To mark the five-year anniversary of the Tax Cuts and Jobs Act, Tax Notes recently released a podcast reflecting on the 2017 bill, with a focus on how states have responded to its $10,000 cap on state and local tax (SALT) deductions. It’s a great reminder of how much the S Corporation Association has helped accomplish in that time, the billions of dollars being saved by businesses each year, and the confounding fact that a dozen states are still missing out on these benefits.

For those new to the issue, the SALT cap put S corporations and partnerships at a competitive disadvantage – while C corporations could continue to fully deduct their SALT as a business expense, pass-through business owners were subject to the new $10,000 limitation.

As readers know, the S Corporation Association has been at the forefront of the effort to restore the deduction for pass-through entities, or what we’ve taken to calling “SALT Parity.” Under our approach, pass-throughs can elect to pay their SALT at the entity level, thus restoring the deduction at the federal level while maintaining revenue neutrality for the state.

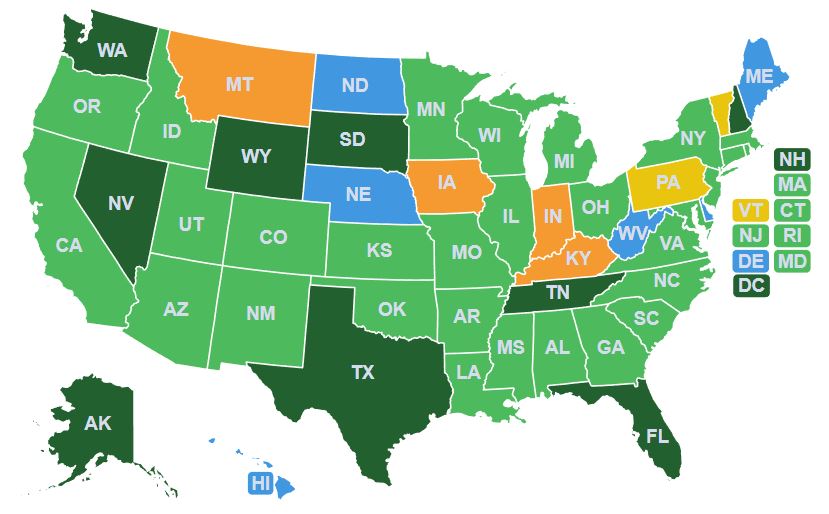

To date, 29 states have adopted our reforms. The Wall Street Journal estimates these bills are saving eligible businesses more than $10 billion each year, a figure we estimate is likely very conservative.

Asked whether he was surprised at how many states have passed SALT Parity bills, podcast guest Steve Wlodychak, a former EY practitioner and an expert in this field, responded:

I wasn’t very surprised. Because if you look at the enactment of the pass-through entity taxes, it’s no cost to the state. And the states recognize that. As proponents of these taxes have pointed out, there would be no net loss – and perhaps a slight revenue increase – to the states by enacting these pass-through entity taxes.

Despite the commonsense nature of these reforms, the road to widespread adoption has not been smooth. For years, two critical questions have loomed large over states looking to take action: (1) will Treasury challenge the approach and, (2) will Congress act to undo the broader SALT cap?

Early on, we saw firsthand just how much reticence that first question engendered. By 2019, five states had enacted SALT Parity bills, but the federal government’s silence on the issue came up time and time again in meetings with state lawmakers and Department of Revenue staff. It wasn’t until late 2020 – when Treasury issued guidance concurring with our legal opinion and blessing our legislative approach – that this concern was finally put to rest.

The second impediment was the concern that Congress would ease or even do away with the SALT cap altogether, thus rendering the reforms unnecessary. But despite recent efforts of the so-called SALT Caucus, a group of lawmakers from high-tax states who vowed to block this year’s budget reconciliation bill if it did not address the cap, the provision remains in place. At this point, it’s pretty clear that the SALT cap is here to stay, at least for the foreseeable future.

The point of that bit of historical context is not to toot our own horn – well, maybe a little – but rather to highlight that the remaining barriers to SALT Parity adoption no longer exist. Which begs the question: Why hasn’t every eligible state taken up these reforms?

By our count, 41 total states could benefit from our SALT Parity approach. That means 12 states – including Montana, North Dakota, Nebraska, and Maine – are literally leaving money on the table and costing Main Street businesses millions of dollars each year. For those states, it is time to get busy.