The Main Street Employers coalition organized a letter calling on tax-writers to reject rate hikes last week. More than 90 trades, including all our Main Street friends, signed on.

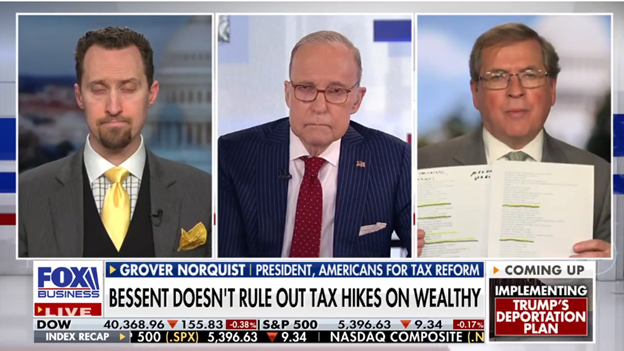

That effort caught the attention of Americans for Tax Reform’s Grover Norquist, who flagged it in a recent media appearance.

President Trump is not going to allow the top rate for income taxes to be increased. That is a direct hit on small businesses. There was a letter that went to the Hill from 90 trade associations that represent small businesses pointing out that subchapter S corporations that pay the individual rate would be badly hit.

…National roofing contractors, the Precision Metalformers, the Association of Builders and Contractors, heating, air conditioning and refrigeration. These are the people who make America work.

You’ve got some [people] in the White House pushing the idea that President Trump is going to break his word and raise taxes. Trump has said, again and again on the campaign, that he wanted a tax cut for everybody.

As we’ve covered previously (see here, here, here, and here), the idea is to bump top marginal rates to roughly double what public C corporations pay. What’s being dubbed as a “millionaire’s tax” would instead hit Main Street employers, raising their rates to the highest level in nearly four decades.

The buzz seems to be driven by comments from tax-writers that “everything is on the table.” That innocuous starting point has morphed into a self-perpetuating media cycle, where any response short of an outright rejection becomes headline news.

Nonetheless, the business community needs to be public in its opposition to this bad idea. Fortunately, Key Republicans feel the same way and have voiced their concerns. Here are a few responses compiled by National Review:

- House Speaker Mike Johnson (R., La.): “Generally we’re trying to reduce taxes here.”

- House Majority Leader Steve Scalise (R., La.): “No. 1 goal is keeping rates where they are and preventing a tax increase.”

- House Ways and Means Committee Chairman Jason Smith (R., Mo.): “We are going to create a tax code that grows the economy, that grows wages, is the focus to help deliver tax relief for America. The way you provide tax relief is, you cut tax rates.”

And just earlier today Republican Senator Dave McCormick of Pennsylvania:

I don’t think that’s likely to happen…We’ve got to reel in the spending. That’s going to require some tough choices. But we can’t do that by raising taxes, which slows the economy and hurts working families.

Finally, here’s economist Arthur Laffer a day earlier speaking on Kudlow’s show:

That we are even talking about a tax rate increase on the top income earners is silly. Can you imagine that conversation appearing a month ago? It makes no sense whatsoever. Trump doesn’t want to raise the highest tax rates.

This broad and swift pushback is exactly what tax-writers need to hear as they begin to craft the tax package. So take recent media reports of looming rate hikes with a grain of salt, but don’t be complacent. Make sure to let your elected officials know how you feel about raising rates on Main Street. We’ll be doing the same.