The Main Street community needs the Big Beautiful Bill to succeed. Absent congressional action, taxes on pass-through businesses of all sizes will go up sharply. The same applies to most families. So the Main Street Employers Coalition supports efforts in both the House and the Senate to extend the sunsetting provisions from the Tax Cuts and Jobs Act.

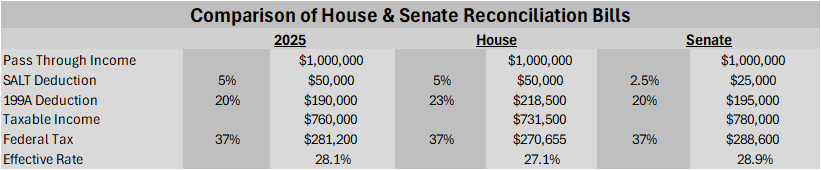

Comparing the two approaches, the House bill is more friendly to small- and family-owned businesses. It increases the Section 199A pass-through deduction to 23 percent and its disallowance of Pass-Through Entity Taxes (PTETs) is limited to Specified Service Trades or Businesses (SSTB) only.

The Senate draft, on the other hand, keeps the current 20-percent 199A deduction and would apply a 50-percent haircut to all PTETs over a $40,000 threshold. Those two changes increase pass-through collections by about $140 billion relative to the House bill. Under the Senate bill, many pass-through businesses will see their taxes go up relative to what they currently pay. That was not the plan initially outlined by the President or congressional leadership.

These tables show the net effect of the House and Senate policies on an example S corporation, assuming a SALT rate of 5 percentage points. As you can see, the House bill would reduce the S corporation’s effective tax rate by one percentage point, while the Senate bill would increase the rate by a similar amount.

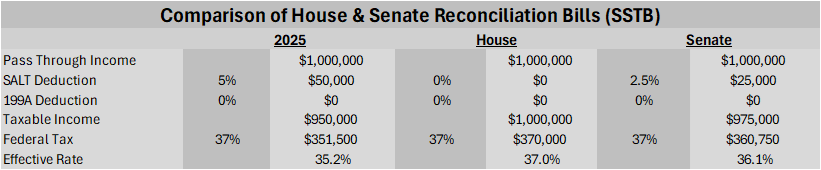

This result is not true for all pass-throughs. The House bill would have precluded so-called SSTBs from deducting their SALT. Those businesses are already excluded from the 199A deduction, so their effective tax rate under the House bill would go from high to higher. Non-SSTB businesses, however, would not be affected by the disallowance. The high marginal rates on SSTBs are the reason so many doctors and accountants are organized as C corporations.

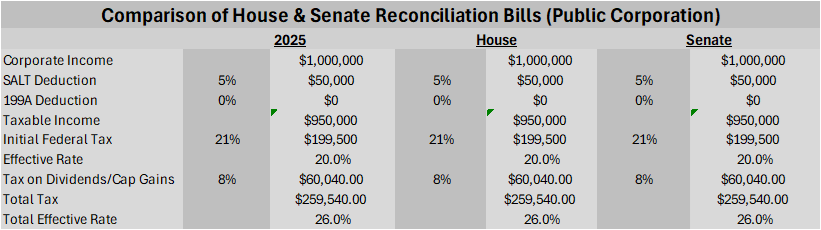

Speaking of C corporations, both bills include increased bonus depreciation, R&E expensing, and a more friendly cap on interest deductions. While some pass-throughs may benefit from these provisions, the bulk of the benefits would accrue to public C corporations. Worse, many pass-throughs who would otherwise benefit may be blocked by the excess loss limitations included in both the House and Senate bills. These rules punish pass-through business owners for using investment income to fund job-creating businesses by disallowing them from realizing the related losses.

For comparison purposes, this table shows the effective rate for a public corporation under the House and Senate bills. The dividend/capital gains tax rate is 8 percent to reflect the fact that only one-quarter of public corporation shareholders are fully taxable. The remainder are made up of tax-exempts, foreign shareholders, and qualified retirement plans.

Under either bill, successful pass-through businesses would continue to pay significantly higher tax rates than their C corporation competition.

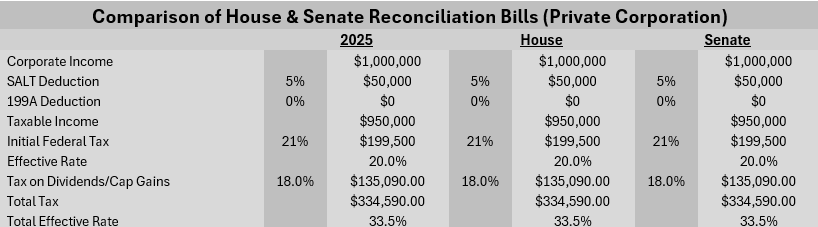

For those wondering why the S corporation doesn’t convert, this table makes clear why that’s not an option. Unlike public C corporations, the shareholders of private companies do pay taxes and those companies are under greater pressure to pay regular dividends, so the second layer of tax bites hard. We use an estimated rate of 18 percent.

These differences result in a tax rate that is 8 percentage points higher than the public C corporation. The private business pays more either way.

As noted above, these tables reflect changes to 199A and SALT policies only. They do not reflect many other changes included in the bills, changes that largely benefit C corporations but can also benefit pass-throughs. Some pass-throughs might do better than these tables suggest. They also might do worse, as both the House and Senate bills include numerous provisions that would increase taxes on pass-through businesses and their owners. These provisions include the extension and expansion of the excess loss provisions, new itemized deduction limits, and others.

The bottom line is while the Main Street community needs the Big Beautiful Bill to succeed, the House and Senate approaches are not equal. The House bill is clearly more friendly to Main Street, whereas the Senate bill focuses more on public C corporations. For both the House and the Senate, avoiding tax hikes on Main Street businesses should be a priority. As the BBB moves through the process, we will be working to ensure the legislation succeeds and that it avoids raising taxes on pass-through businesses.