The BIG news over Memorial Day was the debt limit deal reached by President Joe Biden and Speaker Kevin McCarthy. While the package is an obvious compromise, the result is a big positive signal for the long-term budget picture that should not be overlooked. It’s also a signal that, with tensions high and a hostile press, the government can still operate as it is supposed to.

The deal centers on a suspension of the debt ceiling through calendar year 2024. We did a deep dive last week on what a default would look like, but the takeaway was that those are uncharted waters no one wants to explore. Hence the urgency on both sides to get something done.

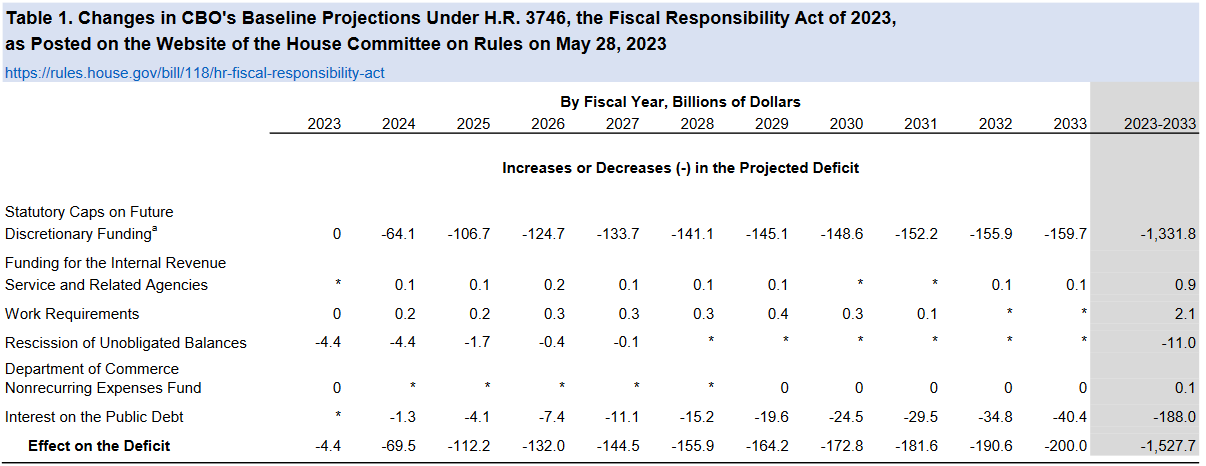

In exchange for extending the limit, Republicans received a number of spending cuts and other reforms, including caps on nondefense discretionary spending, rescissions of unspent Covid relief funds, and a $1 billion reduction in IRS funding. (Both sides agreed in principle to repurpose another $20 billion in IRS funding over the next two fiscal years, but the CBO did not include this deal in its scoring.) The legislation also ends the pause on student loan payments starting August 1, implements new work requirements for welfare recipients, and reforms the permitting process for certain energy projects.

The CBO estimates total savings at around $1.5 trillion over the next decade. That’s far less than Republicans’ original proposal, which cut nearly $5 trillion, but notable given that Democrats were calling for a “clean” debt limit bill until just a few weeks back.

Prospects

Will the package pass both the House and the Senate? Sure appears like it. While members of the conservative House Freedom Caucus have spoken out against the plan, as have some progressive Democrats, it appears there are sufficient numbers of members in the middle to produce a majority in the House.

On the Senate side, the bill’s prospects are also somewhat murky, with opposition on both sides and the chance certain members seek to extend consideration through procedural roadblocks and multiple amendments. But the deal is backed by Leaders Schumer and McConnell and it’s hard to see a scenario where the two can’t cobble together at least 60 votes, so overall the prospects look good.

Timing

In terms of timing, the House Rules Committee adopted the package last evening and the House is set to take up the bill later today. If it succeeds, the Senate would begin consideration either later tonight or early tomorrow and start the process of closing out debate through at least one or, more likely, a series of cloture motions beginning tomorrow or Friday.

Several Senators have made clear they intend to run the clock on the process in order to get votes on their favored amendments and/or voice their opposition, but those efforts often fizzle once the Senate demonstrates it has 60-plus votes necessary to move forward.

So expect the House to complete its work tonight and the Senate to work into the weekend, with final passage coming sometime Saturday or Sunday. Or just prior to the current June 5th “drop dead date” announced by Treasury Secretary Yellen.

Take-Aways

Assuming it all works out, what should the S-Corp community take away from this process?

- Size: The budget savings may be smaller than what some wanted, and tiny compared to the long-term problem, but they should not be discounted. As the saying goes, even the longest journey starts with a first step. This a good first step.

- IRS Funding: If IRS funding is indeed reduced by $20 billion, that’s both significant and, well, maybe not that important. On the surface, a $20 billion reduction of the total $80 billion provided in the Inflation Reduction Act is a 25-percent cut — nothing to sneeze at. As others have noted, however, the IRS’s early spending and hiring plans already are limited by a shortage of qualified workers and other obstacles, so we are unlikely to see much difference over the next couple years either way.

- Focus on Spending: One reason these savings are a “good first step” is they move in the right direction by focusing on the real problem – spending. Federal spending has grown dramatically in recent years, easily outpacing revenues and resulting in trillion-plus deficits “as far as the eye can see.”

- Spending Caps: Most of the budget savings comes from new caps on discretionary spending, which have a mixed history of success. Critics argue that Congress has a bad habit of repealing the caps every time they start to bite. There is some truth to this, but it’s also true that spending caps are better than nothing, which is what we have right now.

For Main Street businesses who already pay combined federal and state rates of around 50 percent, the prospect of future tax hikes is daunting. This package may not be as big as some wished, but it moves federal budgeting in the right direction. It’s a welcome development which should be applauded by the business community.