Want to understand what’s happening in the economy? Look to inflation-adjusted data. Wage levels and company revenues are reported in nominal terms, while the GDP estimates are adjusted for inflation. That’s why they appear to be headed in different directions when, in fact, it’s all going south.

It’s also the reason inflation is something to be avoided, and something to be addressed quickly when it does appear. When you dump trillions of new dollars into the economy for a year or two, people and businesses feel wealthier and flush with cash. They spend more, increase commitments, and hire more workers.

So the initial phase of an inflationary cycle is characterized by increased demand by consumers, more investment by businesses, and increased employment.

But workers aren’t better off. In the last year, nominal wages rose 5 percent, so a typical worker’s annual income might have risen from $50,000 to $52,500. But inflation rose 8 percent, so those increased wages are actually worth less, just $48,500. The worker thinks she’s better off, but she’s actually losing ground. Here’s the BLS on the most recent data:

From June 2021 to June 2022, real average hourly earnings decreased 3.1 percent, seasonally adjusted. The change in real average hourly earnings combined with a 0.9-percent decrease in the average workweek resulted in a 3.9-percent decrease in real average weekly earnings over this period.

The effect on businesses is the same. All businesses, even the most sophisticated, measure their performance in nominal dollars. So early in an inflationary cycle, they make decisions under the illusion that their revenues are rising, and make investment and hiring decisions that the underlying realities don’t justify. Later in the cycle, they have to juggle the consumer’s changing purchasing decisions based on the same money illusion. The result is a massive amount of misallocated capital and labor.

That’s what’s happening to our nation’s retailers right now, who were slow to recognize an initial increase in demand for durable consumer goods and now are trying to catch up as consumers leave durable goods behind and focus on recession-proof goods instead. All that, as they try to manage rapidly changing prices at both the wholesale and retail level. Here’s the recent Walmart outlook that resulted in a massive sell-off of its stock:

Comp sales for Walmart U.S., excluding fuel, are expected to be about 6% for the second quarter. This is higher than previously expected with a heavier mix of food and consumables, which is negatively affecting gross margin rate. Food inflation is double digits and higher than at the end of Q1.

This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel.

During the quarter, the company made progress reducing inventory, managing prices to reflect certain supply chain costs and inflation, and reducing storage costs associated with a backlog of shipping containers. Customers are choosing Walmart to save money during this inflationary period, and this is reflected in the company’s continued market share gains in grocery.

Comp sales are up 6 percent, but inflation is up 8 percent. Like our worker, Walmart is worse off.

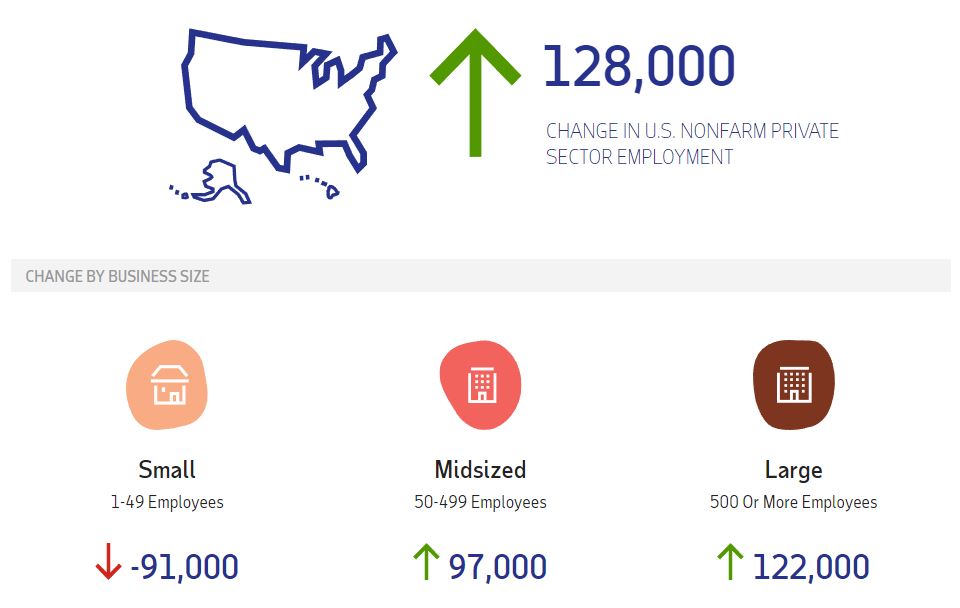

From the Main Street perspective, the debate over the definition of a recession is beside the point – as we’ve written in the past, the small business sector has been shedding jobs and paring back for months. Here’s the most recent ADP report showing how the economy has bisected between large and small firms:

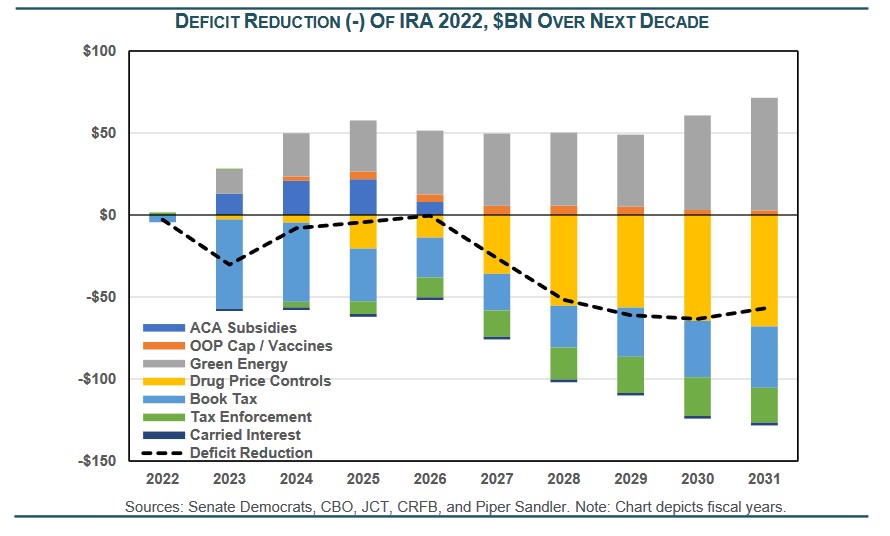

Finally, the case that the legislative package unveiled earlier this week will reduce prices can only be justified if you focus on the deal’s broad parameters and ignore the details. In theory, reducing deficits would reduce price pressures, but only if the tax increases and spending reductions were focused on the demand side. The tax hikes in this package are shouldered by corporations, and one-third of those will be passed on to consumers in the form of price increases.

Moreover, the bulk of the deficit reduction doesn’t get going until 2027 and later. Until then, the bill is nearly budget neutral, suggesting it won’t have a significant impact on prices in the short term. This chart from Piper Sandler shows you the year-by-year effects. Just follow the dotted line.

So the economy is troubled by any measure once you account for rising prices, the small business sector is in recession already and has been for months, and the so-called Inflation Reduction Act is anything but. Still confused? Just adjust your perspective for inflation and you’ll uncover the truth.