S-Corp and its friends at the National Federation of Independent Business hosted a Tax Day briefing for Hill staff and other stakeholders yesterday. The topic: the massive tax hikes threatening Main Street at the end of 2025.

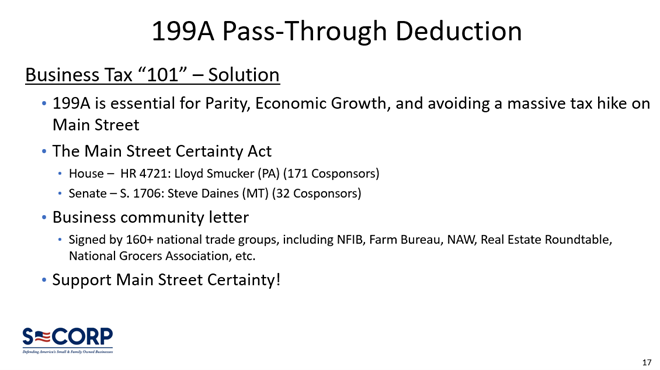

As readers know, the expiration of the Section 199A deduction coupled with significant increases in the marginal rates paid by the 95 percent of businesses nationwide is a significant challenge facing Main Street and Congress next year. We know Congress is going to have to act, and we know the issues in play are new to most of the staff and Members currently serving. The education challenge is daunting and yesterday’s briefing is just the first of many education sessions we have planned through the end of the year.

The briefing kicked off with a panel on the history and economics of Section 199A, featuring NFIB’s Vice President for Federal Relations Jeff Brabant, S-Corp President Brian Reardon, and EY QUEST Co-Director and veteran tax pro Bob Carroll.

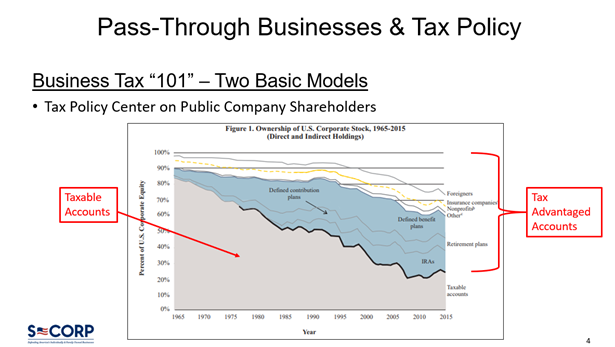

Brian ran through the ABCs of the pass-through structure, and explained why it remains the choice for virtually every business currently operating in America. The bottom line is that while pass-throughs pay tax once at the owner level on income when it’s earned, C corps pay tax once at the entity level, and once again when those profits are distributed to shareholders.

So why would any company opt in to the distortive corporate double tax? As Brian laid out, that second layer of tax is increasingly discretionary, especially for public companies whose shareholders include qualified retirement plans, charities and endowments, and foreign investors.

As a result, the double tax is largely reserved for private companies only, not public ones, meaning businesses engaged in the same industries can face tax burdens that differ significantly depending on how they are organized. The Section 199A small business deduction is designed to help bridge this gap.

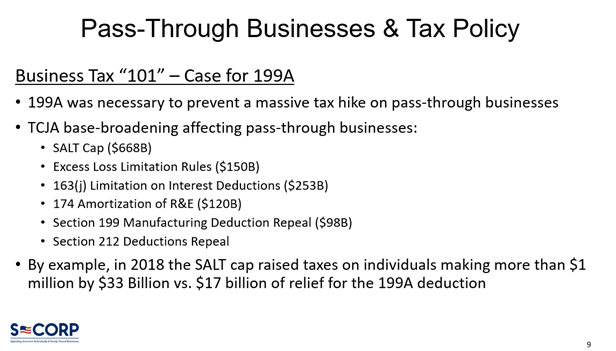

Another key point was the reason why 199A is necessary. Parity is important, as is encouraging economic growth and job creation. Central to the Main Street advocacy back in 2017, however, was the desire to avoid a massive tax hike. That’s because the base broadening included in the TCJA’s corporate reforms affected not only C corporations but pass-throughs too.

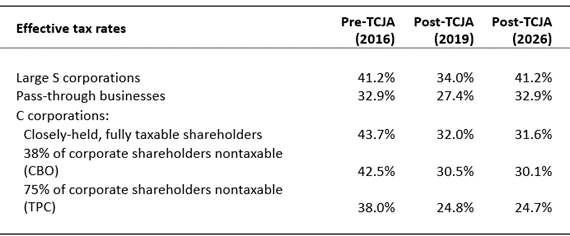

On the parity front, EY’s Bob Carroll presented an earlier study quantifying how the marginal rates faced by pass-throughs and C corporations vary depending on their size, the profile of their shareholders, and the presence of 199A.

The clear lesson of this table is that without 199A, private companies will be a significant disadvantage compared to public companies post-2025.

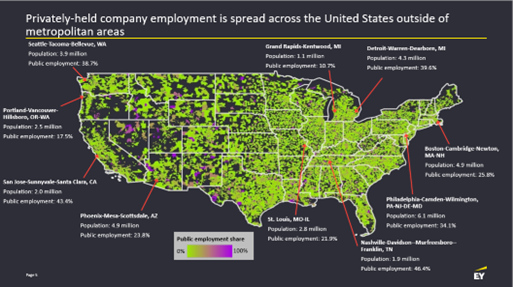

This disadvantage has geographical implications. As Bob’s work shows, private company employment is more evenly spread across the country. Ensuring parity for Main Street businesses is critical to the economic health of thousands of communities.

The day closed out with a presentation from David Winston, founder of the polling and research firm The Winston Group. David summarized the results of his latest polling which found that American voters in key swing states strongly oppose raising taxes on Main Street businesses and are concerned that any tax hikes would be passed on to consumers in the form of higher prices.

Which all leads us back to the focus of our advocacy, the Main Street Certainty Act. We are up to 171 cosponsors of the Smucker bill in the House, and the Smucker staff was on hand to help educate staff on the issue.

So thank you to NFIB, EY, the Winston Group, the Ways and Means Committee, and to the dozens of Hill staff who came out on Tax Day to learn about business taxation and the importance of 199A. When it comes to advocating for Main Street Certainty and a permanent 199A small business deduction, we’re just getting started.