The Myth of Corporate Decline

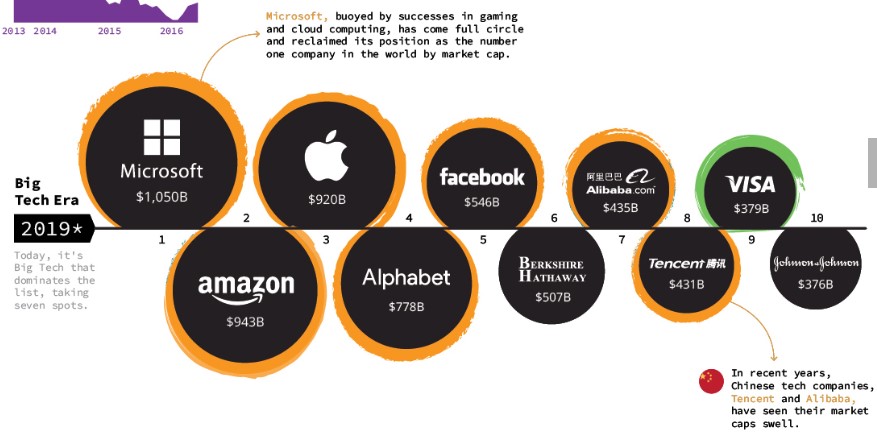

The visual economist issued another great chart last month, this time showing the largest public companies by market cap.

Our first reaction is, wait, Microsoft is number one? When did that happen? All the focus on FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) and stodgy old Microsoft is bigger? Go figure.

Our second reaction is “Gee Grandmother, what big market caps you have.” These companies are huge! And that’s not limited to the ten companies illustrated here. Measured against GDP, the market cap of all public companies in the US has …

(Read More)