Earlier this week S-Corp hosted a briefing to present the results of its latest study, which illustrates just how much economic activity is supported by the Section 199A deduction. The event featured Bob Carroll, Co-Director of EY’s US National Tax Quantitative Economics and Statistics Group (QUEST) and author of the new report, who walked through his findings. (Click here to watch a replay of the briefing.)

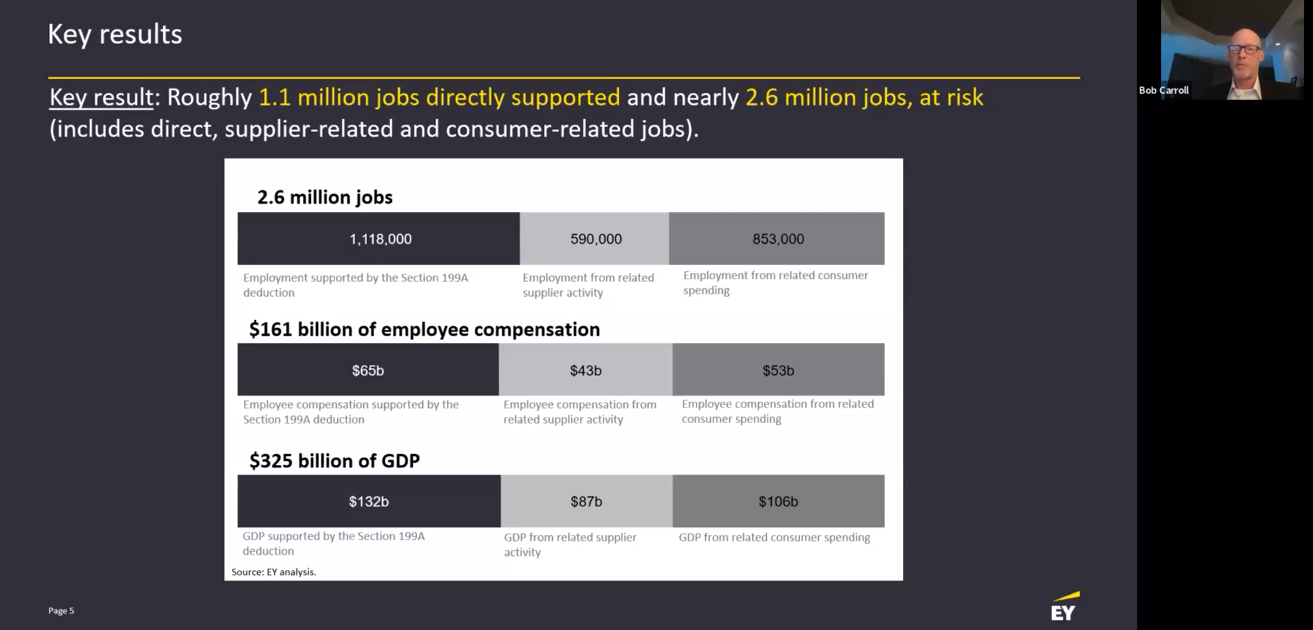

The key takeaway is that Section 199A supports 2.6 million jobs, drives $161 billion of employee compensation, and is responsible for $325 billion of GDP. Conversely, if 199A is allowed to expire at the end of next year as currently scheduled, it would put these jobs – which make up a sizeable portion of the private-sector workforce – at risk, along with the economic expansion the provision has engendered.

Also on hand at the briefing were Caroline Oakum, tax counsel for Senator Steve Daines (R-MT) and Noelle Britton, deputy chief of staff for Congressman Lloyd Smucker (R-PA). The two offices are the lead sponsors of the Main Street Certainty Act (S. 1706 / H.R. 4721) to make the Section 199A deduction permanent.

In an accompanying press release, those offices offered broad support for the study and its importance to the fight to make 199A permanent:

“This report underscores what I have heard directly from small and family-owned businesses in my community and across the nation. Section 199A allows main street businesses to grow, create jobs, and invest in their community. Making Section 199A permanent will prevent a massive tax hike and provide small business owners and their employees the certainty they need to thrive,” said Rep. Lloyd Smucker (PA-11), a member of the tax-writing Ways and Means Committee and lead sponsor of the Main Street Tax Certainty Act in the House.

“It’s no surprise that when we provide our small businesses with much-needed tax relief, they not only thrive, but they help the whole economy grow. It’s time this tax deduction is made permanent so that Montana small and family-owned businesses can continue to create jobs, serve their communities and spur economic activity,” Senator Daines said.

On behalf of the 95 percent of businesses operating as pass-throughs, thank you to Representative Smucker and Senator Daines for their unwavering commitment to preserving Section 199A, and thank you to Bob Carroll and the team at EY for another excellent report. As we approach the 2025 fiscal cliff, S-Corp will continue to arm our allies with the information they need to win this important battle for Main Street.