Thanks to the OB3, Section 199A is now a permanent fixture of the Tax Code. Millions of small and family-owned businesses can now stop worrying about their taxes and refocus on growing and hiring. It’s a good thing that means more investment and jobs on Main Street.

That doesn’t mean the debate is over, however.

A Congressional Research Service (CRS) report, for example, included a nice overview of the provision, but also made a point about horizontal equity we’ve seen previously:

The deduction may diminish horizontal tax equity in two ways. First, it taxes wage earners and pass-through business owners with similar income at different rates, even though there is no apparent economic justification for such disparate treatment.

To illustrate this point, assume that a sole proprietor and an employee have the same taxable income ($100,000 in 2024), and that the former’s income comes solely from QBI for a retail business she owns and the latter’s income is from wages only. Both are single filers. Under the federal individual income tax rate schedules for 2024, the sole proprietor is eligible for the maximum Section 199A deduction, which reduces her top marginal tax rate from 22% to 17.6% (22% x 0.8). By contrast, because the employee cannot claim the deduction, her income is taxed at 22.0%. Under pre-TCJA tax law, both taxpayers would have been taxed at the same top marginal rate.

In other words, two similarly situated taxpayers (horizontal, if you will) are treated differently because of Section 199A. But are they really similar? Is the wage earner really at a disadvantage? Finally, is this the correct comparison?

The answer to all these questions is an emphatic “No”. Treating wage earners and business owners as equivalent ignores the fundamental differences in how their income is generated and the ongoing obligations they face.

Regarding who pays what, we responded to a similarly misplaced comparison a few years back but it’s worth revisiting. The CRS report identifies Section 199A as an advantage but ignores a long list of tax benefits enjoyed by employees, including employer-provided health insurance and employer-paid retirement contributions. Employees also get half of their payroll taxes paid by their employer.

Pass-through owners, on the other hand, pay the full SECA tax and have less access to tax-advantaged benefits. When they do get those benefits, well, they are the one paying for them, aren’t they? Take all that into account and the advantage conferred by Section 199A simply disappears. In many scenarios, the business owner pays a higher effective rate, even with 199A.

The real world bears this out. Many experts worried (see here, here, here, and here) 199A would lead to a wave of employees quitting their jobs to become independent contractors. IRS data and independent studies make clear that never happened. For example, here’s the key passage from a 2021 NBER paper:

Taken together, our analyses of contractor transitions show no evidence of a short-run increase in independent contracting as a result of Section 199A…nor do we see a rise in individuals becoming contractors (or forming other sole proprietorships) more generally. Thus, using several measures, we do not find any evidence that Section 199A has led to increased contractor work relative to wage employment.

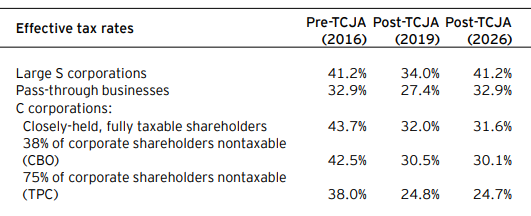

Finally, we should emphasize that this is all beside the point. The local hardware store owner doesn’t compete with his employees, he competes with Home Depot. That is the horizontal equity question that should challenge the experts – how do you ensure that Main Street businesses paying 37 percent top rates are not disadvantaged when competing against their larger, public competition paying just 21 percent?

The answer is 199A. As our EY study makes clear, with it there’s rough parity. Without it, public C corporations will continue to use their tax and financial advantages to accelerate the economic consolidation already taking place across the country – raising cheap capital, buying successful family businesses, and stripping our communities of the economic power and vitality they need.