More than a Dime’s Worth of Difference

Two events took place this week which demonstrate just how remarkably divergent the potential paths of tax policy are next year.

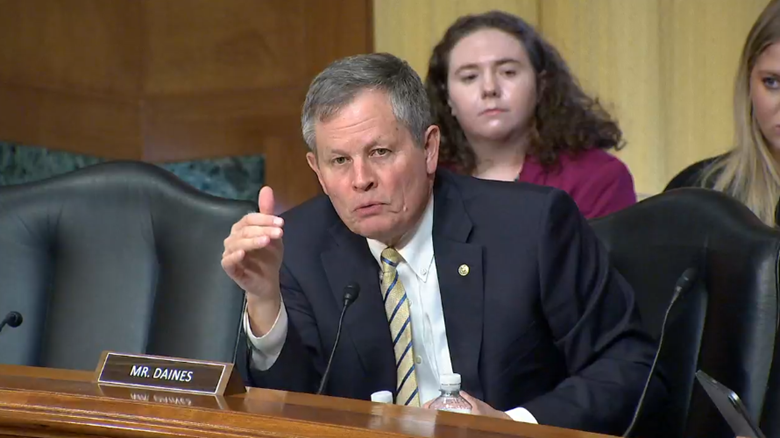

First, the Senate Finance Committee held a rare hearing Tuesday on the challenges faced by American manufacturers. Senator Steve Daines (R-MT) took the opportunity to highlight the importance of 199A to his manufacturers in Montana and how Congress needs to act to make it permanent.

As Daines noted:

The foundation of businesses in Montana are passthrough businesses. They make up 95 percent of all businesses and employ a majority of workers …

(Read More)