Friday’s District Court decision declaring the Corporate Transparency Act (CTA) unconstitutional is garnering lots of attention. As the Wall Street Journal editorial board noted, “The judgment is a legal bullet dodged for millions of small businesses that would be smacked this year by the new reporting requirements.”

The ruling is a massive victory for the Main Street business community, no doubt, but its real-world implications remain to be determined. The ruling is not a nationwide injunction but instead applies narrowly to the suit’s plaintiffs, the members of the National Small Business Association (NSBA). As presiding Judge Liles Burke’s judgement reads:

For the reasons articulated in its March 1, 2024, opinion on the parties’ cross-motions for summary judgment, the Court finds that the Plaintiffs are entitled to summary judgment as a matter of law, and grants the Plaintiffs’ request for relief as follows:

(1) The Court enters this final declaratory judgment: as discussed in the Court’s opinion, the Corporate Transparency Act is unconstitutional because it exceeds the Constitution’s limits on Congress’ power. The Court makes no ruling as to the constitutionality of the Act on any other grounds.

(2) The Defendants, along with any other agency or employee acting on behalf of the United States, are permanently enjoined from enforcing the Corporate Transparency Act against the Plaintiffs. [Emphasis added.]

(3) The Court will hear the parties’ arguments concerning the allocation and amount of costs on a date to be determined.

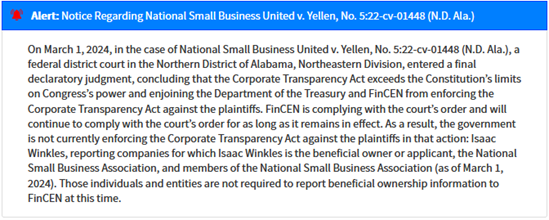

In response, FinCEN – the agency tasked with implementing and overseeing data collection under the CTA – announced that it would cease enforcement of the CTA for NSBA members, while continuing to apply the law to everyone else:

It may seem ridiculous that 65,000 NSBA members are now carved out of reporting regime affecting tens of millions of entities – especially as the entire law was declared unconstitutional – but that appears to be the case given FinCEN’s response to the ruling. Could covered small businesses simply join the NSBA and thus exempt themselves from the reporting requirement? FinCEN says no, only those businesses who were members as of the ruling on March 1 are exempt.

From a practical standpoint, it may not make all that much of a difference. Existing entities have until the end of the year to file their reports, so there’s a good chance the court case will have made its way through the 11th Circuit by that time. As we noted on Friday, the ruling is strong and is likely to be upheld. At that point, the government will have less of an excuse to continue this information collection regime.

In the meantime, exactly how is FinCEN to know who is and isn’t an NSBA member? Their membership list, like that of most trade associations, isn’t public. Moreover, NSBA is protected from being forced to divulge their membership by the 1st Amendment. (Yes, that pesky Constitution again.) FinCEN can say the relief is limited to NSBA members, but they have no means of distinguishing them from anybody else.

That ignorance applies to the CTA itself. FinCEN has no practical means of assessing which of the millions of entities who might be covered under the CTA are actually obligated to file their beneficial ownership forms. The reporting requirements are premised on the industry, employment, and revenues of each entity, information FinCEN simply doesn’t have. Absent an intrusive audit of every legal entity out there, how will they know?

Who does know? Accountants, but they are being told not to advise their clients on CTA compliance matters as that would constitute practicing law without a license. This reality is just one of many as to why the CTA is doomed to fail as a law enforcement exercise.

It is also one of the reasons why now, two months after the CTA went live, so few businesses have filed or are even aware of the law’s existence.

So where does this leave us? The Department of Justice is sure to appeal the ruling and, as this case is a matter of law rather than facts and circumstances, it’s possible the appeal will move quickly and be considered prior to the end of the year. Rapid resolution of this case is in everyone’s interest.

In the meantime, S-Corp and its allies will be pressing our friends in Congress for two actions: 1) use your influence to convince FinCEN to suspend CTA implementation for everyone pending the outcome of the court case and, 2) adopt the Beatty/Nunn bill (HR 5119) to delay CTA reporting by a year. That legislation would give the court process time to work and give FinCEN and the business community more time to educate covered entities as to the CTA’s requirements. The bill passed the House 420-1 last year and currently is pending in the Senate Banking Committee.

Last week’s court decision helps move the ball forward on both of these efforts, even as it increases the chances the whole law falls on constitutional grounds. It is difficult to appreciate just how badly the sponsors failed to take the Constitution into account when formulating this law. It is like they forgot we had one.