SALT Parity Continues to Roll

More good news to report on the SALT Parity front! Just yesterday, South Carolina Governor Henry McMaster signed our parity legislation into law. As a result, more than 300,000 S corporations and partnerships in the state will have access to some $38 million in annual tax relief. That’s a big deal, especially for businesses that have been hardest hit by the pandemic.

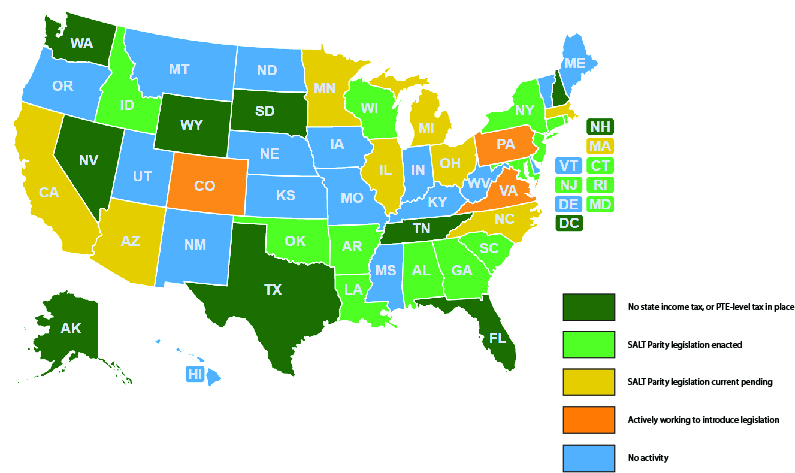

South Carolina now becomes the 13th state to enact our SALT Parity legislation, and joins Georgia, New York, Idaho, Arkansas, Alabama, Maryland, New Jersey, Rhode Island, Louisiana, Oklahoma, …

(Read More)