Critics of the Section 199A passthrough deduction are back in full swing. A recent release by Senate Finance Committee Ranking Member Ron Wyden (D-OR) claims the House-passed proposal to extend and modestly expand the 199A deduction “disproportionately benefits the rich.”

Senate and House tax-writers need to ignore the critics and support 199A, including the House proposal to increase the deduction to 23 percent. The Wyden release may generate headlines, but it doesn’t change the underlying facts: Section 199A is one of the most effective tools to spur economic growth and job creation while helping level the playing field between Main Street businesses and large corporations.

Parity is Key

A key goal of Section 199A is to avoid placing America’s privately held businesses at a tax disadvantage relative to their C corporation competitors.

The 2017 Tax Cuts and Jobs Act (TCJA) cut the corporate rate from 35 percent to 21 percent, a historic reduction that dramatically lowered the tax burden on large (and typically publicly-traded) corporations. Meanwhile, the top rate on pass-through income was set at 37 percent and pass-through businesses generally lost their ability to deduct SALT as a business expense. C corporations continued to deduct all their SALT.

Enter Section 199A, which provided a deduction of up to 20 percent on qualified business income, thus narrowing that disparity.

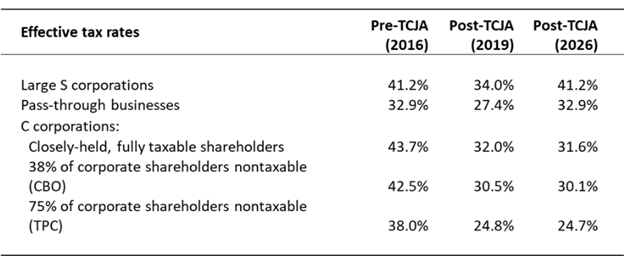

Did it completely level the playing field? No. As our EY study from 2023 showed, pass-throughs and C corporations pay similar levels of tax, but only if the pass-through deduction is available and only if lots of the C corporation’s shareholders actually pay tax. For multinationals with lots of tax-exempt or tax-advantaged shareholders, they continue to have a clear advantage when it comes to effective tax rates.

Guardrails Still Apply

Critics also gloss over the fact that Section 199A includes built-in protections that restrict the deduction for high-income owners unless they create jobs or invest significant amounts of capital.

Specifically, once a pass-through owner exceeds the income threshold of around $400,000, the deduction is limited to 50 percent of W-2 wages paid, or a similar formula applies to significant investments in property. A Treasury Department study found these guardrails exclude nearly 40 percent of pass-through income.

In other words, successful pass-throughs do get the 199A deduction, but only if they employ lots of people or make significant investments.

199A is “Neutral”

The Wyden release says most of the benefits of the 199A deduction go to high-income business owners, but a recent CRS report flatly states that the 199A deduction is neutral regarding progressivity – “The Section 199A deduction appears to have little effect on vertical equity, as it does not appear to diminish the progressivity of the federal income tax.” As the report explains:

The deduction has little effect on vertical tax equity. In theory, it reduces statutory marginal tax rates by the same factor (20%), leaving a progressive rate structure intact for pass-through business owners.

Nonetheless, available evidence indicates that high-income taxpayers might capture much of the Section 199A deduction’s overall benefit. Such an outcome would be consistent with what is known about the income distribution of pass-through business profits.

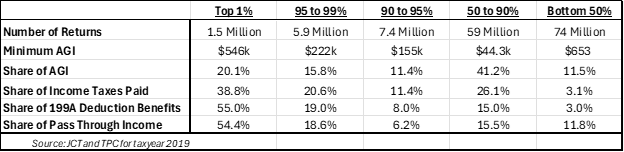

We put together this table to illustrate what the CRS report is talking about. As you can see, in 2019 the top 1 percent of taxpayers earned 54 percent of pass-through income and received a similar level of 199A deduction benefits:

Again, large pass-throughs get the 199A deduction, but only consistent with the amount of taxes they pay, and only if they employ lots of people and/or make significant investments.

Offsetting Provisions

Finally, it is important to remember that Section 199A was not enacted in a vacuum – it was part of a package that included many tax hikes. These included the caps on SALT deductions, excess loss deductions, interest deductions, repeal of the manufacturing deduction, etc.

Many of these provisions are permanent and all of them raise taxes on pass-through businesses, primarily larger ones. If the concern is progressivity, it’s clear the combined individual and pass-through provisions in the TCJA made the Tax Code more progressive, not less.

Conclusion

The Senate is moving quickly to pass its version of the Big Beautiful Bill Act, too quickly to do a deep dive on exactly who pays what under all its provisions. What is clear, however, is a robust 199A is more important than ever, particularly if the Senate keeps the 50-percent haircut on all PTET deductions. To offset these tax hikes, the Senate should adopt the House 23-percent 199A deduction and to help restore parity between Main Street and their C corporation competition.