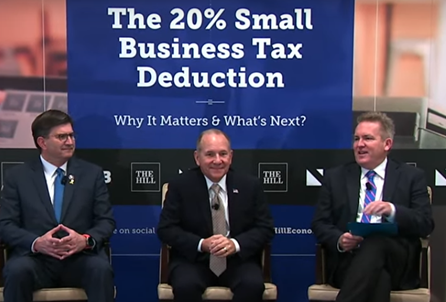

Earlier today our friends at NFIB held an event on Capitol Hill focused exclusively on the looming expiration of the Section 199A deduction, and what it means for the Main Street business community.

The event kicked off with a discussion featuring Ways and Means members Lloyd Smucker (R-PA) and Brad Schneider (D-IL). S-Corp readers will recognize Smucker as the lead sponsor of our Main Street Certainty Act in the House, which now has 192 cosponsors!

A couple highlights – first, Representative Smucker discussed the importance of making 199A permanent:

As head of the Tax Team specifically focused on small business finance and tax structure, we’ve held multiple roundtables and heard from small business owners that those additional dollars back in their pockets allowed them to reinvest in their businesses, their workers, and their communities. If we allow [199A] to expire, and the individual rates to expire, it’ll be the largest tax increase in our history. So our goal is to make this permanent to provide the predictability that small business owners want to see. It’s a key provision of our agenda in terms of what this tax package should look like. As you mentioned [my 199A permanence bill] has 192 cosponsors now, including some Democrats, so there’s bipartisan support for the idea. Because people see the impact of these businesses on their communities, and how the health of these businesses is critical to the health of these communities.

Congressman Schneider then hit on an important theme we’ve made in the past – that family businesses need a viable pass-through structure in order to compete with larger public companies:

There is a difference between C corporations and large multinationals, and small businesses – whether they’re family owned or privately owned….

For the closely-held and family-owned businesses, they don’t have access to the same capital markets. So for a small business, the key things they require are access to capital, access to talent, and access to a stable political environment. And they don’t have the same way of going to market for capital; they’re either going to family and friends, maybe their local community bank, whose presence is shrinking. Their opportunities are less….

So maintaining that ability to be an LLC, S corporation, partnership, and keep that closeness, to access that capital, and invest in their people and products, and doing it in a way that’s very different than these large companies. That’s why it’s so important that we have a Main Street strategy.

Exactly. Family-owned businesses may be the economic cornerstone of most communities, but they face specific challenges not shared by public corporations. The Tax Code should not add to those challenges by taxing them at higher rates.

That’s where Section 199A comes in. It ensures the rates paid by local, family-owned businesses are not 50 or 100 percent higher than the public company they compete with. Congress is poised to make sure 199A remains in the Tax Code next year, and we’re going to do what we can to support that effort. Today’s briefing by NFIB was a big help.