It still feels like the calm before the storm, but federal lawmakers are back in town to kick off what could be a surprisingly interesting year for tax policy. Below are a few items we’ll be watching closely on behalf of the pass-through business community.

Tax Package in the Funding Deal?

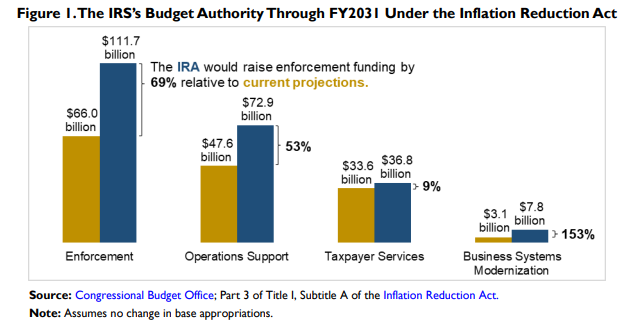

The big news this weekend was the deal reached by party leaders to keep the federal government funded through 2024. The deal calls for modest increases in defense spending while keeping non-defense outlays at current levels. It also executes some of the targeted spending cuts that were agreed to in the 2023 debt limit bill, most notably a $20 billion clawback of new IRS funding.

Meanwhile, Punchbowl News reports that tax chairs Wyden and Smith may soon announce a package of business tax relief sought by most Republicans along with an expanded child tax credit supported by Wyden and his conference. Smith is scheduled to brief his committee members tomorrow.

Getting a tax package done this late in the process is a long shot, but a public agreement by the two chairs would certainly help move things along. The spending package will need support from Democratic and Republicans alike, so a tax package that appeals to the same voting bloc is unlikely to upset that arrangement.

What might the deal look like? Expect a $50 to $80 billion package evenly divided between business relief — Section 174 R&E expensing, restoring the EBITDA base for 163(j), and bringing back expensing via bonus depreciation – together with an expanded Child Tax Credit.

Does the new Speaker have the votes for the spending deal? Can a tax title catch a ride on a last-minute spending bill? Could it ride alone? Would lawmakers advance tax relief without offsets? Are ERC reforms a viable pay-for? We’ll see in the next couple of weeks.

Tax Panel Turnover

An ongoing challenge all advocates face is the rapid turnover of Members and staff. Just when they begin to understand your issues, they leave! To point, of the twenty four Ways and Means Republicans who crafted the TCJA, only five remain. The turnover of staff is, if anything, more dramatic.

Expect to see lots more of that in the coming year. Of the 27 seats on the Finance Committee, 11 are up for reelection. Three members – Senators Cardin (MD), Carper (DE), and Stabenow (MI) – have already announced their retirements, Senators Brown (OH) and Casey (PA) face competitive races, and Senator Menendez (NJ) is fending off a strong primary challenge.

On Ways and Means, two Republicans are retiring while another three face competitive races. Three Democrats are retiring as well, including Representative Brian Higgins (NY) who plans to depart early next month. A change in control would reset the membership further. Republicans would drop from 24 to 17 seats so that, even with turnover, junior Republicans could lose their seats. Democrats, on the other hand, would need to add at least ten new members.

All of this is to say that, as we inch closer to the “fiscal cliff” in 2025, the education challenge before S-Corp and the Main Street Employers coalition will be daunting. Time to get busy.

Regulatory Activity

Tax Notes has an interesting article on the regulatory outlook at Treasury. As Jonathan Curry reports:

It’s been nearly three years since President Biden took office, but the legislative and regulatory reckoning that many estate planners feared has yet to materialize. And 2024 looks to be no different. A risk-averse Treasury and a divided Congress — in an election year, no less — means wealthy individuals and families shouldn’t expect significant changes in the estate planning advice they receive next year, observers say.

Not to poke a sleeping bear, but Treasury’s lack of aggressive rulemaking has been a welcome respite given everything else going on – COVID, Build Back Better, inflation, supply chain disruptions, labor shortages. Sometimes it is nice to have a little stability, no? Will this period of calm extend through the new year?

Beth Shapiro Kaufman of Lowenstein Sandler LLP also noted that the current IRS and Treasury priority guidance plan contains fairly mundane estate and gift tax items and said it’s unlikely there’s a sleeper project in the works that hasn’t been telegraphed. The government typically doesn’t devote much time to projects that aren’t on the guidance plan unless there’s newly enacted legislation that takes priority, she said.

Tax Notes is focused on estate tax rules, but it could also have applied to other areas of the Code. Compared to other agencies, Treasury has been very restrained. For Main Street, that’s a good thing.

Court Activity

Lots of tax policy before the courts these days, starting with the Moore case. The SCOTUS heard oral arguments back in December and a decision is due this Spring. We’ve written extensively on the case (here, here, here) but suffice to say the feedback from orals is we should expect a modest decision that restores the old definition of income without ending the Tax Code as we know it, as many breathless commentators warned. So that’s that, but Moore isn’t the only case before the courts. Here are three more worth your attention:

- Partnerships and SECA: Tax professionals expect a spike in audits of limited partnerships following a recent tax court opinion. Soroban Capital Partners LP v Commissioner found that LPs are not automatically exempt from SECA. If the ruling survives, many limited partners will no longer be able to claim the SECA exemption. It also opens the door for audits under a compliance campaign launched back in 2018. Just the latest chapter in a long-running campaign to expand the application of payroll taxes to more business income.

- Business Valuation: Business valuations are always contentious. This time, the SCOTUS has agreed to hear Connelly v. United States where the Eight Circuit sided with the IRS that life insurance proceeds used to redeem a deceased shareholder’s stake would increase the fair market value of the business and, as a result, the value of the shareholder’s estate too. Estate planners are watching this one closely. Can you pronounce “amicus”?

- Antio v. Department of Revenue: This Washington State case has implications for investors and fund managers nationwide. In Antio LLC v. Washington, the Washington state Department of Revenue applied the state’s 1.5 percent business and occupation (B&O) tax to the plaintiff’s investment income. Prior to this, most investment income had been exempt from the B&O tax. It’s unclear how the state would apportion the investment income of non-residents, or the gains from funds invested in Washington state businesses, so you don’t need to live in Seattle to care about this. The state supreme court is scheduled to hear the appeal later this Spring.

State Activities

In a recent TTT Podcast (that’s short for “Talking Taxes in a Truck”!), we chatted with Jared Walczak of the Tax Foundation about all the tax policies moving at the state level. As Jared noted, it’s largely a good news story, but there are threats out there:

- Rate Cuts: According to the Tax Foundation, fourteen states will have reduced individual income tax rates this year — Arkansas, Connecticut, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Carolina, Ohio, and South Carolina. Nice to see Connecticut trying something new! (They also amended their SALT Parity tax to make it elective, just like we suggested…. six years ago.)

- SALT Parity: We are declaring our SALT parity efforts to be over. Of the 41 states where the reform offers benefits, 37 states have acted. The rest can fend for themselves or miss out on the $20 billion a year this effort is saving pass-through businesses. Come to think of it, we’re not done with SALT. We need to educate states on why they should keep the election in place regardless of what happens to the federal cap – you save either way — plus there’s cleanup to do in California, Louisiana, and elsewhere. Nevermind.

- Rate Hikes: A couple of states will increase their rates in 2024 – Michigan and California. The rate hike in Michigan is fairly modest but California’s effort deserves special attention. Their top rate is rising from 13.3 percent to 14.4 percent! That’s about three times the average. Will the last pass-through business operating in California please turn off the lights when you leave? Thank you.

- Wealth Taxes: Last year, there was a concerted effort by a handful of states to push for wealth taxes. As reported by the Washington Post: “A group of legislators in statehouses across the country have coordinated to introduce bills simultaneously in seven states later this week. … Some of the state bills resemble the ‘wealth tax’ that Sen. Elizabeth Warren (D-Mass.) pitched during her 2020 presidential candidacy.”

The good news is these proposals went nowhere and don’t appear to have traction this year either. In California, the notorious “Wealth and Exit” tax – they really expect to tax all those businesses leaving the state (see above) — may be getting its own hearing this week, but Governor Newsom has already killed its chances. “Wealth tax proposals are going nowhere in California,” said his spokesman. Apparently there are limits, even in California.

Conclusion

So plenty of activity on the tax front, even in a “quiet” year where the elections are grabbing all the headlines. We’ll be keeping an eye on these and other developments important to the pass-through business community as 2024 gets into full swing. And we’ll be laying the groundwork for what promises to be a massive undertaking in 2025. As with the TCJA, the coming fiscal cliff poses an existential threat to the pass-through community and Main Street. We plan to be ready.