Congressman Lloyd Smucker today will introduce the Main Street Tax Certainty Act, legislation to make permanent the Section 199A deduction. The bill mirrors S. 1706, recently introduced by Senator Steve Daines, so the campaign to protect Main Steet from looming tax hikes is now bicameral and bipartisan.

The legislation introduced today enjoys widespread support in the House. Over 80 original cosponsors joined Smucker in its introduction, including Democratic Representatives Henry Cuellar (TX) and Josh Gottheimer (NJ), and all 25 Republican members of the Ways & Means Committee.

Meanwhile, over 160 trade associations joined our letter thanking Congressman Smucker and Senator Daines for their leadership on this critical issue, and encouraging other members of the House and Senate to support the Main Street Tax Certainty Act. The letter reads:

Section 199A is scheduled to sunset at the end of 2025, even as the businesses it supports continue to recover from the COVID-19 pandemic and the price hikes, labor shortages, and supply chain disruptions that followed.

Making the Section 199A deduction permanent will help Main Street during this very difficult time, leading to higher economic growth and more employment. Separate studies by economists Barro and Furman, the American Action Forum, and DeBacker and Kasher found that making the pass-through deduction permanent would result in significantly improved parity and lower rates for Main Street businesses.

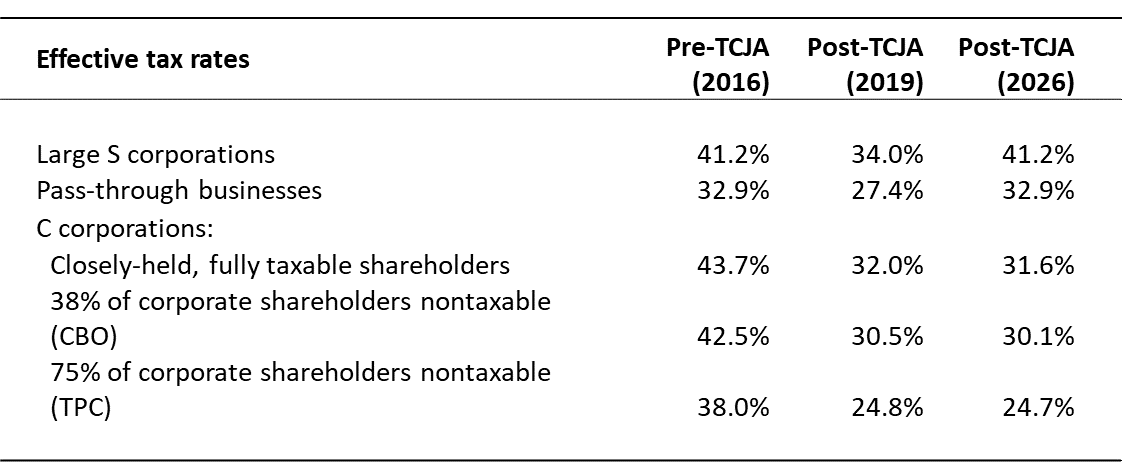

As the letter notes, Section 199A was created in 2017 to encourage job creation and new investment by private businesses. It also helps private companies compete with large, publicly-traded corporations. This table from our recent EY study says it all – without 199A, pass-throughs would face rates up to 16 percentage points higher than their public company competitors:

Despite this important role, Section 199A is set to expire at the start of 2026. That means the same companies that employ the vast majority of workers in virtually every community across the country – and have traditionally been the primary drivers of new jobs and economic expansion – are facing a massive tax hike that threatens their very existence.

The bottom line is that Section 199A is more than just a tax provision. It protects thousands of local communities from fewer jobs and more boarded up buildings, reduces the tax burden on local businesses to make them more competitive, and allows multi-generation businesses to stay family-owned.

So a big “Thanks!” to Congressman Smucker and Senator Daines for their leadership on this issue, and a big thanks as well as to the dozens of House members who cosponsored the Main Street Tax Certainty Act today. S-Corp and the Main Street Employers Coalition are looking forward to working with all of you to get this critical legislation enacted, before it’s too late.