It’s been a busy month on the 199A front, thanks partially to our latest study showing the large amount of economic activity supported by the provision and the importance of making it permanent. (See here, here, and here for more on that.) Before the month wraps, we wanted to highlight a trio of additional 199A news items that caught our attention.

The first is Fox Business’ coverage of a press conference hosted by NFIB during their congressional fly-in this week. As correspondent Hillary Vaughn reported, NFIB members were in town to talk about the importance of making the Section 199A deduction permanent and, conversely, the consequences of allowing the provision to expire. Here’s how Vaughn described the situation:

What will happen if [Section 199A] goes away? Nine out of ten small businesses use this deduction – more than half would have to increase their sticker price without this deduction. More than half of businesses say they would delay or cancel investments in their business, and around 30 percent said they would have to put off hiring new workers or stop hiring altogether.

But if that wasn’t persuasive enough, here’s small business owner Candace Price on how the scheduled tax hike would hit her company:

If this deduction goes away, and prices continue to climb, it can literally be the difference between a small business staying open or closing its doors forever and going out of business.

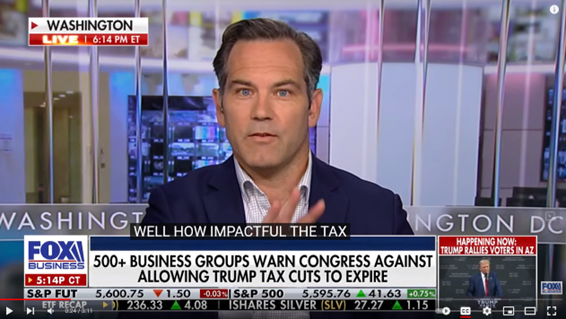

The second item was an appearance by S-Corp friend and ally Liam Donovan, with the Associated Builders and Contractors, also on Fox Business.

Asked about the looming 2025 fiscal cliff, Liam delivers a succinct summary of what’s at stake, including a reference to our earlier employment data to drive home his point:

The corporate piece of this – the ticker symbols you see scrolling across your screen – those companies absent congressional action keep their 21 percent rate…meanwhile the individual rates for all of us – everyone on camera, everybody at home – will go up absent congressional action.

If you think about how businesses pay taxes, 9 out of 10 businesses in the United States actually pay through the individual side of the code. They employ 62 percent of Americans. So when kamala Harris says she will raise taxes on people making more than $400,000, she is talking about raising taxes on Main Street, an average 20 percent increase in taxes on small businesses, family-owned businesses, Main Street Businesses.

It’s not just in the construction industry…think about anything downtown and on Main Street that isn’t a big box retail store. They are independent businesses paying at the individual rate – that is what is at stake when you’re thinking about going to the polls in November.

Exactly.

Finally, Michelle Gallagher, long-time S-Corp Advisor and Principal at the accounting firm Gallagher, Flintoff & Klein, also has a great video out on the looming 199A expiration, which she says will hit upwards of 80 to 90 percent of businesses in America:

Drawing from her extensive experience helping family business clients, Michelle drills down on the importance of 199A, a message she shared when she recently briefed Ways and Means members as part of the ongoing Tax Teams process:

What it allowed businesses to do over the last 8 years is to incentivize employers to invest back into their employees and grow their business, by employing more people and buying more equipment – capital investment. We have a number of studies that we are sharing with the Congressional Budget Office that show it worked. If you look at employment and capital investment, the business owners did go out and do what they were supposed to with [Section 199A]. So that’s a key selling point for keeping that portion of the Act in place and making it a permanent provision.

Tax policy often involves a disconnect between the statutory fine print of a specific policy and the very real effect that policy has on everyday Americans. Candace, Liam and Michelle do an excellent job bridging that gap and we hope lawmakers will take their message to heart.