With the House preparing to vote as early as today on the Senate-passed reconciliation bill, any lawmakers still undecided should take a close look at what’s at stake for Main Street businesses across the country. Absent congressional action, these businesses will be hit with an unprecedented tax hike, putting millions of jobs and billions in wages and economic growth at risk.

The urgency here stems from the looming expiration of the Section 199A deduction, which sunsets at the end of this year. We’ve done a number of studies in the past showing the benefits of 199A when it comes to achieving rough parity between pass-throughs and publicly-traded corporations. To build on that data we asked EY last year to estimate how much economic activity is supported by the provision, and the numbers are staggering.

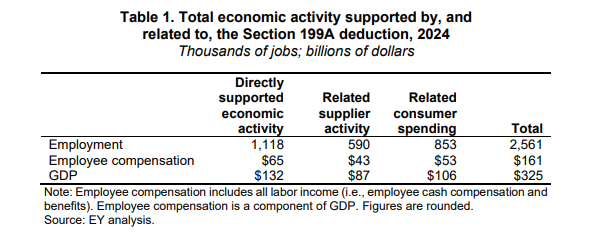

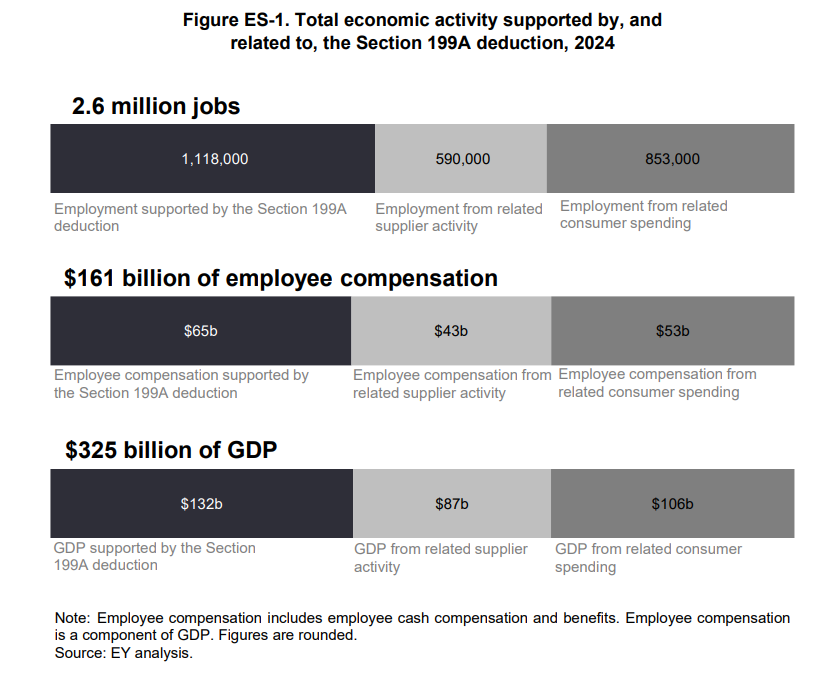

According to EY, Section 199A supports 2.6 million jobs, contributes $161 billion to employee compensation, and adds $325 billion to the national economy:

Drilling down on the jobs figures, the study found that 199A supports 1.1 million jobs directly, 590 thousand jobs through increased employee compensation, and another 853 thousand jobs from related consumer spending increases:

That’s why, as Chairman Jason Smith has said repeatedly, “failure is not an option.” Main Street businesses are the backbone of the American economy and supply well over half of all private sector jobs. They rely on Section 199A to hire, reinvest in their communities, and thrive.

As policymakers cast their votes, they should be clear-eyed about the consequences of inaction. Letting Section 199A expire would not just raise taxes — it would undermine millions of jobs, depress wages, and tilt the playing field further in favor of large, publicly traded corporations. It’s up to the House to finish the job and deliver the certainty Main Street needs to keep driving the American economy forward.