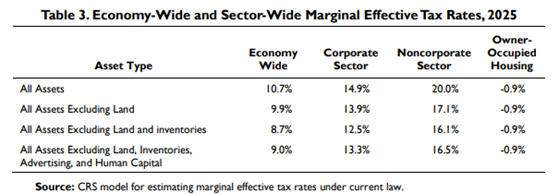

As Congress puts together the big tax bill, CRS just produced another reminder of why making the Section 199A pass-through deduction permanent needs to be part of the package. This chart says it all:

The rates reflected here are important because they measure the overall tax burden imposed on new investment. As CRS notes: “The marginal effective tax rate (METR) is a forward-looking measure that estimates… the share of the rate of return on a prospective investment that is paid in taxes over the life of that investment.”

So under current law, C corporations enjoy a marginal effective tax rate that’s a full one-quarter lower than the rate paid by pass-through businesses organized as S corporations, partnerships, and LLCs. That’s now, with 199A in place. If we go off the cliff, that gap is going to grow dramatically.

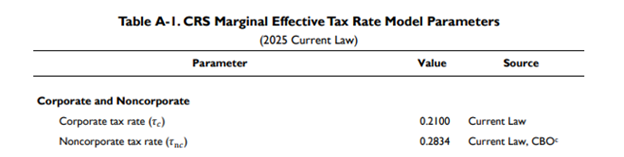

What parameters did CRS use to drive these numbers? Here’s the statutory rates they used:

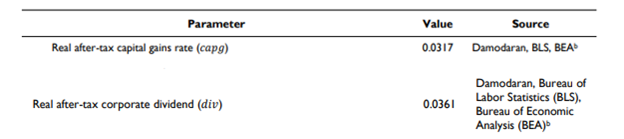

And here are their estimates for effective rates on corporate dividends and capital gains:

A couple points of emphasis. First, the rate estimates include all pass-through income, so the 28 percent statutory rate is a blend reflecting all the individual rates, including the lower rates paid by small pass-through businesses. For companies whose owners pay the top rates, the gap is larger.

Second, the table shows the effective rates on corporate dividends and capital gains are just above 3 percent, or a fraction of the 23.8 percent statutory rate. That is largely due to all those C corporation shareholders who don’t pay taxes, the low percentage of corporate income paid out as dividends, and the deferral benefit of capital gains.

These low rates also explain why the double tax hits family businesses hard. Public C corporations enjoy discounted rates because so many of their shareholders pay little or no tax, whereas the owners of family businesses are almost always full taxpayers. They really do pay the full double tax.

So just in time for the tax debate, our friends at CRS provide strong evidence as to why Congress needs to act. Absent 199A and rate permanence, Main Street businesses just won’t be able to compete.