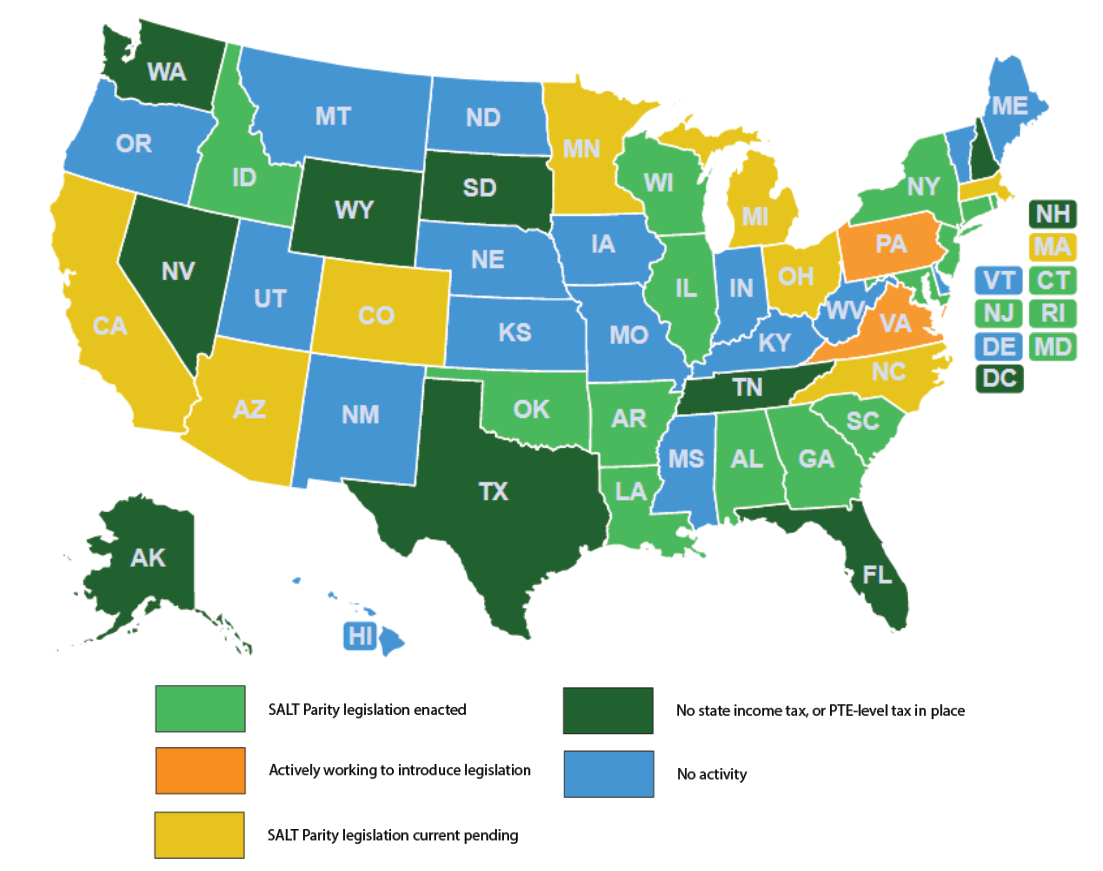

Our SALT Parity reform bills continue to roll across the country. Since 2018, 13 states have adopted our parity legislation. Colorado and Illinois, whose legislatures recently approved similar bills, are just a Governor’s signature away from becoming states 14 and 15 on that list.

SALT Parity enables S corporations and partnerships to deduct the full amount of their state and local tax (SALT) payments, just like C corporations can. If enacted across the country, we estimate that over 3 million pass-through businesses would receive some $6 billion in annual tax relief, all at no cost to the states.

These benefits have not gone unnoticed and have now been enacted in Connecticut, Wisconsin, Oklahoma, Louisiana, Rhode Island, New Jersey, Maryland, Alabama, Arkansas, Idaho, New York, Georgia, and South Carolina. As noted above, Colorado and Illinois are just a signature away from joining that group.

Which state might be next? Here’s the latest on states where S-Corp is active and reforms are moving:

- California: SALT Parity language was included in Governor Gavin Newsom’s initial and revised budget proposals, and S.B. 104 is pending in the Senate. Given state lawmakers’ continued interest in these reforms, we remain optimistic CA will pass legislation soon.

- Minnesota: S.F. 263 is currently before the legislature and our allies in the state have worked with the state Department of Revenue to finalize language. We anticipate this bill’s inclusion in the broader budget package being negotiated with the Governor.

- Arizona: Legislation passed the House in March and is in play in the Senate. We’ve worked out technical changes with the state’s Department of Revenue, and are awaiting resolution of general budget debate.

- Michigan: The state House voted 88-18 in favor of H.B. 4288 last month, and S-Corp recently testified in favor of the bill before the Senate Finance Committee. The bill is now before the full Senate, which has a history of support.

- North Carolina: H.B. 334 was passed by the House in April, and is expected to clear the Senate in the coming days. Parity language has also been included in three other legislative vehicles. We ultimately hope to see a bill on the governor’s desk shortly.

- Ohio: H.B. 124 was introduced back in February and remains pending in the Ways and Means Committee.

With employers continuing to struggle to find workers, and many states still engaged in COVID-related limitations, adopting SALT parity is a no-cost way for those states to benefit their businesses now, when they could use the help. Half of the states that could benefit from SALT parity are taking action. The question we have is, what is up with the other half? Now is the time for them to take up this reform and unlock billions of dollars in relief for their Main Street businesses.