Earlier today, S-CORP hosted a webinar featuring David Winston and Myra Miller of The Winston Group, longtime experts in measuring voter attitudes on tax policy. The focus was the One Big Beautiful Bill and its Main Street tax provisions, which are not only good policy but also extremely popular with voters.

So how popular are these provisions?

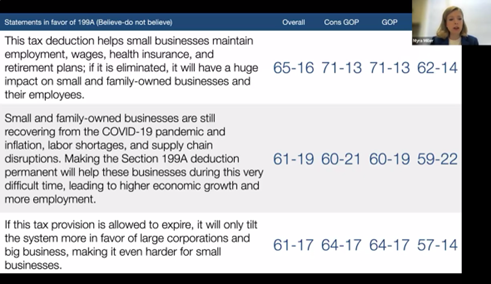

Very. The Winston Group’s research shows broad, bipartisan support across key items in the bill. For example, Section 199A continues to enjoy strong favorability, with 60 percent of voters supporting the deduction outright, and even stronger support when they learn how it helps small businesses create jobs and compete.

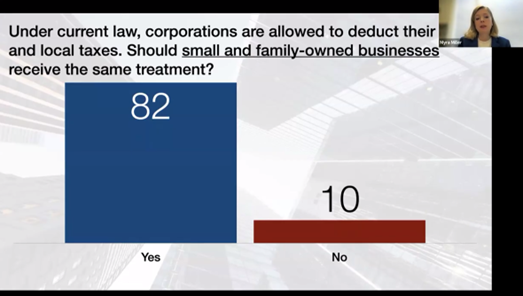

Similarly, when voters were presented with the idea of restoring SALT parity for pass-through businesses, support increases significantly, especially when it’s framed as a matter of fairness with C corporations.

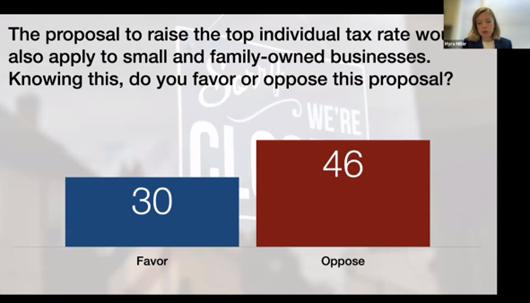

The presentation also highlighted how Main Street remained front and center throughout the tax debate. While some voters express openness to higher taxes on the wealthy, that support collapses when they learn that many “high-income earners” are actually small and family-owned businesses. As David and Myra made clear, voters overwhelmingly believe that Main Street businesses should pay less in taxes, not more.

The takeaway? These Main Street provisions aren’t just sound economic policy, but also resonate with broad swaths of the American electorate. Lawmakers should be talking about them loudly and often as they head into August.

For those interested in learning more, click here to access the full recording!