As we wrote earlier this week, it’s a busy April for tax policy. The packed agenda kicked off Tuesday with a hearing at the House Small Business Committee entitled, “Exploring the Adverse Effects of High Taxes and a Complex Tax Code.” It was the perfect opportunity to highlight the tax priorities that are top of mind for the Main Street business community and did not disappoint.

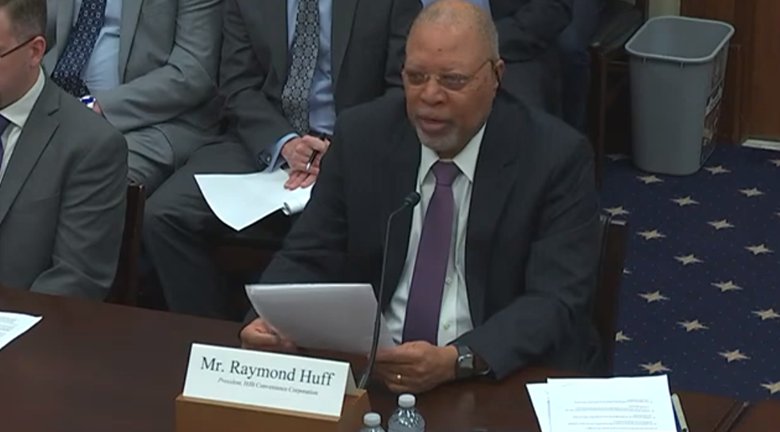

The hearing had a number of high points but we’ll flag just a few, starting with witness Raymond Huff, President of HJB Convenience Corporation based in Denver, CO.

Asked by committee Chair Roger Williams how his business utilizes the Section 199A deduction – and the opportunities afforded to it by keeping more of its hard-earned money – Huff responded:

Having those extra funds, I then invested in 2019 in additional technology that allowed my stores to stay open during the Covid pandemic. So 199A and bonus depreciation helped me tremendously over those two years.

Mr. Huff’s account mirrors those of millions of small business owners across the country. The deduction isn’t pocketed by business owners – it is reinvested in the form of new workers and equipment that help them grow. These businesses already face a challenge when competing with public companies, and absent the Section 199A deduction that challenge will grow larger.

Representative Beth Van Duyne (R-TX) pressed the point further and addressed the argument that the Tax Cuts and Jobs Act was merely a bailout for “wealthy corporations and one-percenters.” She asked Mr. Huff if he felt his business fell into one of these two categories – here’s his response:

No, I’m definitely not either. I’m a small business owner who goes to work every day, trying to make a dollar and pay my employees, and grow my business. But I’d like to one day be wealthy and be one of those things!

The next day, the House Ways & Means Committee convened for a hearing titled, “Expanding on the Success of the 2017 Tax Relief to Help Hardworking Americans.” Early on the panel heard from Michael Ervin, founder of the Coal River Coffee Company and a member of the National Federation of Independent Business:

Businesses like mine were able to benefit from the newly minted small business deduction, also known as the 199A deduction. This provision has allowed me to deduct up to 20 percent of my business income which has let me invest in my business, my employees, and in my community.

We’ve been able to increase my employees’ hourly wages, invest in equipment grow from a single location to four iterations, create a mobile location, and sell my Main Street roasted coffee internationally.

…However, in less than two years our business will be facing a huge, significant tax hike. Unless Congress acts to extend and make permanent the small business deduction, not only will my 20% small business deduction go away but my marginal tax rates will increase. These tax increases do not exist in a vacuum – my larger competitors like Starbucks and Tim Hortons are organized as C corporations and pay a 21 percent corporate rate, which is permanent. If the small business deduction lapses and my marginal rates increase, I could be staring at an effective tax rate of nearly 45 percent, when you combine federal and state income taxes.

As we’ve written before, one of the challenges facing the US economy is the ongoing consolidation of economic activity into large, public companies and away from Main Street. That consolidation means fewer jobs and more boarded up store fronts in thousands of communities nationwide. In response to Representative Vern Buchanan (R-FL) question that “it’s not like you take all that money home and put it under your mattress,” Mr. Ervin responded:

If we don’t have that deduction, there are some things that I’m personally going to lose as a business owner. One of those in particular is giving back to my community. We do a lot of philanthropic work; one example is that we have a partnership with the West Virginia Collegiate Recovery Network and with that partnership we have developed a coffee roast that we sell, and the profits go directly to a scholarship for people that have gone through recovery; this helps them and rewards them for their progress. That would be threatened in a major way.

Congressman Lloyd Smucker – the lead champion of legislation making the Section 199A deduction permanent – also commented:

Main Street businesses employ 60 percent of all private sector employees, and they’ll face a dramatic increase in taxes. If we do away with 199A, a 43.4 percent federal tax rate will be the top tax rate for them. Raising their taxes it would result in reduced wages, reduced benefits for workers, certainly reduced investment in the business, and other impacts to our growth.

Our recent work with EY confirms these data points and highlights just how much is at stake. The businesses facing these massive tax hikes are the ones that supply the majority of jobs nationwide, with many congressional districts relying on pass-through employers for over 75 percent of their jobs.

By our count, the Section 199A deduction was mentioned 61 times throughout the hearing, a reflection of just how important this provision is to millions of businesses nationwide.

So a big thanks to Chairmen Roger Williams and Jason Smith for putting a spotlight on 199A. We look forward to carrying that momentum into next year and securing a favorable outcome for the Main Street business community.