ADP is out with its revised, independent jobs forecast this week and it shows continued challenges for Main Street. As with past reports (before they revamped the product to produce a truly independent alternative to the monthly BLS reports), the latest data shows a continued divergence in the economy, with larger businesses adding jobs while smaller firms shed them.

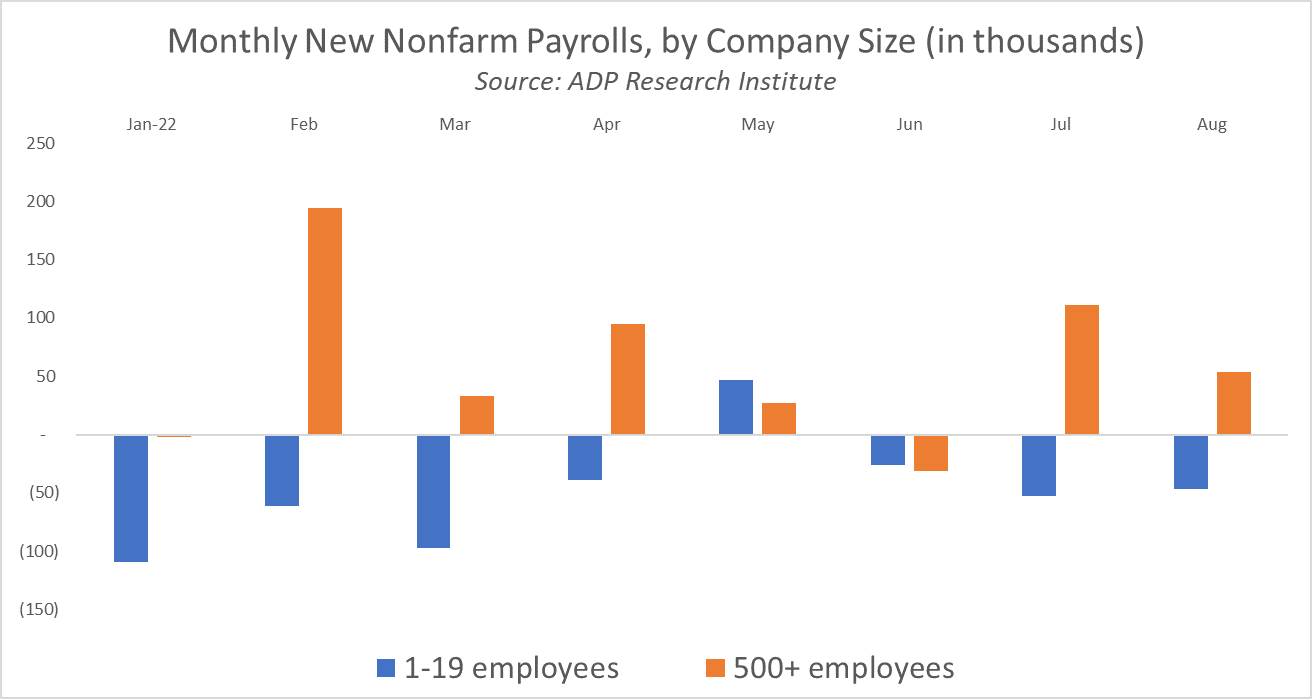

According to ADP, private employers created 132,000 net jobs in August. But while large firms (those with more than 500 employees) added 54,000 jobs, small businesses with less than 20 employees contracted by roughly the same amount, losing 47,000 jobs. As the chart below shows, this is part of an ongoing trend:

Add the numbers up and you find that, since the start of 2022, small businesses have lost a whopping 385,000 jobs while employment at larger firms increased by 481,000.

Why is the small business sector contracting? Inflation is definitely a culprit. As CNBC recently reported, small businesses are facing an unprecedented rent crisis:

Inflation has been the No. 1 concern of small businesses for some time, as high prices in raw materials, labor, energy and transportation cut into margins. Higher rents, and landlords feeling more aggressive the farther away the nation moves from the peak of Covid, have compounded the hit from inflation being felt on Main Street.

How much has rent spiked? Forty-five percent of small businesses surveyed said they’re paying at least 50 percent more in rent than they did prior to Covid, while 12 percent said rent payments have tripled. At the same time, 77 percent of respondents reported revenue that’s still below pre-Covid levels, a dynamic that could worsen as the Federal Reserve takes steps to shut down inflation.

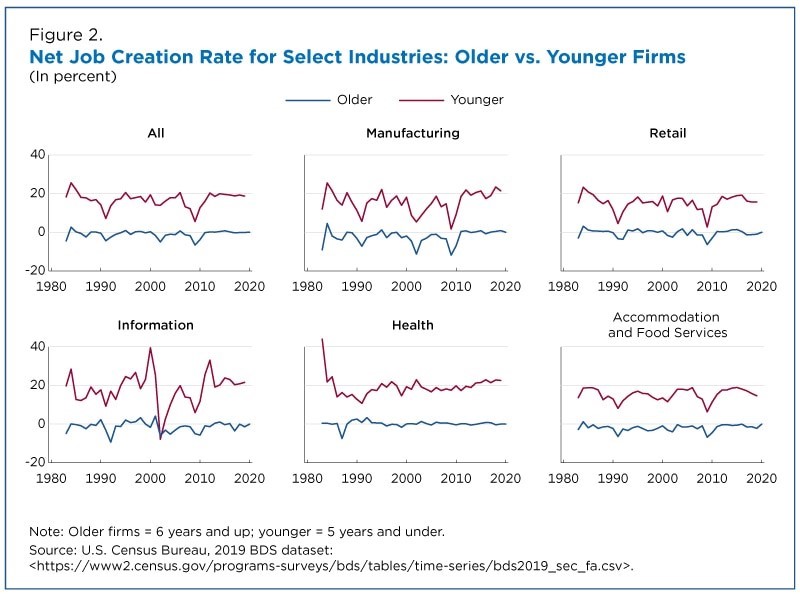

But if aggregate employment numbers are on the rise, why does it matter that Main Street is shrinking? As we’ve written before, small businesses have historically been the drivers of job creation and economic expansion, accounting for nearly two-thirds of new jobs historically. Which makes sense – compared to larger, established companies, smaller, younger firms are more likely to hire and expand. Data from the Census Bureau bears this out:

The bottom line is that this migration of workers from small businesses to large, publicly-traded firms is bad news for most of the country. As our employment heatmap from EY shows, most of the country relies on non-public firms for their job base:

At the end of the day, only so much economic consolidation can occur before growth and hiring levels inevitably flatline. We need smaller businesses and startups for net job creation – unfortunately, the post-pandemic economic environment isn’t helping. Nor is the adoption of policies that raise their costs and increase the burden of government. Something to keep in mind the next time the White House touts an otherwise positive job report.