Before the Independence Day festivities kick off, we wanted to wrap up the week by sharing three news-worthy items on the tax front important to the Main Street community.

SCOTUS on Taxes

First, the Supreme Court will take up a case challenging Congress’ authority to levying income taxes before the income is realized. At the heart of Moore v. United States is the plaintiff’s claim that the federal government exceeded its constitutional authority by taxing earnings before they were repatriated back to the United States. Under Section 965, Congress deemed the earnings to have been repatriated and then imposed a tax on them.

The problem is that the 9th Circuit, while weighing in against the litigants, argued that realization is a matter of administrative convenience and is not a constitutional bar to income taxation. As the decision notes:

Whether the taxpayer has realized income does not determine whether a tax is constitutional. In Heiner v. Mellon, the Supreme Court stated that whether or not a “partner’s proportionate share of the net income of the partnership” was distributable was not material to whether it could be taxed. Similarly in Eder, the Second Circuit noted that “[i]n a variety of circumstances it has been held that the fact that the distribution of income is prevented by operation of law, or by agreement among private parties, is no bar to its taxability.” [edited]

This is a remarkably broad ruling that, depending on how the Supreme Court treats it, could open the door to mark-to-market taxation or even wealth taxes under the 16th Amendment. More to come on this one.

IRS Sheds Oversight

Earlier this month, the White House announced IRS regulations would no longer be subject to review by the Office of Information and Regulatory Affairs (ORIA) at the Office of Management and Budget (OMB). The move reverses a Trump-era policy requiring Treasury to get OMB sign-off on proposed tax regulations.

Proponents argue the change cuts down on bureaucratic red tape and puts the rulemaking process back in the hands of career IRS experts, rather than political appointees. But as University of Minnesota professor Kristin Hickman pointed out in a recent interview, streamlining will likely come at a cost:

Treasury and the IRS take the position that most of their regs are simply implementing the decisions Congress has already made, but anyone who works with the Internal Revenue Code on a regular basis recognizes the hundreds of opportunities the code gives Treasury and the IRS to fill in statutory gaps, and in doing so make choices that can have a real economic impact.

Removing the regulatory review process also deprives businesses and other stakeholders of the opportunity to have their voices heard. We’ve seen firsthand the IRS’ willingness to act unilaterally in a congressional directive. With regulations pending on the Inflation Reduction Act’s $650 billion in green energy credits and an additional $80 billion in IRS funding, is this really the time for less oversight?

199A Takes Center Stage

NFIB Vice President of Federal Affairs and S-Corp ally Kevin Kuhlman was up on the Hill recently to make the case for Section 199A permanence. He was one of four witnesses who testified at a House Budget Committee hearing entitled “Incentivizing Economic Excellence Through Tax Policy.”

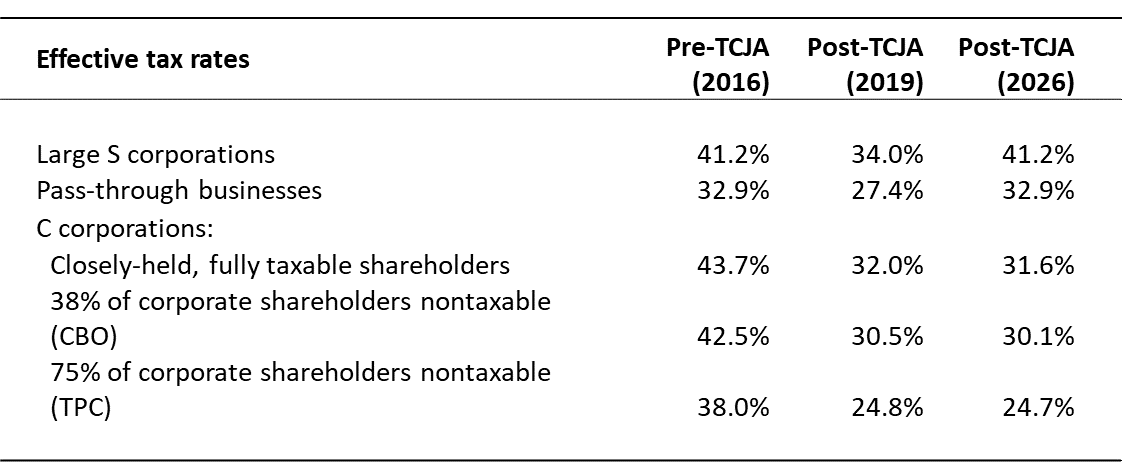

The hearing was timely, and came on the heels of our latest EY study showing just how important the provision is in ensuring rough parity between pass-through businesses and corporations. We did a deep dive on the numbers last week, but the main takeaway is that if Section 199A is allowed to expire at the end of 2025, pass-throughs could face rates as much as 10-percentage points higher than their publicly-traded C corp competitors:

But 199A does not exist in a vacuum. The combination of other expiring provisions, as well as tax hikes proposed by the Administration would directly target Main Street businesses and further stack the deck against them. Kevin hit on this point in his opening statement:

The 20-percent small business deduction combined with the lower individual tax rates and broader income brackets provided tax relief that was invested in small businesses and their employees. For example, Lana Pol, owner of Geetings in Pella, Iowa, testified before this committee a couple years ago that “the new small business deduction will provide around forty thousand dollars in tax relief for our businesses. This tax relief provides crucial cash flow that allowed us to provide up to four thousand dollar raises for our employees, the largest compensation increases we have been able to provide in recent years. The small business tax relief was plowed back into people and production, not owners’ pockets.

The more we can consistently get our message out there, the better off we’ll be heading into 2025. With Senator Daines’ 199A permanency bill introduced, and a House companion bill on the way from Congressman Smucker, pass-through businesses have one more thing to celebrate over the holiday weekend.