, Idaho, Arkansas, Alabama, Maryland, New Jersey, Rhode Island, Louisiana, Oklahoma, Wisconsin, and Connecticut in doing so. As you can see from the map, similar legislation is being actively considered in nearly a dozen other states.

SALT Parity Progress

Speaking of those states, there’s lots of SALT Parity progress to report. Our goal at the beginning of the year was to see parity legislation enacted in at least 20 states total, and we appear well on our way of accomplishing that goal:

- Georgia / South Carolina / Idaho / New York: Each of these states has enacted our reforms in the past month, bringing the total to 13 states.

- Arizona: Legislation passed the House in March and is in play in the Senate. We’ve worked out technical changes with the state’s Department of Revenue, and are awaiting resolution of general budget debate.

- California: SALT Parity language was included in Governor Newsom’s initial and revised budgets, while SB 104 has been introduced in the Senate.

- Illinois: The state Senate passed SB 2531 by a 56-0 vote back in April, and the bill is now before the state House.

- Massachusetts: SALT parity language was included in the Senate version of the state’s FY2022 budget. The MA Department of Revenue has already endorsed the reform and the Governor included it in his budget.

- Michigan: The state House voted 88-18 in favor of H.B. 4288 on May 13th. The bill now goes to the Senate, which has a history of support. A hearing is set for Wednesday.

- Minnesota: Legislation is currently before the legislature, and we are working with the state Department of Revenue to finalize language. This bill should be made part of the broader budget package being negotiated with the Governor.

- North Carolina: Legislation has been introduced and was recently considered by the House tax committee.

Federal SALT Cap Relief

We’ve received a number of questions regarding federal efforts to repeal or roll back the SALT cap. Since full repeal of the cap would eliminate the need for our SALT Parity efforts, it’s worth addressing where things stand at the moment.

Changes to the SALT deduction cap were not included in either of the two infrastructure packages (here and here) released by the Biden Administration. The Biden administration has not taken a position on SALT, but they have said if Congress wants to act, that relief needs to be offset. The challenge is that SALT cap relief is extremely expensive, so coming up with acceptable offsets will not be easy. Rolling back the cap is extremely controversial too, even within the Democratic party. As the Hill summarized this week:

But getting [SALT cap repeal] done with extremely small Democratic majorities in the Senate and House is turning into a major headache and at this point it looks like leaders may have to settle for lifting the cap instead of getting rid of it entirely. “I think there are far better ways to spend our money,” Sen. Michael Bennet (D-Colo.) said when asked about repealing the cap on SALT deductions…. “It sends a terrible, terrible message when you have Republicans telling us that this is a tax break for the rich,” [Senator] Sanders told Axios in an interview…. Rep. Alexandria Ocasio-Cortez (D-N.Y.), a leading progressive voice in New York who didn’t rule out a primary challenge against Schumer, last month called the SALT deduction a “giveaway to the rich” and “a gift to billionaires.”

Meanwhile, other provisions that would make a pass-through entity level tax valuable will also be in play during any tax debate, including capping the value of itemized deductions at 28 percent and restoring the Pease limitation. Ultimately, Congress may act on SALT, but it is by no means a done deal and there’s a strong chance the election will continue to confer benefits to the businesses that make it.

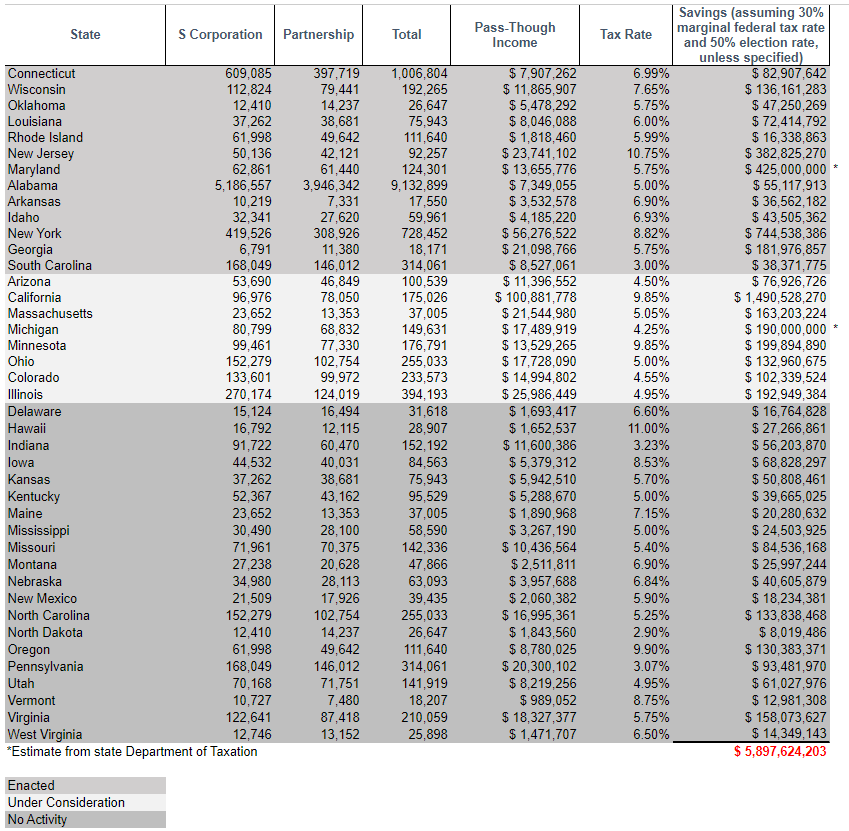

Given those uncertain prospects, S-Corp will continue to fight for this critical relief. As you can see from the table below, there’s billions at stake. We’re up to over $2.25 billion in estimated annual savings so far, with another $4 billion in relief possible in the remaining states. With the economy just emerging from the pandemic and businesses looking to re-tool and rehire, this relief couldn’t come at a better time.